The past six months have been a windfall for CrowdStrike’s shareholders. The company’s stock price has jumped 40.1%, hitting $376.81 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy CRWD? Find out in our full research report, it’s free.

Why Is CRWD a Good Business?

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ: CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

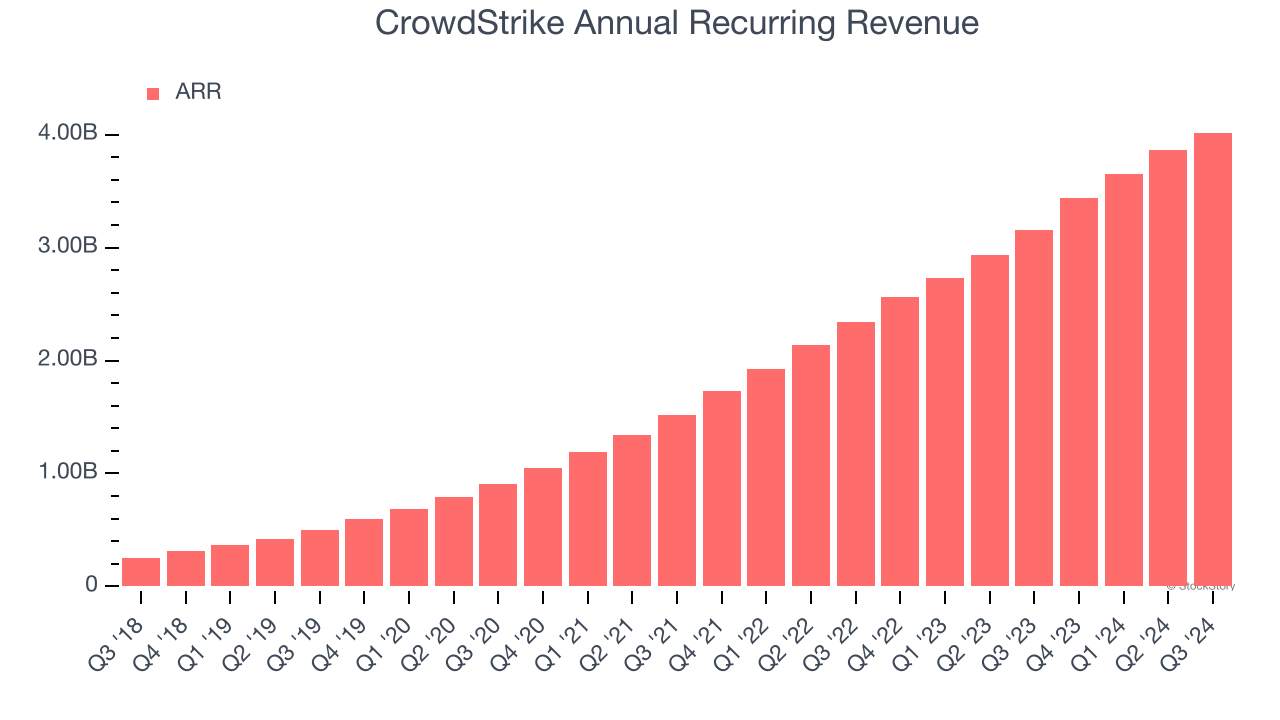

1. ARR Surges as Recurring Revenue Flows In

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

CrowdStrike’s ARR punched in at $4.02 billion in Q3, and over the last four quarters, its year-on-year growth averaged 31.7%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes CrowdStrike a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

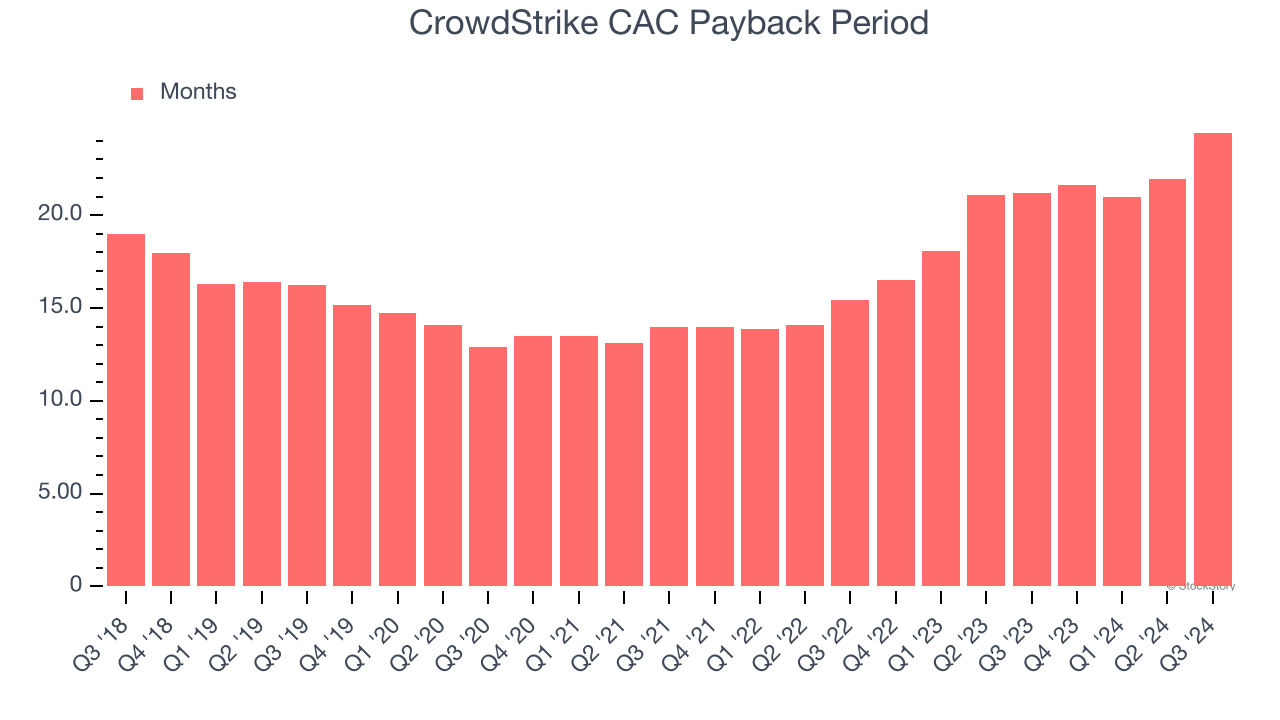

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

CrowdStrike is very efficient at acquiring new customers, and its CAC payback period checked in at 24.4 months this quarter. The company’s rapid sales cycles indicate it has a highly differentiated product offering and a strong brand reputation. These dynamics give CrowdStrike more resources to pursue new product initiatives while maintaining optionality.

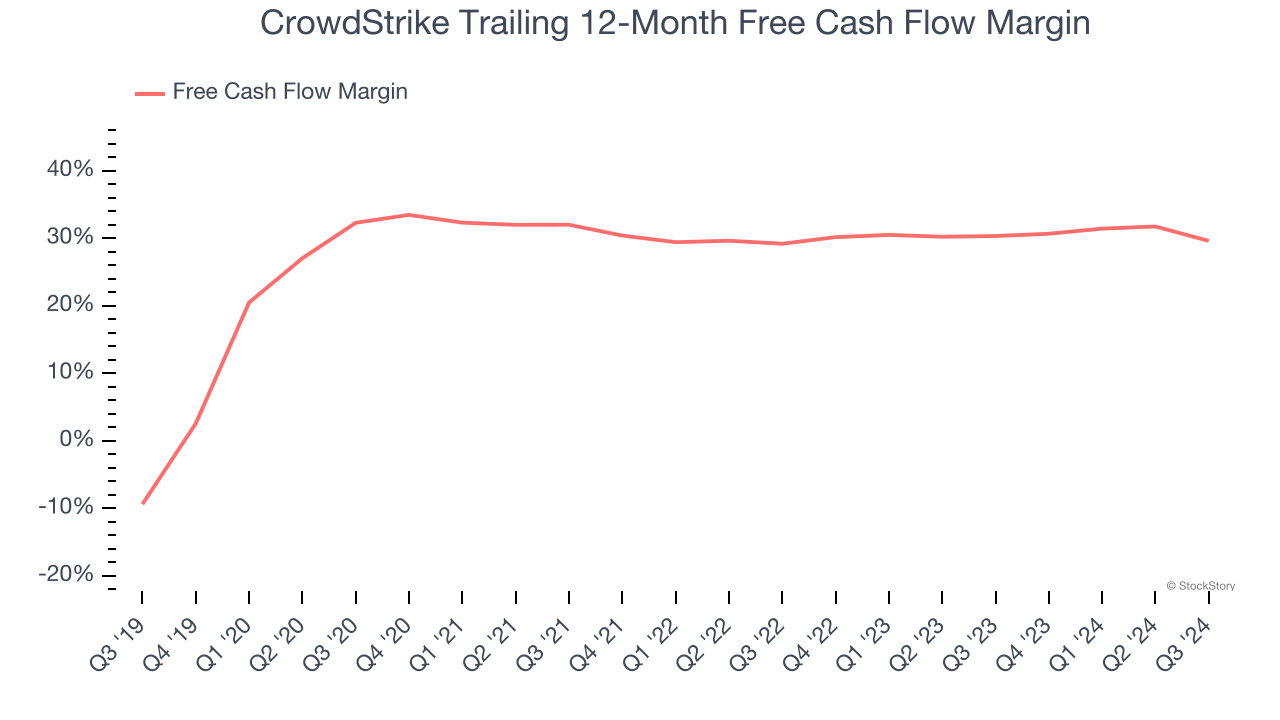

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

CrowdStrike has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging 29.6% over the last year. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Final Judgment

These are just a few reasons why we think CrowdStrike is a great business, and with the recent rally, the stock trades at 20.6× forward price-to-sales (or $376.81 per share). Is now the time to buy despite the apparent froth? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than CrowdStrike

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.