Over the last six months, Sotera Health Company’s shares have sunk to $10.94, producing a disappointing 17.4% loss - a stark contrast to the S&P 500’s 1.1% gain. This might have investors contemplating their next move.

Is now the time to buy Sotera Health Company, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Sotera Health Company Not Exciting?

Despite the more favorable entry price, we're swiping left on Sotera Health Company for now. Here are three reasons why you should be careful with SHC and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

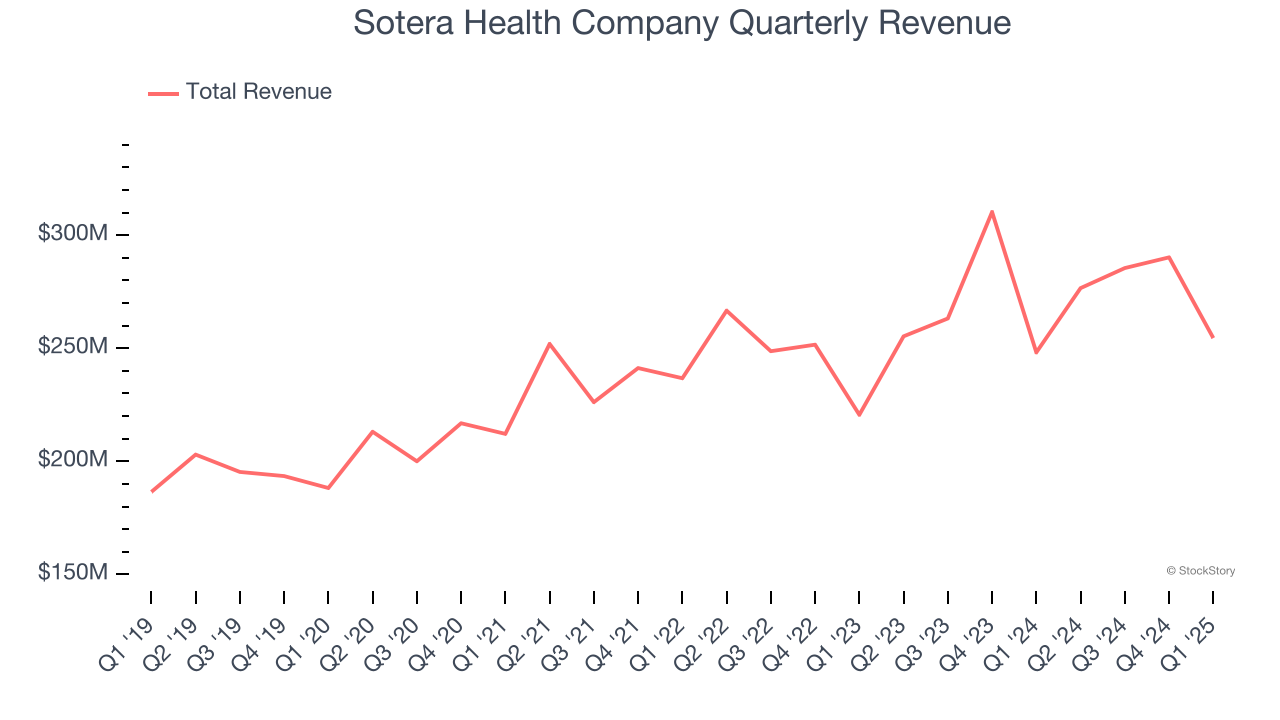

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Sotera Health Company’s sales grew at a mediocre 7.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the healthcare sector.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.11 billion in revenue over the past 12 months, Sotera Health Company is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

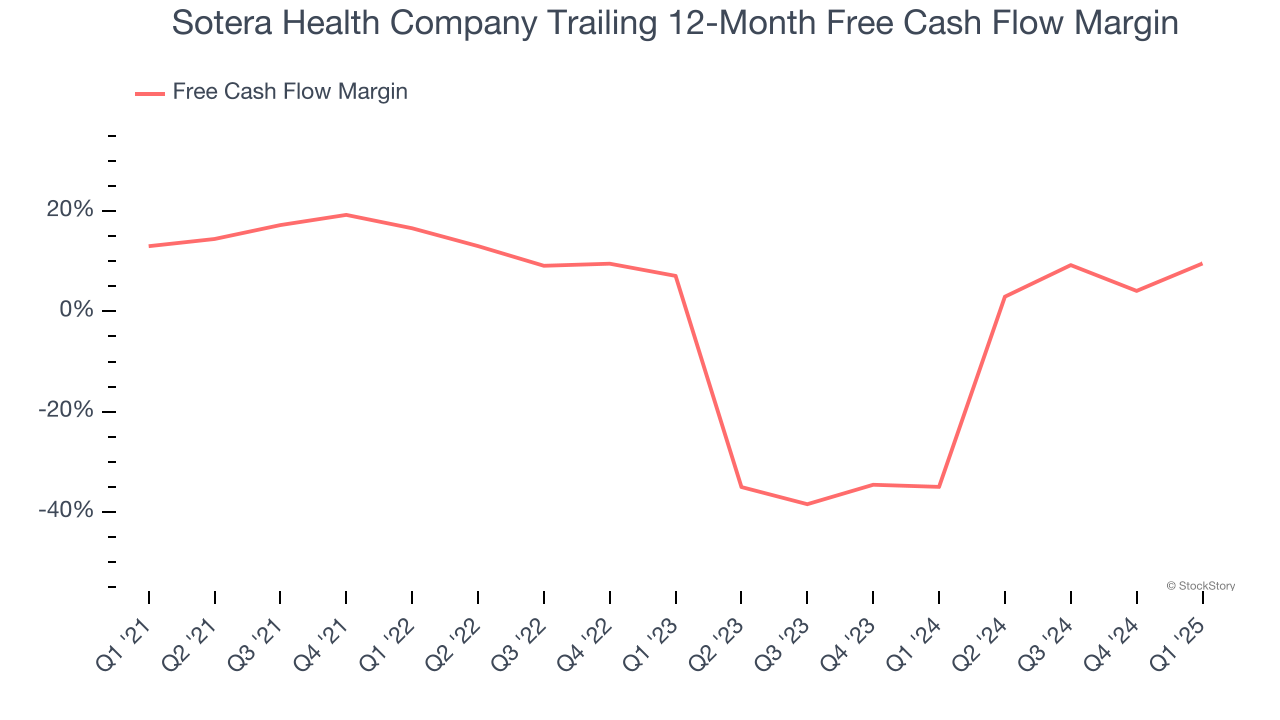

Sotera Health Company has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.4%, subpar for a healthcare business. The divergence from its good adjusted operating margin stems from its capital-intensive business model, which requires Sotera Health Company to make large cash investments in working capital and capital expenditures.

Final Judgment

Sotera Health Company’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 14.4× forward P/E (or $10.94 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Sotera Health Company

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.