Over the last six months, Globalstar’s shares have sunk to $23.83, producing a disappointing 15.5% loss - a stark contrast to the S&P 500’s 1.9% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now a good time to buy GSAT? Find out in our full research report, it’s free.

Why Does GSAT Stock Spark Debate?

Known for powering the emergency SOS feature in newer Apple iPhones, Globalstar (NASDAQ: GSAT) operates a network of low-earth orbit satellites that provide voice and data communications services in remote areas where traditional cellular networks don't reach.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

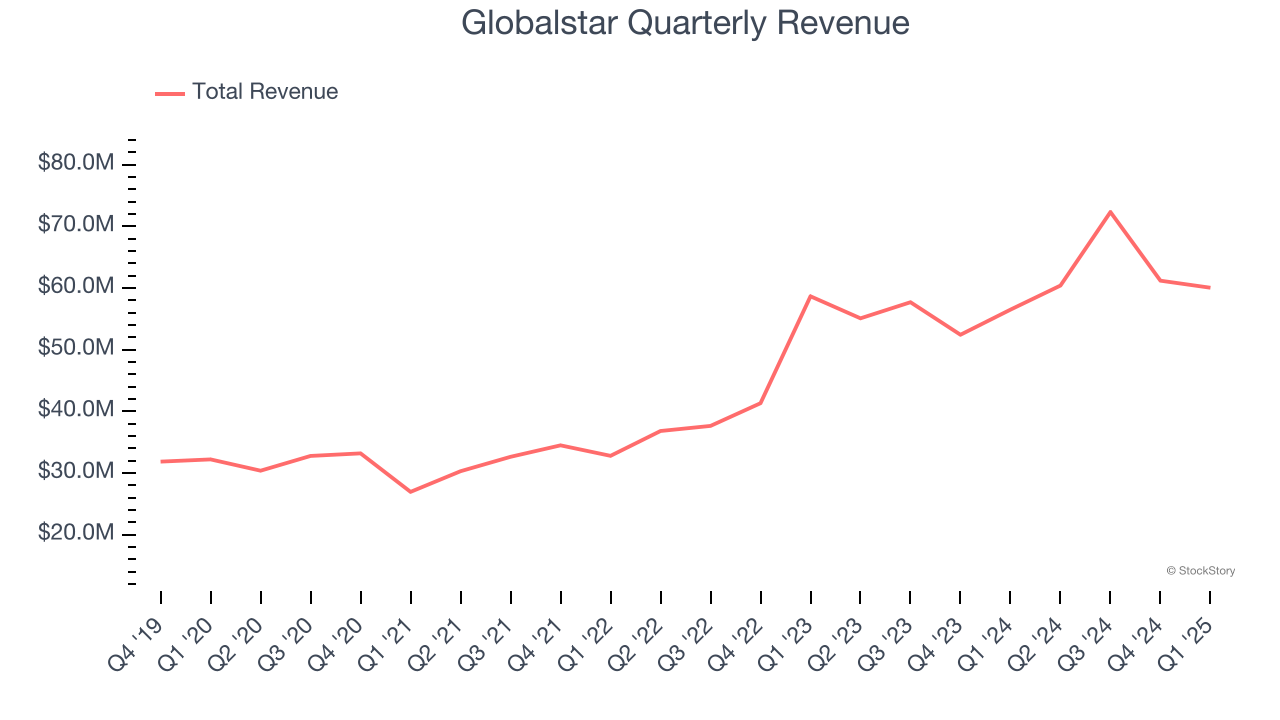

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Globalstar grew its sales at an exceptional 13.6% compounded annual growth rate. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

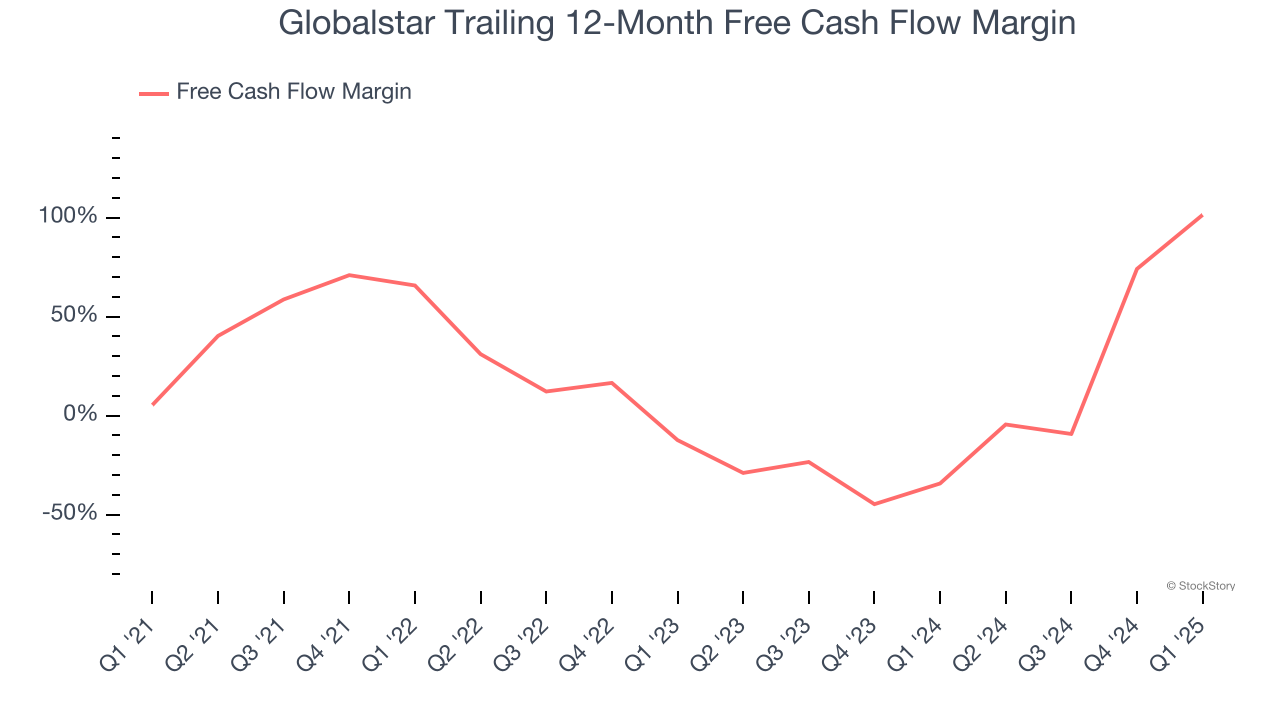

Globalstar has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 27.9% over the last five years. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

One Reason to be Careful:

Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Globalstar has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 5.5%, meaning management lost money while trying to expand the business.

Final Judgment

Globalstar has huge potential even though it has some open questions. With the recent decline, the stock trades at 29.1× forward EV-to-EBITDA (or $23.83 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.