Yum China has been on fire lately. In the past six months alone, the company’s stock price has rocketed 51.5%, reaching $45.26 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Yum China, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re happy investors have made money, but we're swiping left on Yum China for now. Here are three reasons why we avoid YUMC and a stock we'd rather own.

Why Is Yum China Not Exciting?

One of China’s largest restaurant companies, Yum China (NYSE: YUMC) is an independent entity spun off from Yum! Brands in 2016.

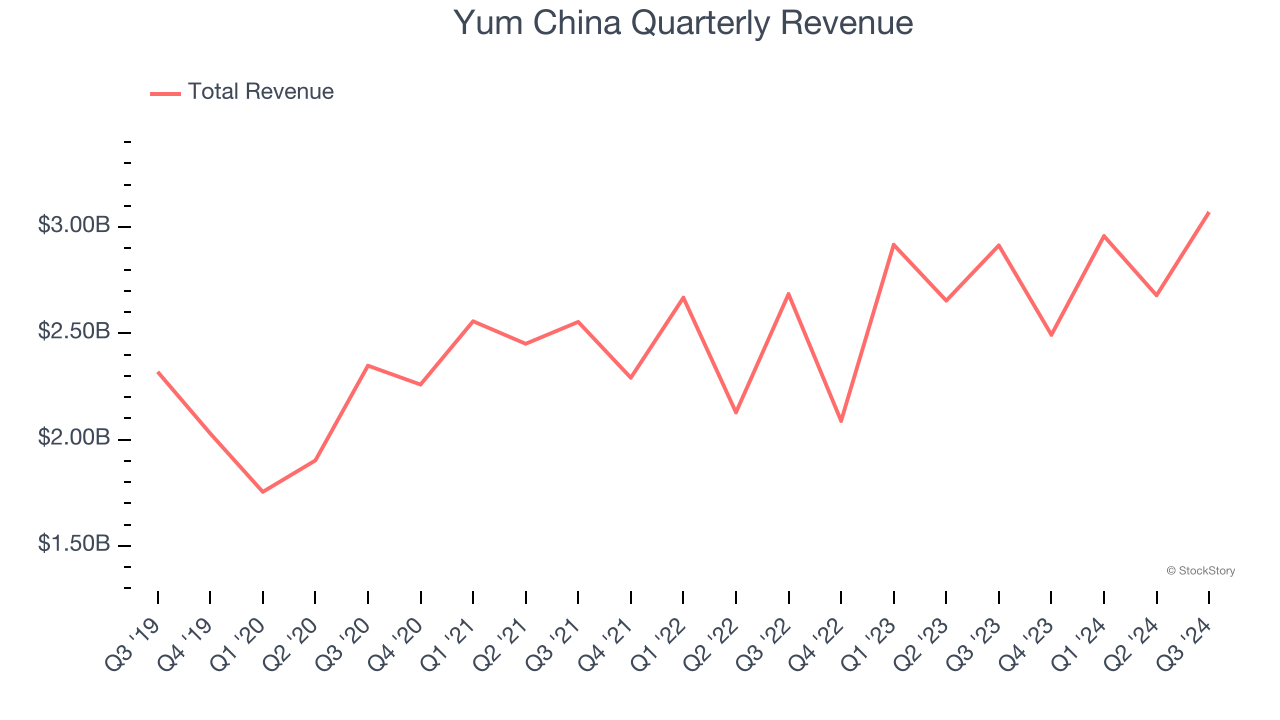

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Yum China’s sales grew at a tepid 5.3% compounded annual growth rate over the last five years. This was below our standard for the restaurant sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Yum China’s revenue to rise by 3.4%, a slight deceleration versus its 5.3% annualized growth for the past five years. This projection is underwhelming and suggests its menu offerings will see some demand headwinds.

3. Low Gross Margin Reveals Weak Structural Profitability

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate pricing power and differentiation, whether it be the dining experience or quality and taste of food.

Yum China has bad unit economics for a restaurant company, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 20.3% gross margin over the last two years. That means Yum China paid its suppliers a lot of money ($79.69 for every $100 in revenue) to run its business.

Final Judgment

Yum China isn’t a terrible business, but it doesn’t pass our quality test. Following the recent rally, the stock trades at 18.2× forward price-to-earnings (or $45.26 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Yum China

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.