Boutique fitness studio franchisor Xponential Fitness (NYSE: XPOF) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 2.1% year on year to $78.82 million. The company expects the full year’s revenue to be around $305 million, close to analysts’ estimates. Its non-GAAP profit of $0.34 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Xponential Fitness? Find out by accessing our full research report, it’s free for active Edge members.

Xponential Fitness (XPOF) Q3 CY2025 Highlights:

- Revenue: $78.82 million vs analyst estimates of $75.83 million (2.1% year-on-year decline, 3.9% beat)

- Adjusted EPS: $0.34 vs analyst estimates of $0.12 (significant beat)

- Adjusted EBITDA: $33.48 million vs analyst estimates of $25.81 million (42.5% margin, 29.7% beat)

- The company reconfirmed its revenue guidance for the full year of $305 million at the midpoint

- EBITDA guidance for the full year is $108.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 4.5%, up from -8% in the same quarter last year

- Free Cash Flow Margin: 10.4%, up from 4.2% in the same quarter last year

- Market Capitalization: $229.9 million

“Over my first 90 days, I’ve gained a much clearer picture of our strengths and opportunities ahead. This time has only reinforced my confidence in both the power of our brands and the commitment of our franchisees,” said Mike Nuzzo, CEO of Xponential Fitness, Inc.

Company Overview

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE: XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Revenue Growth

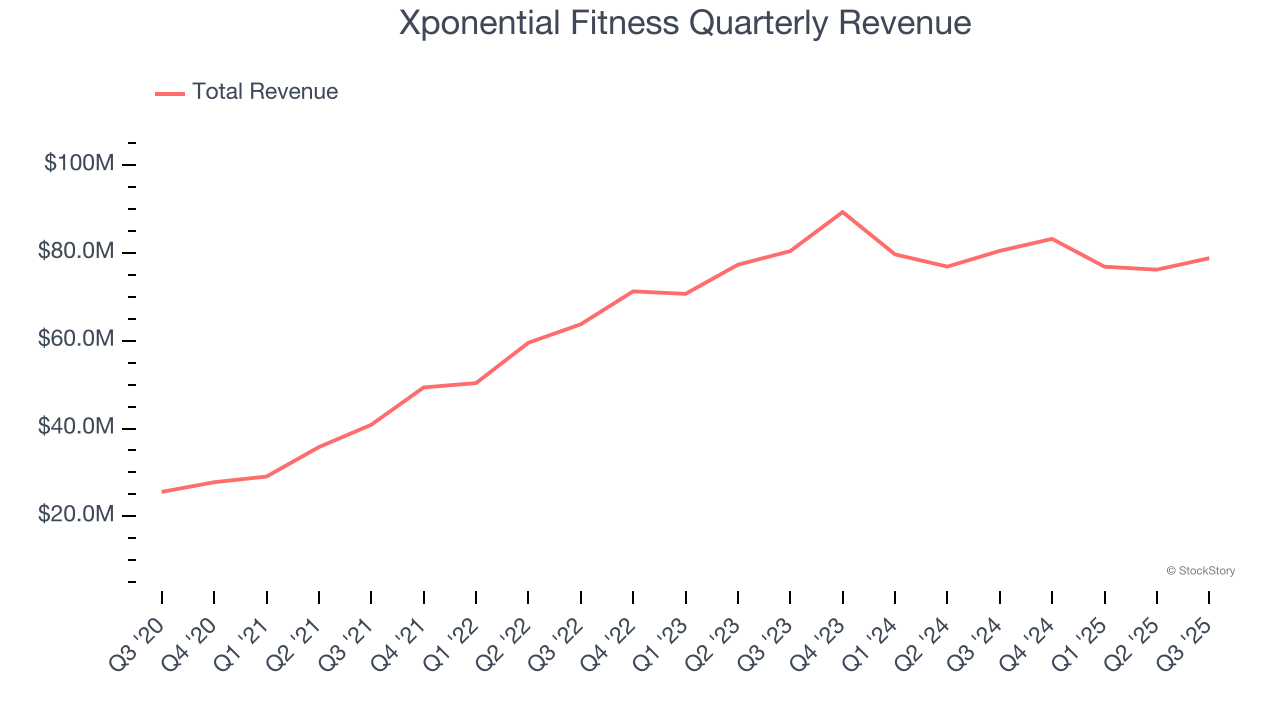

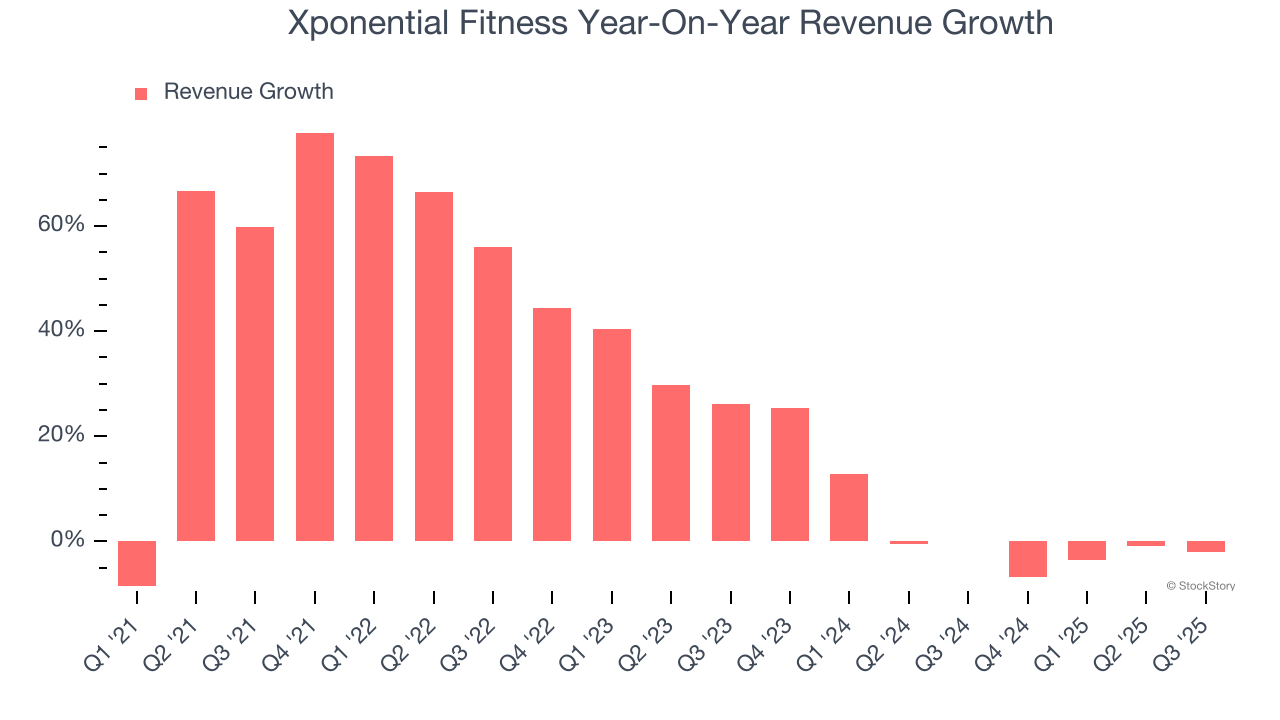

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Xponential Fitness’s 24.1% annualized revenue growth over the last five years was excellent. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Xponential Fitness’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 2.5% over the last two years was well below its five-year trend. Note that COVID hurt Xponential Fitness’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

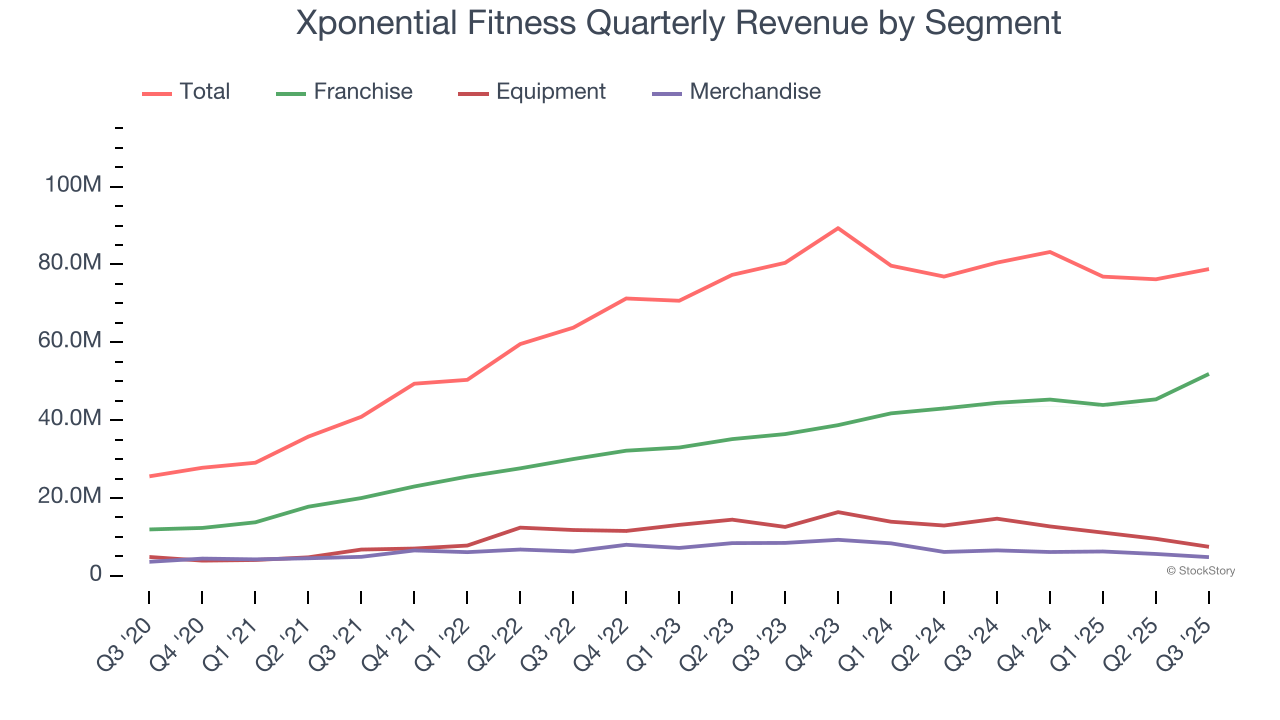

Xponential Fitness also breaks out the revenue for its three most important segments: Franchise, Equipment, and Merchandise, which are 65.8%, 9.5%, and 6.1% of revenue. Over the last two years, Xponential Fitness’s Franchise revenue (royalty fees) averaged 17% year-on-year growth while its Equipment (workout equipment sold to franchisees) and Merchandise (apparel sold to franchisees) revenues averaged declines of 8% and 13.9%.

This quarter, Xponential Fitness’s revenue fell by 2.1% year on year to $78.82 million but beat Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to decline by 2.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

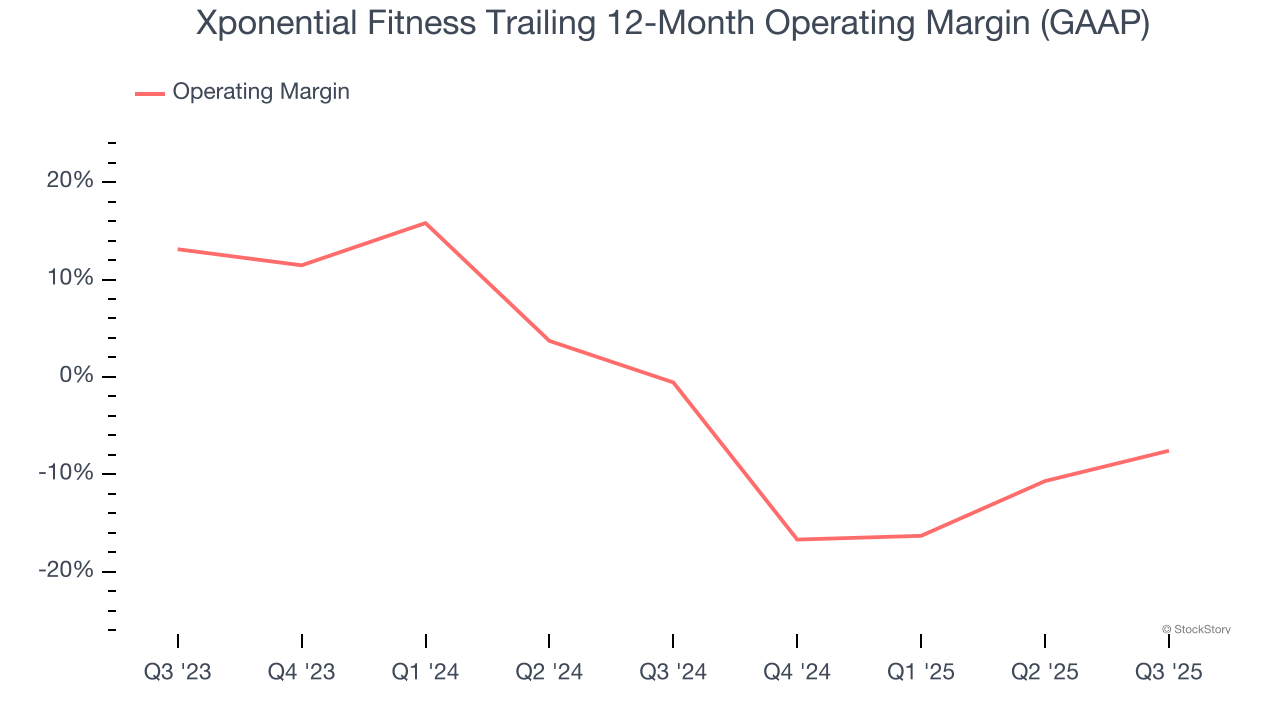

Xponential Fitness’s operating margin has shrunk over the last 12 months and averaged negative 4% over the last two years. Unprofitable, high-growth companies warrant extra scrutiny, especially if their margins fall because they’re spending loads of money to stay relevant, an unsustainable practice.

This quarter, Xponential Fitness generated an operating margin profit margin of 4.5%, up 12.5 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

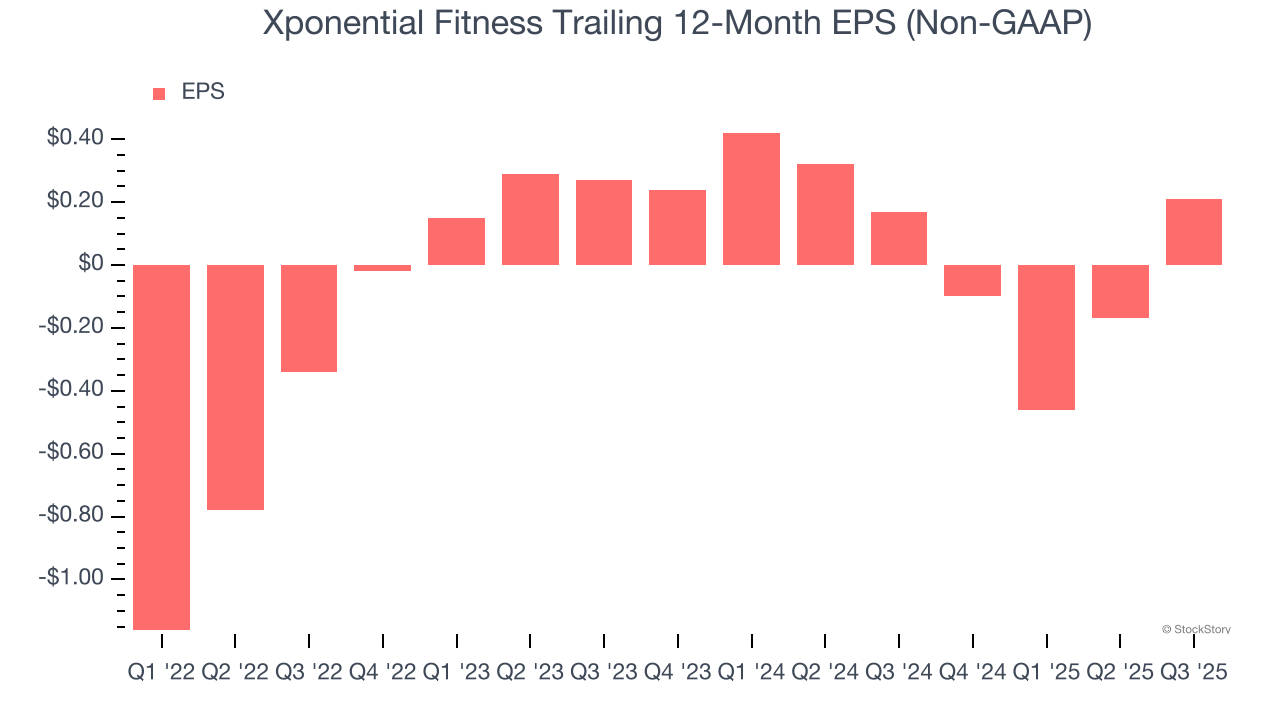

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Xponential Fitness’s full-year EPS flipped from negative to positive over the last four years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Xponential Fitness reported adjusted EPS of $0.34, up from negative $0.04 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Xponential Fitness’s full-year EPS of $0.21 to grow 395%.

Key Takeaways from Xponential Fitness’s Q3 Results

It was good to see Xponential Fitness beat analysts’ revenue, EPS, and EBITDA expectations this quarter. This outperformance was driven by its Franchise segment, as its Merchandise and Equipment revenue fell short of Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 13.5% to $7.15 immediately after reporting.

Indeed, Xponential Fitness had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.