Insurance giant Allstate (NYSE: ALL) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 3.8% year on year to $17.35 billion. Its non-GAAP profit of $14.31 per share was 45.1% above analysts’ consensus estimates.

Is now the time to buy Allstate? Find out by accessing our full research report, it’s free.

Allstate (ALL) Q4 CY2025 Highlights:

- Net Premiums Earned: $15.51 billion vs analyst estimates of $14.85 billion (2.9% year-on-year growth, 4.4% beat)

- Revenue: $17.35 billion vs analyst estimates of $16.69 billion (3.8% year-on-year growth, 3.9% beat)

- Pre-tax Profit: $4.92 billion (28.3% margin)

- Adjusted EPS: $14.31 vs analyst estimates of $9.86 (45.1% beat)

- Market Capitalization: $52.8 billion

Company Overview

Born from a Sears, Roebuck & Co. initiative during the Great Depression with its famous "You're in good hands" slogan, Allstate (NYSE: ALL) is one of America's largest personal property and casualty insurers, offering protection for autos, homes, and personal property.

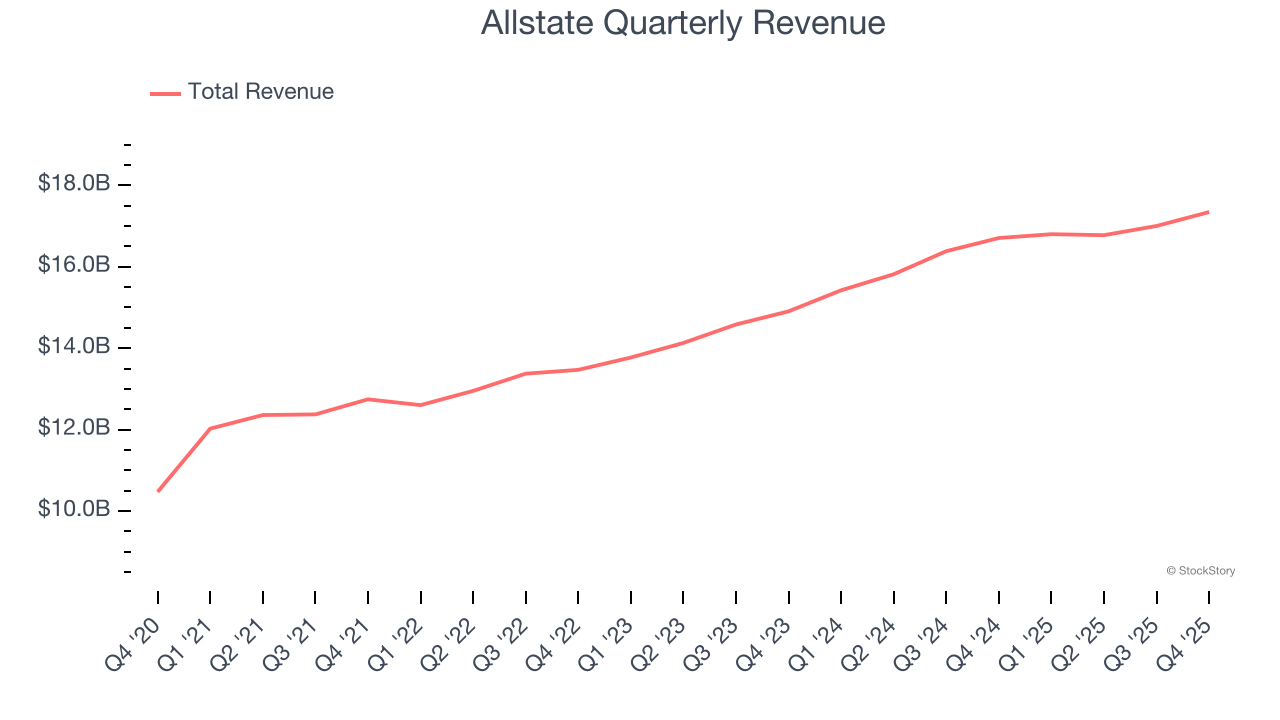

Revenue Growth

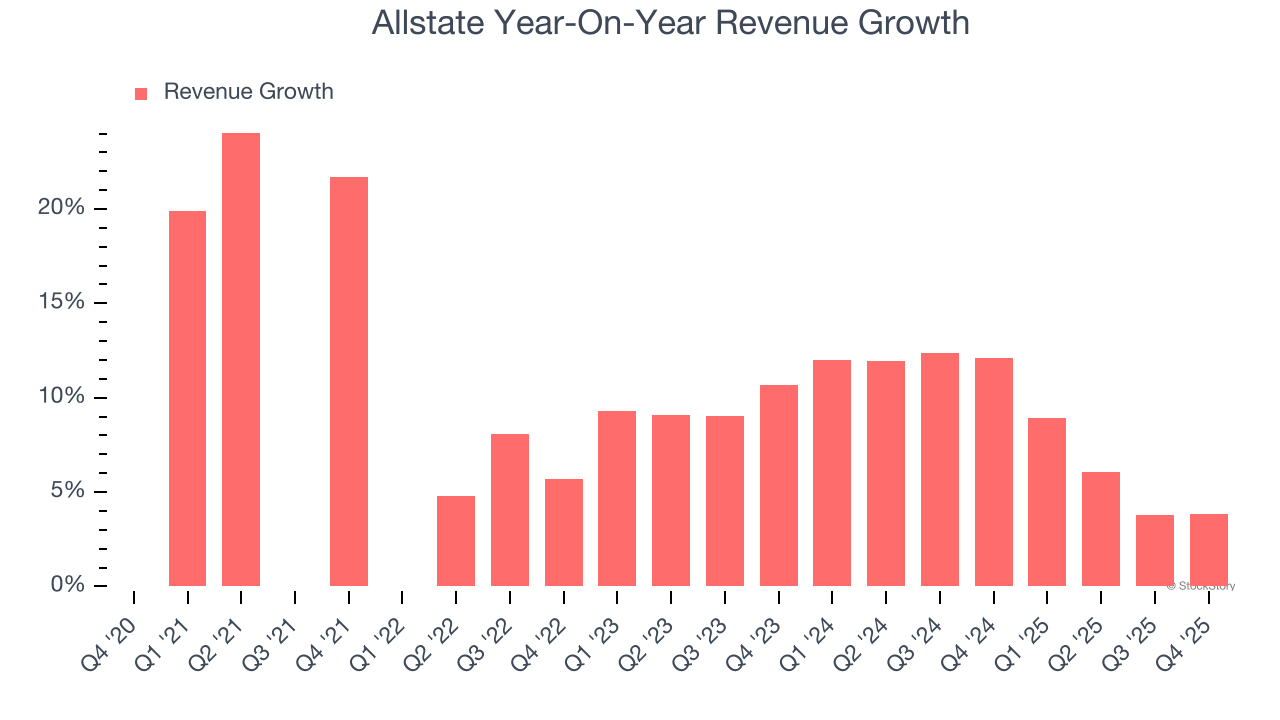

Insurance companies earn revenue from three primary sources: 1) The core insurance business itself, often called underwriting and represented in the income statement as premiums 2) Income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities 3) Fees from various sources such as policy administration, annuities, or other value-added services. Over the last five years, Allstate grew its revenue at an impressive 10.7% compounded annual growth rate. Its growth beat the average insurance company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Allstate’s annualized revenue growth of 8.8% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Allstate reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 3.9%.

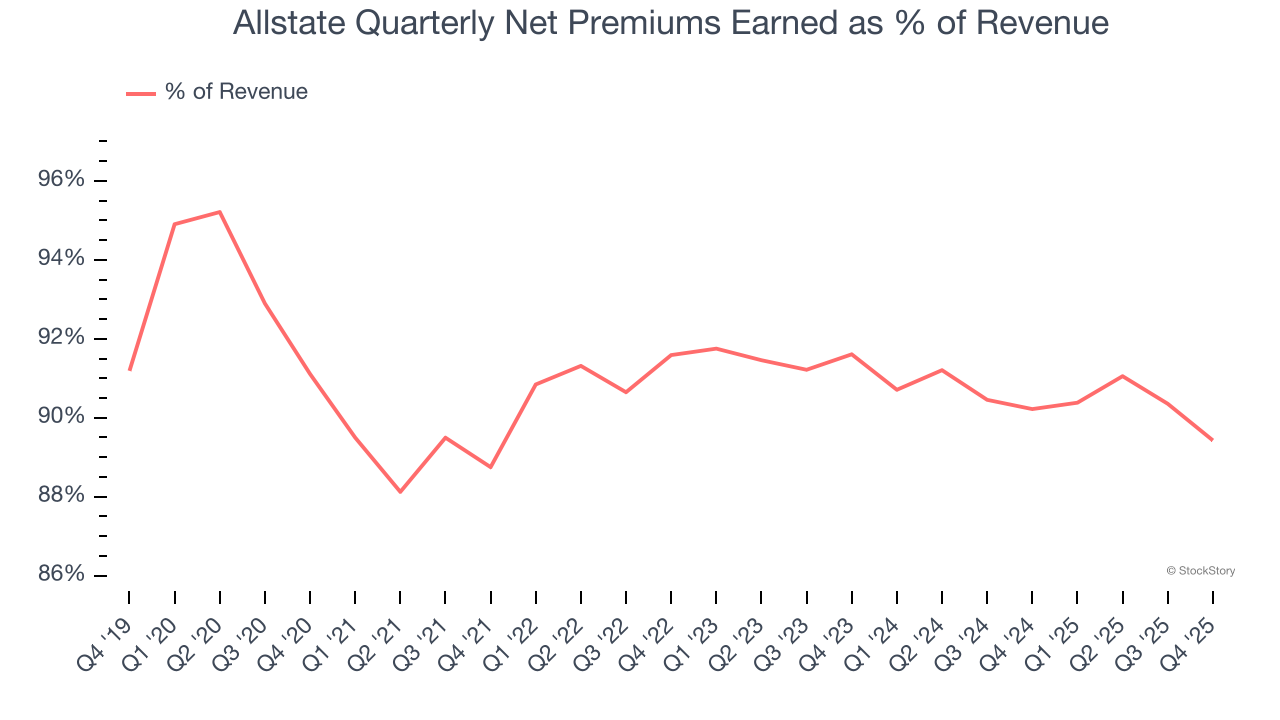

Net premiums earned made up 90.5% of the company’s total revenue during the last five years, meaning Allstate lives and dies by its underwriting activities because non-insurance operations barely move the needle.

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

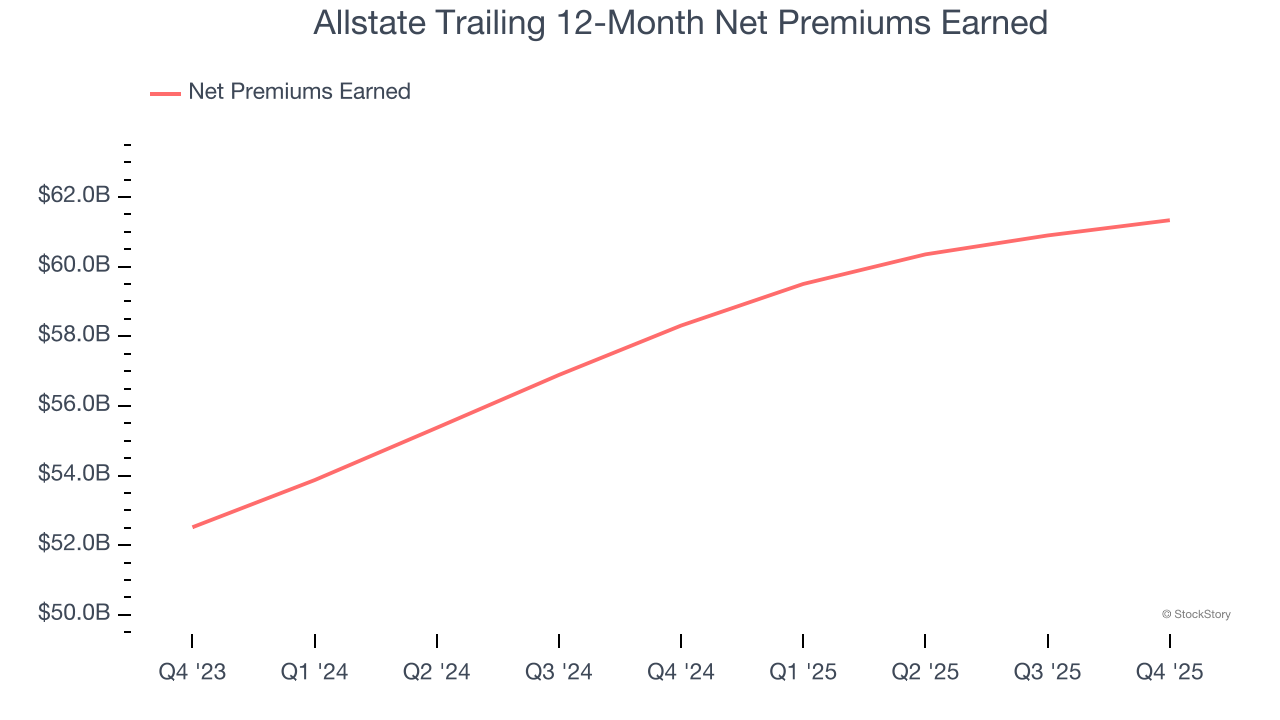

Allstate’s net premiums earned has grown at a 10% annualized rate over the last five years, a step above the broader insurance industry and in line with its total revenue.

When analyzing Allstate’s net premiums earned over the last two years, we can see that growth decelerated to 8.1% annually. This performance was similar to its total revenue.

In Q4, Allstate produced $15.51 billion of net premiums earned, up 2.9% year on year and topping Wall Street Consensus estimates by 4.4%.

Key Takeaways from Allstate’s Q4 Results

It was good to see Allstate beat analysts’ EPS expectations this quarter. We were also excited its net premiums earned outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.9% to $211.12 immediately after reporting.

Allstate had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).