Over the past six months, CarGurus’s stock price fell to $31. Shareholders have lost 14.1% of their capital, which is disappointing considering the S&P 500 has climbed by 1.7%. This may have investors wondering how to approach the situation.

Is now the time to buy CarGurus, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is CarGurus Not Exciting?

Even with the cheaper entry price, we're cautious about CarGurus. Here are three reasons why there are better opportunities than CARG and a stock we'd rather own.

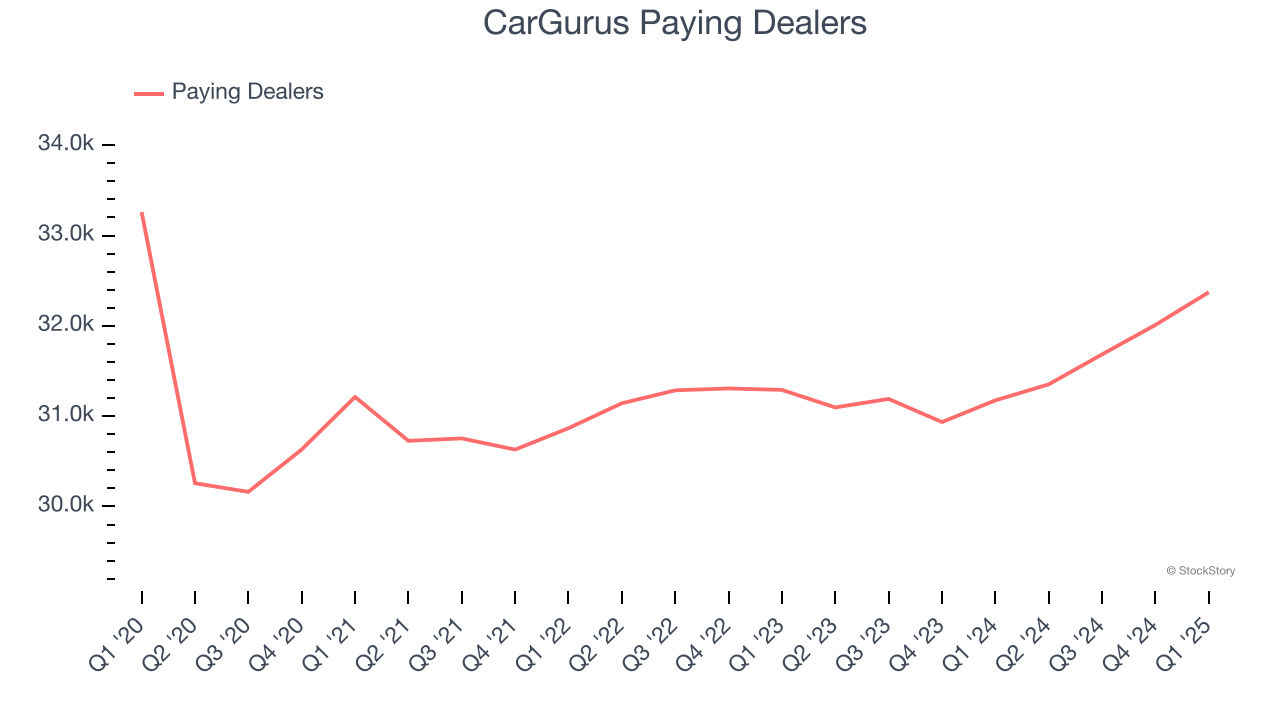

1. Paying Dealers Hit a Plateau

As an online marketplace, CarGurus generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

CarGurus struggled with new customer acquisition over the last two years as its paying dealers were flat at 32,372. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If CarGurus wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect CarGurus’s revenue to rise by 6.1%. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

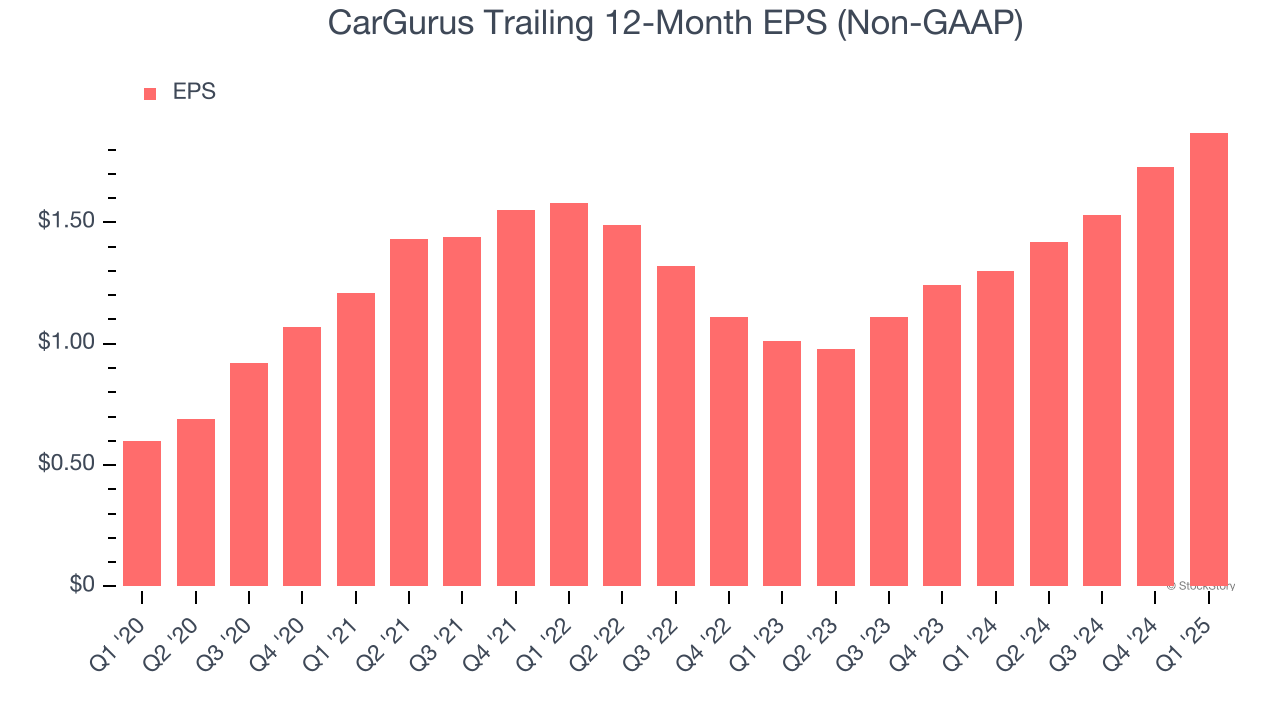

3. EPS Barely Growing

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

CarGurus’s EPS grew at an unimpressive 5.8% compounded annual growth rate over the last three years. On the bright side, this performance was better than its 9.3% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

CarGurus isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 11.6× forward EV/EBITDA (or $31 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.