Fashion conglomerate G-III (NASDAQ: GIII) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 4.3% year on year to $583.6 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $570 million was less impressive, coming in 8.2% below expectations. Its non-GAAP profit of $0.19 per share was 51.1% above analysts’ consensus estimates.

Is now the time to buy G-III? Find out by accessing our full research report, it’s free.

G-III (GIII) Q1 CY2025 Highlights:

- Revenue: $583.6 million vs analyst estimates of $580.3 million (4.3% year-on-year decline, 0.6% beat)

- Adjusted EPS: $0.19 vs analyst estimates of $0.13 (51.1% beat)

- Adjusted EBITDA: $19.49 million vs analyst estimates of $19.95 million (3.3% margin, 2.3% miss)

- The company reconfirmed its revenue guidance for the full year of $3.14 billion at the midpoint

- Adjusted EPS guidance for Q2 CY2025 is $0.07 at the midpoint, below analyst estimates of $0.48

- Operating Margin: 1.5%, in line with the same quarter last year

- Market Capitalization: $1.20 billion

Morris Goldfarb, G-III’s Chairman and Chief Executive Officer, said, “G-III delivered solid first quarter results, marked by earnings that exceeded the high end of guidance. Our performance was fueled by double-digit growth of our key owned brands, DKNY, Karl Lagerfeld and Donna Karan, which largely offset the exit of the Calvin Klein jeans and sportswear businesses. These results underscore the strong demand and desirability of our brand portfolio and are a testament to our team’s outstanding execution.”

Company Overview

Founded as a small leather goods business, G-III (NASDAQ: GIII) is a fashion and apparel conglomerate with a diverse portfolio of brands.

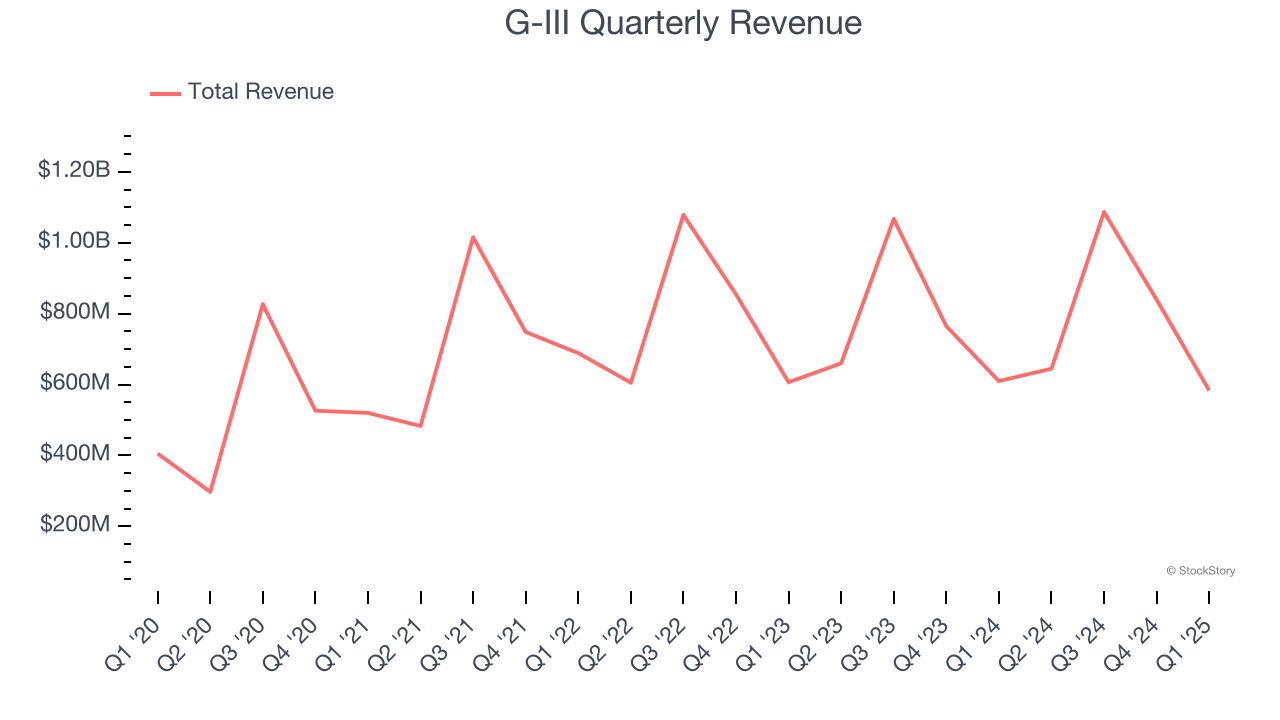

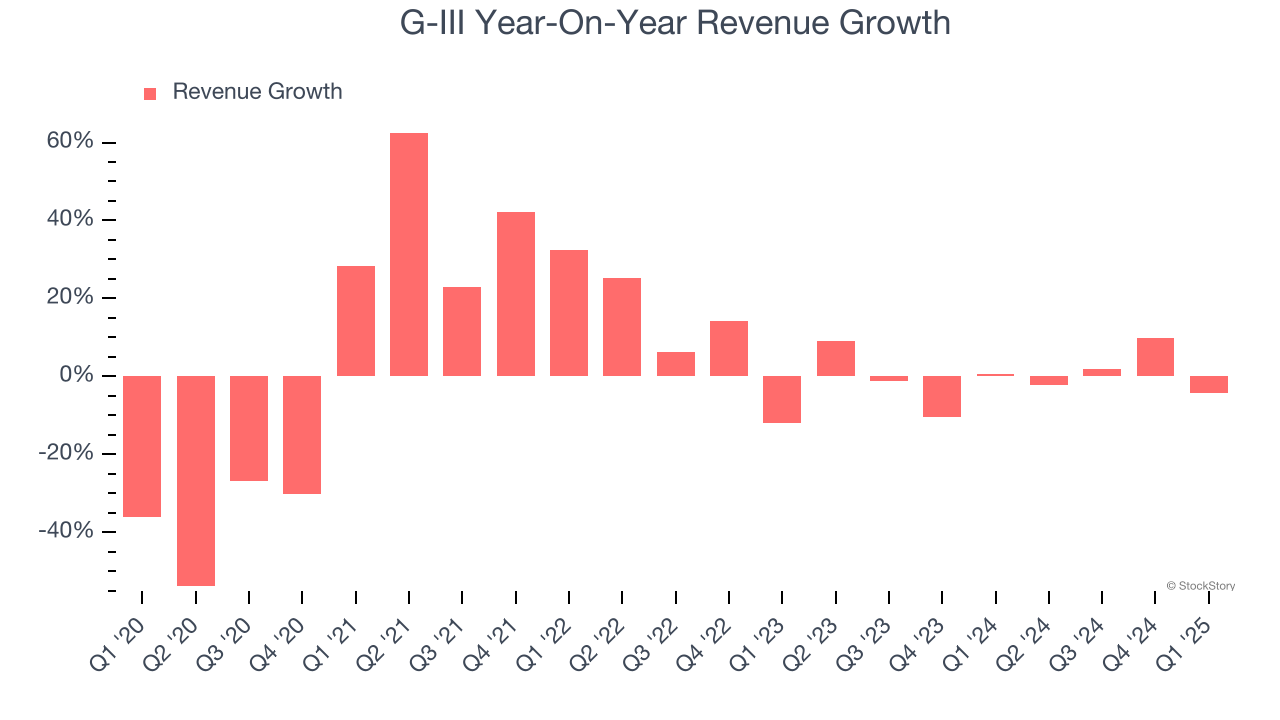

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, G-III’s sales grew at a weak 1.5% compounded annual growth rate over the last five years. This was below our standards and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. G-III’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, G-III’s revenue fell by 4.3% year on year to $583.6 million but beat Wall Street’s estimates by 0.6%. Company management is currently guiding for a 11.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.6% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

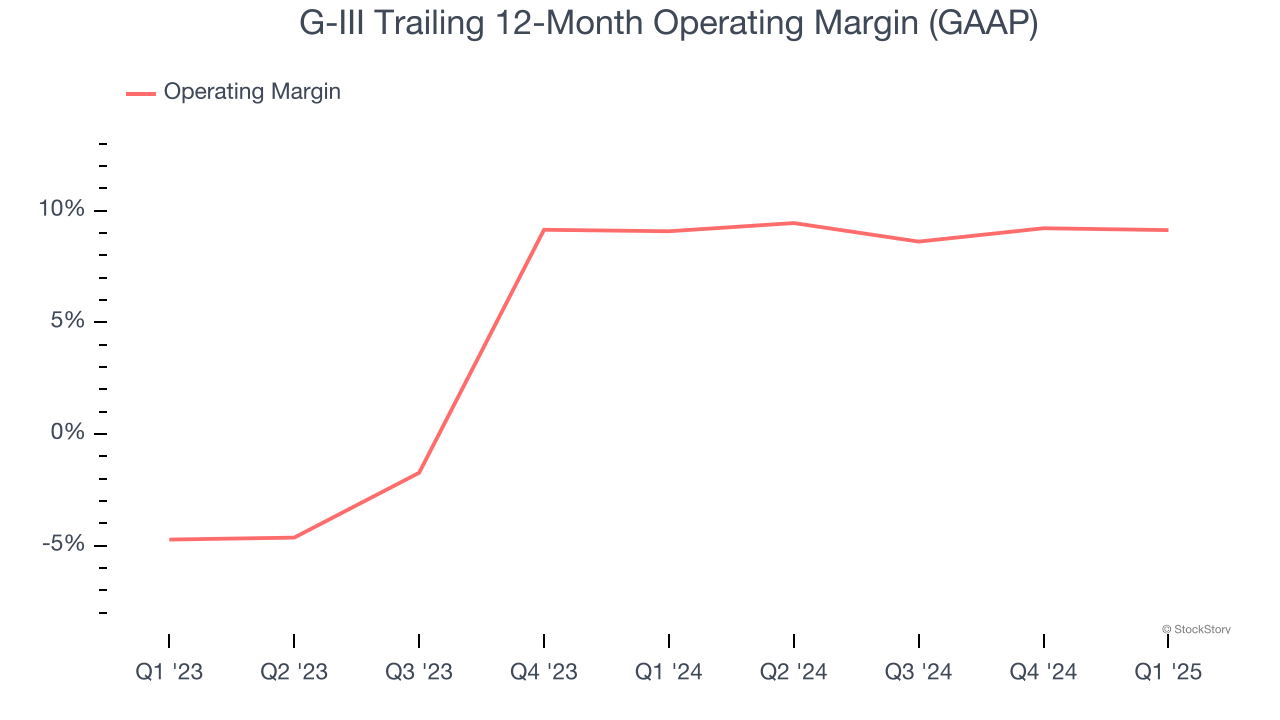

Operating Margin

G-III’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 9.1% over the last two years. This profitability was mediocre for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, G-III generated an operating margin profit margin of 1.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

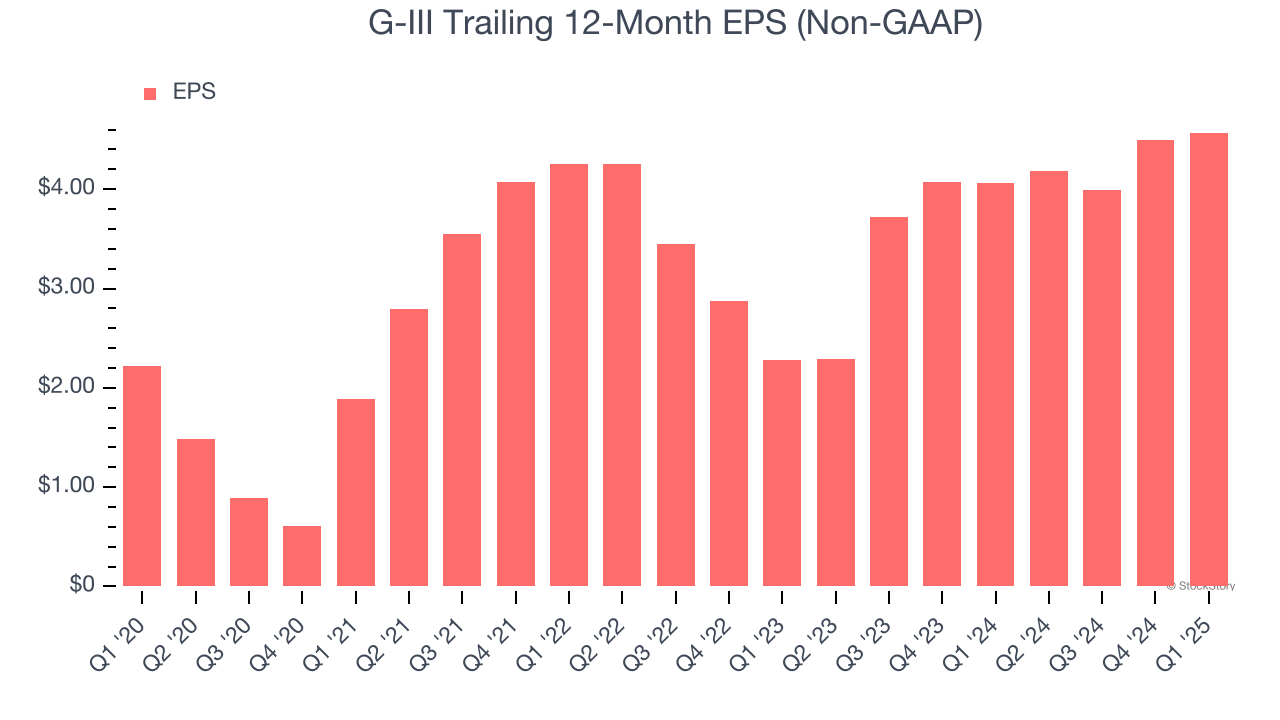

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

G-III’s EPS grew at a solid 15.5% compounded annual growth rate over the last five years, higher than its 1.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q1, G-III reported EPS at $0.19, up from $0.12 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects G-III’s full-year EPS of $4.57 to shrink by 16.1%.

Key Takeaways from G-III’s Q1 Results

We were impressed by how significantly G-III blew past analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its EPS guidance for next quarter and its EBITDA missed. Overall, this quarter was mixed. The stock remained flat at $27.80 immediately after reporting.

So should you invest in G-III right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.