Food flavoring company McCormick (NYSE: MKC) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 2.6% year on year to $1.80 billion. Its non-GAAP profit of $0.80 per share was 4.3% above analysts’ consensus estimates.

Is now the time to buy McCormick? Find out by accessing our full research report, it’s free.

McCormick (MKC) Q4 CY2024 Highlights:

- Revenue: $1.80 billion vs analyst estimates of $1.77 billion (2.6% year-on-year growth, 1.5% beat)

- Adjusted EPS: $0.80 vs analyst estimates of $0.77 (4.3% beat)

- Adjusted EBITDA: $404.9 million vs analyst estimates of $364.6 million (22.5% margin, 11.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2025 is $3.05 at the midpoint, missing analyst estimates by 2%

- Operating Margin: 17%, in line with the same quarter last year

- Free Cash Flow Margin: 20.8%, down from 28.6% in the same quarter last year

- Sales Volumes were up 2.2% year on year

- Market Capitalization: $19.66 billion

Brendan M. Foley, Chairman, President, and CEO, stated, "We are pleased to report strong performance for both fourth quarter and fiscal year 2024, an important year for McCormick, in which we built momentum and strengthened our leadership, returning to differentiated and sustainable volume-led growth. We successfully delivered on our objectives for the year. Our strategic investments in core categories enabled us to drive positive volume growth, expand our margins, and deliver robust earnings growth. Additionally, we achieved another year of strong cash flow, paid down debt, and reduced our leverage ratio, further strengthening our balance sheet."

Company Overview

The classic red Heinz ketchup bottle’s competitor, McCormick (NYSE: MKC) sells food-flavoring products like condiments, spices, and seasoning mixes.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

McCormick is one of the larger consumer staples companies and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because it's harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, McCormick must lean into newer products.

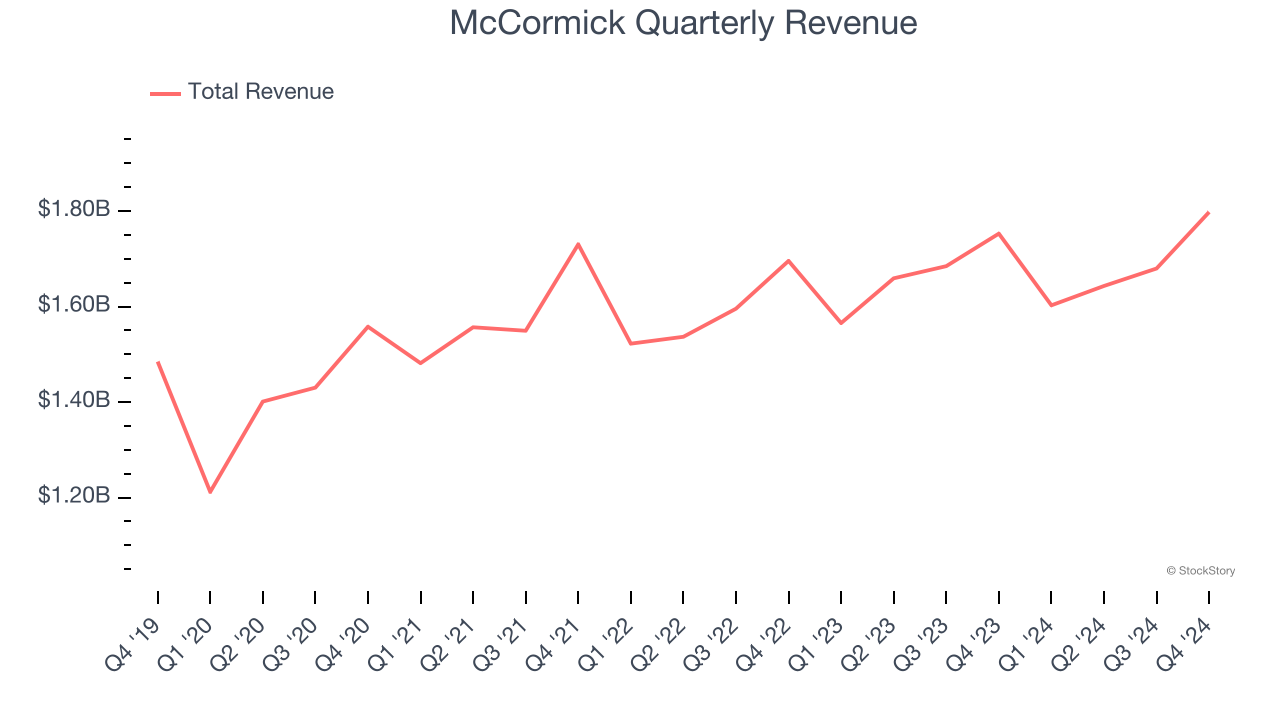

As you can see below, McCormick grew its sales at a sluggish 2.1% compounded annual growth rate over the last three years, but to its credit, consumers bought more of its products.

This quarter, McCormick reported modest year-on-year revenue growth of 2.6% but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months, similar to its three-year rate. This projection is underwhelming and suggests its newer products will not accelerate its top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

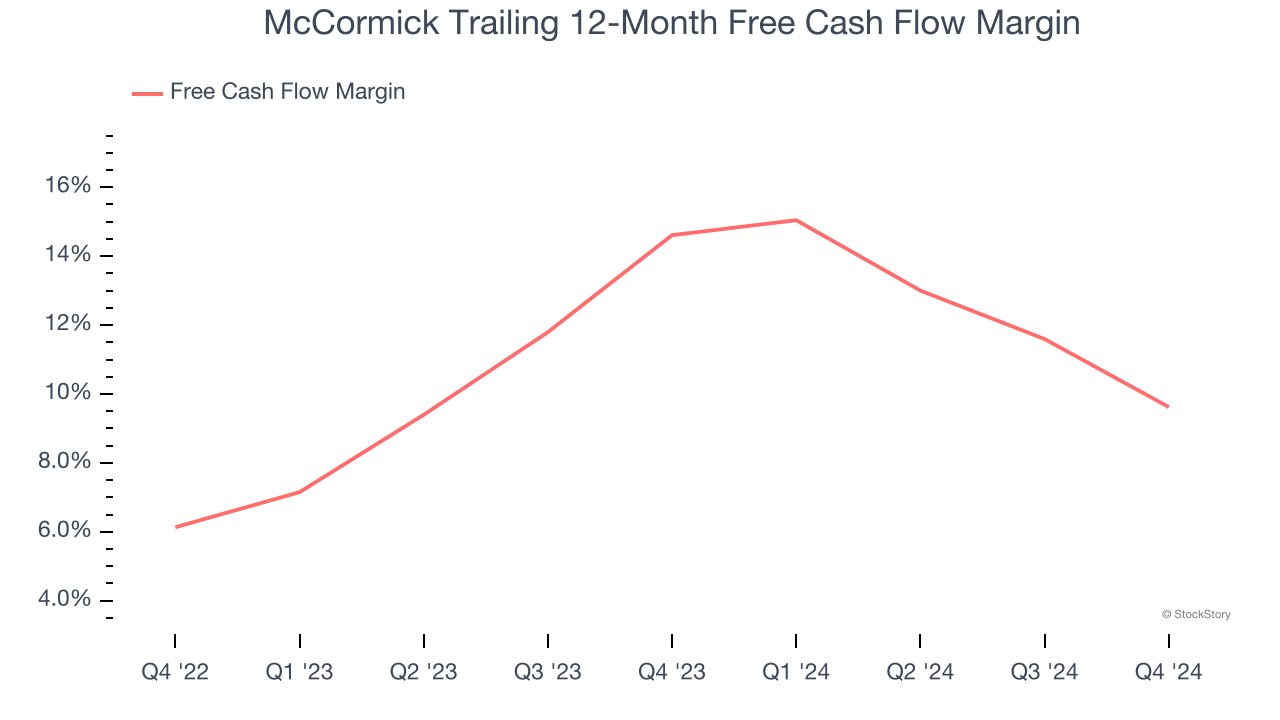

McCormick has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.1% over the last two years, quite impressive for a consumer staples business.

Taking a step back, we can see that McCormick’s margin dropped by 5 percentage points over the last year. If its declines continue, it could signal higher capital intensity.

McCormick’s free cash flow clocked in at $373.1 million in Q4, equivalent to a 20.8% margin. The company’s cash profitability regressed as it was 7.8 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Key Takeaways from McCormick’s Q4 Results

We liked how McCormick beat analysts’ revenue and EPS expectations this quarter. On the other hand, its full-year EPS guidance missed. Overall, this quarter was mixed, and it seems like guidance is weighing on shares. The stock traded down 2.3% to $71.55 immediately after reporting.

Is McCormick an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.