iShares 1-3 Year Treasury Bond ETF (NQ:SHY)

All News about iShares 1-3 Year Treasury Bond ETF

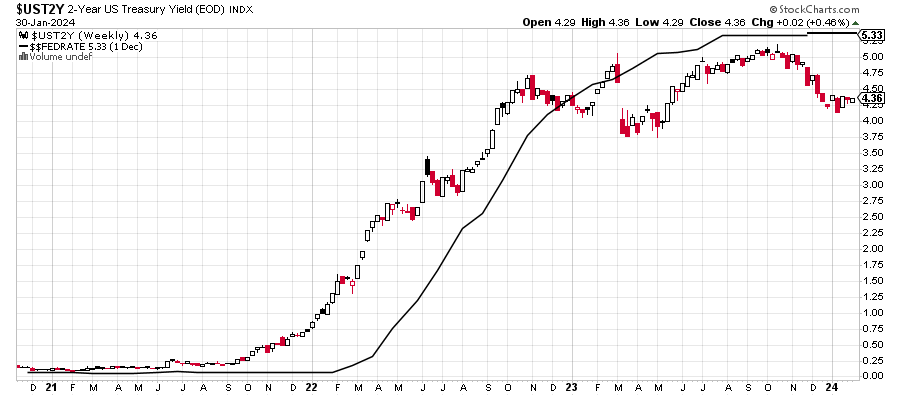

Special Fed Day Update – Powell Has Cover To Cut ↗

January 31, 2024

Via Talk Markets

Topics

Economy

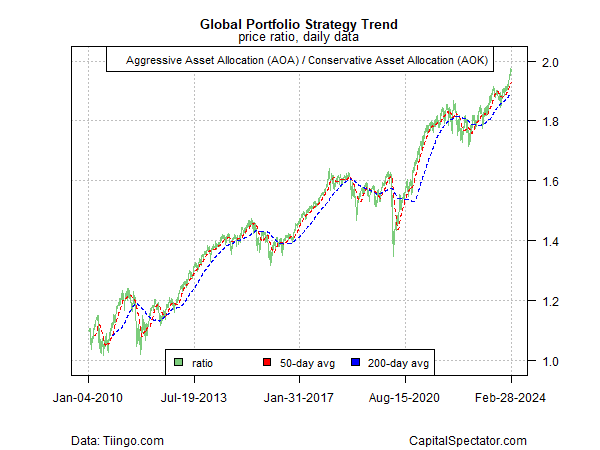

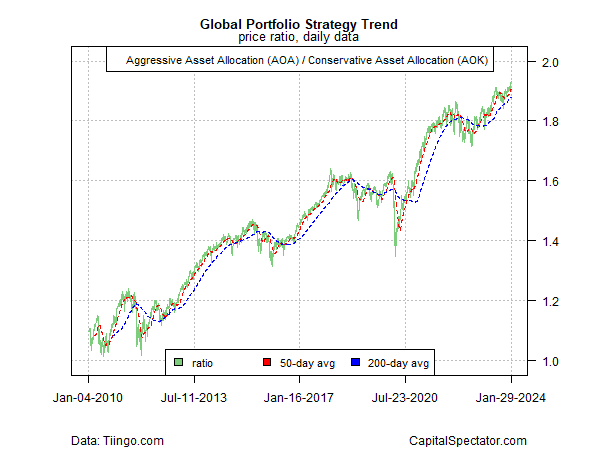

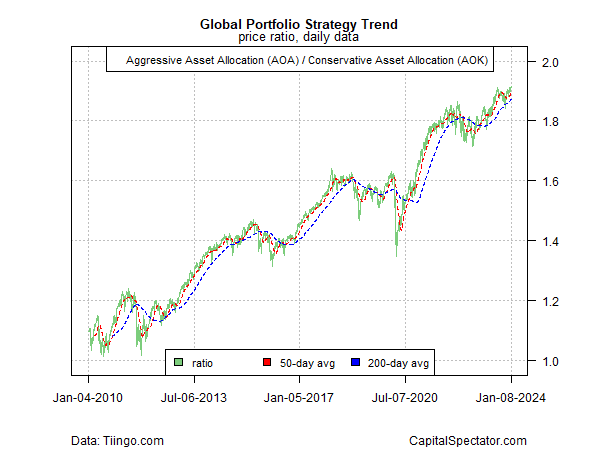

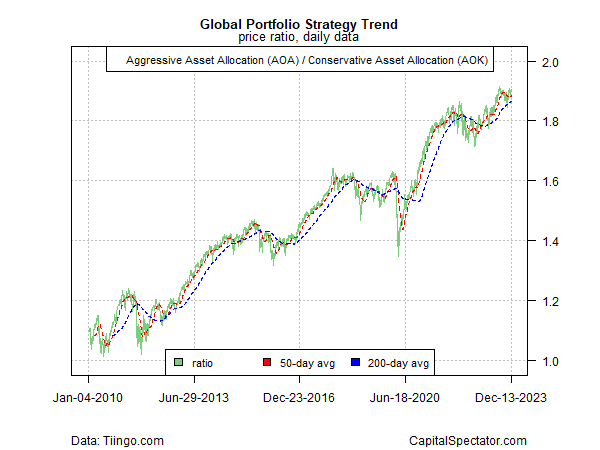

Still Waiting For A Clear Risk-Off Signal At 2024’s Start ↗

January 09, 2024

Via Talk Markets

Topics

ETFs

Via Talk Markets

U.S. Weekly FundFlows: Equity ETFs Attracted $10.0 Billion Of Net Inflows During the Fund-Flows Week ↗

December 07, 2023

Via Talk Markets

Topics

ETFs

Rate Cut Expectations Fuel Bond Market Rally ↗

November 30, 2023

Via Talk Markets

Stocks Have No Juice As The 2-Year Rate Plunges On November 28, 2023 ↗

November 28, 2023

Via Talk Markets

Oil Is Sending A Warning Message To The Stock Market ↗

November 18, 2023

Via Talk Markets

Topics

Bonds

U.S. Weekly FundFlows: Equity ETFs Attract $7.8 Billion In Inflows ↗

November 03, 2023

Via Talk Markets

Topics

ETFs

Speculator Extremes: VIX, Cocoa, DowJones & 2-Year Lead Bullish & Bearish Positions ↗

October 29, 2023

Via Talk Markets

Topics

Stocks

Why Investors Should Only Buy Individual Fixed Income Securities ↗

October 02, 2023

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.