As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the leisure products industry, including Harley-Davidson (NYSE: HOG) and its peers.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 12 leisure products stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4% on average since the latest earnings results.

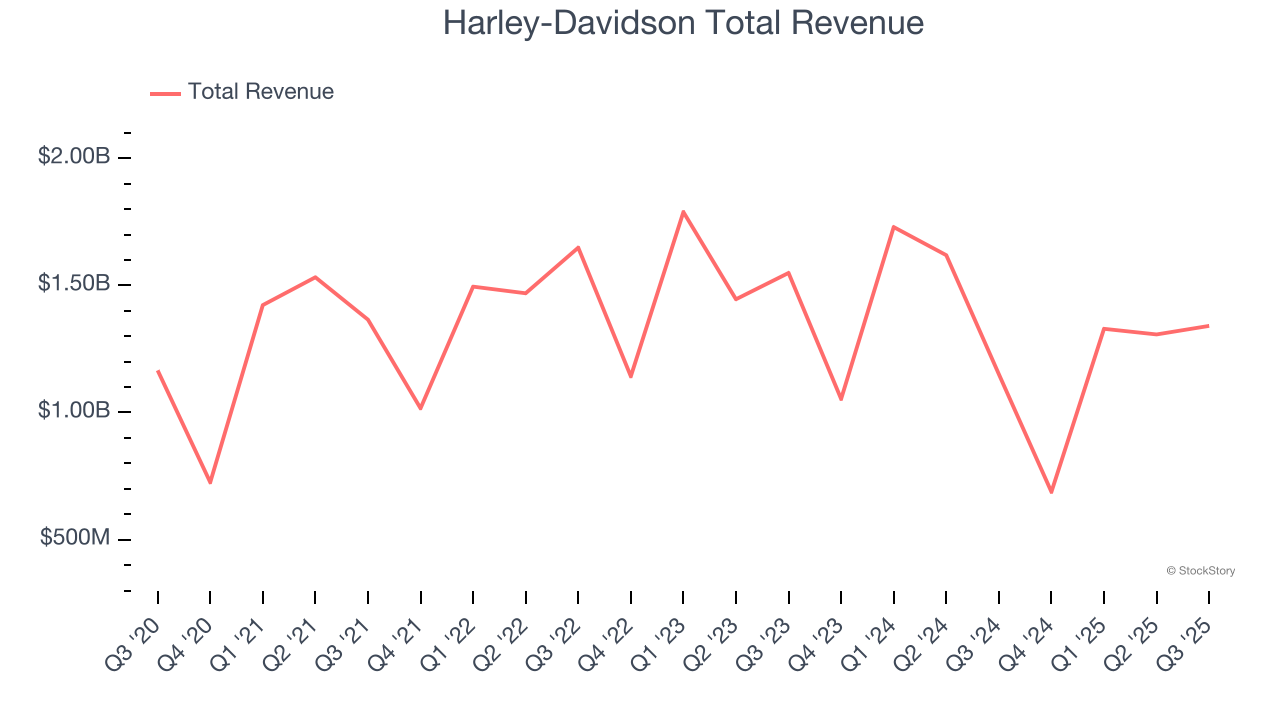

Harley-Davidson (NYSE: HOG)

Founded in 1903, Harley-Davidson (NYSE: HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson reported revenues of $1.34 billion, up 16.5% year on year. This print exceeded analysts’ expectations by 2.8%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

Harley-Davidson scored the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 23% since reporting and currently trades at $20.88.

Is now the time to buy Harley-Davidson? Access our full analysis of the earnings results here, it’s free for active Edge members.

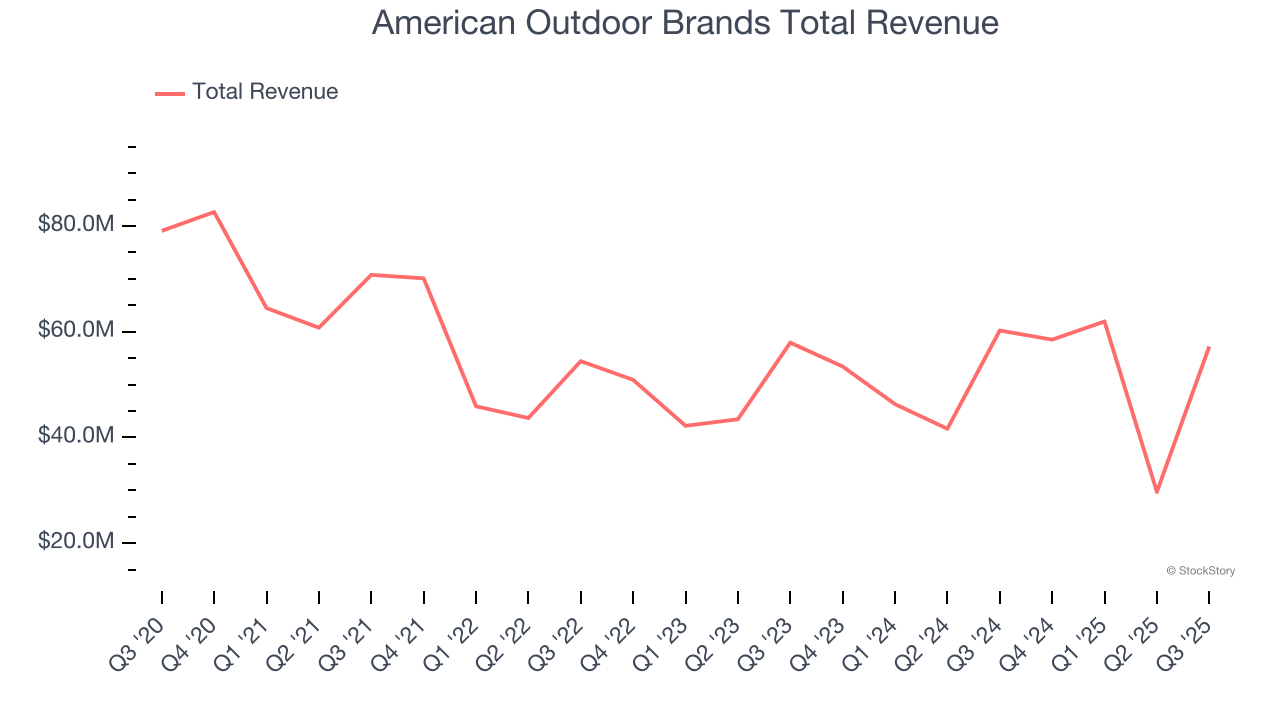

Best Q3: American Outdoor Brands (NASDAQ: AOUT)

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ: AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

American Outdoor Brands reported revenues of $57.2 million, down 5% year on year, outperforming analysts’ expectations by 12.3%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

American Outdoor Brands pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 7.2% since reporting. It currently trades at $8.28.

Is now the time to buy American Outdoor Brands? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Ruger (NYSE: RGR)

Founded in 1949, Ruger (NYSE: RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger reported revenues of $126.8 million, up 3.7% year on year, exceeding analysts’ expectations by 2.1%. Still, it was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 19.8% since the results and currently trades at $35.25.

Read our full analysis of Ruger’s results here.

Malibu Boats (NASDAQ: MBUU)

Founded in California in 1982, Malibu Boats (NASDAQ: MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Malibu Boats reported revenues of $194.7 million, up 13.5% year on year. This print topped analysts’ expectations by 4.3%. Overall, it was an exceptional quarter as it also logged a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 4.7% since reporting and currently trades at $31.06.

Read our full, actionable report on Malibu Boats here, it’s free for active Edge members.

Smith & Wesson (NASDAQ: SWBI)

With a history dating back to 1852, Smith & Wesson (NASDAQ: SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $124.7 million, down 3.9% year on year. This result surpassed analysts’ expectations by 0.8%. It was an exceptional quarter as it also produced a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 19% since reporting and currently trades at $10.60.

Read our full, actionable report on Smith & Wesson here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.