Red Rock Resorts’s stock price has taken a beating over the past six months, shedding 21.6% of its value and falling to $47.59 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Red Rock Resorts, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than RRR and a stock we'd rather own.

Why Is Red Rock Resorts Not Exciting?

Founded in 1976, Red Rock Resorts (NASDAQ: RRR) operates a range of casino resorts and entertainment properties, primarily in the Las Vegas metropolitan area.

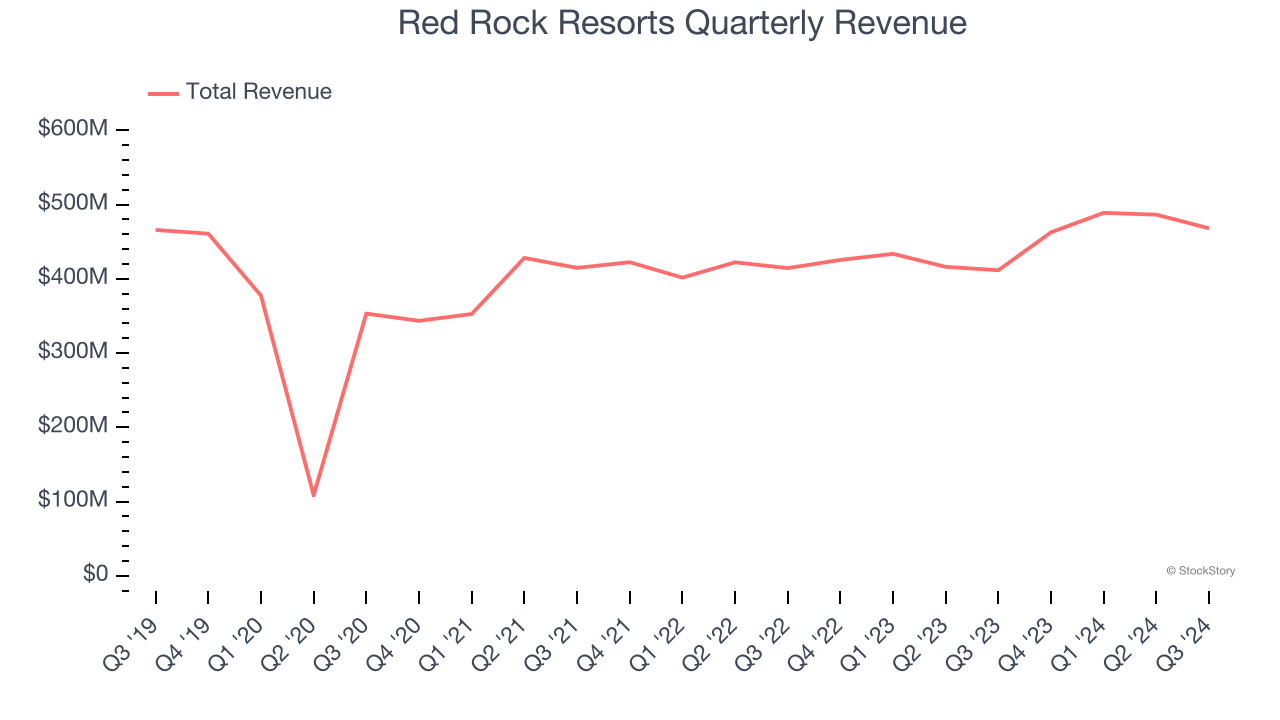

1. Long-Term Revenue Growth Flatter Than a Pancake

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Red Rock Resorts struggled to consistently increase demand as its $1.91 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and signals it’s a lower quality business.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Red Rock Resorts’s revenue to rise by 4.5%, a slight deceleration versus its 7.1% annualized growth for the past two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

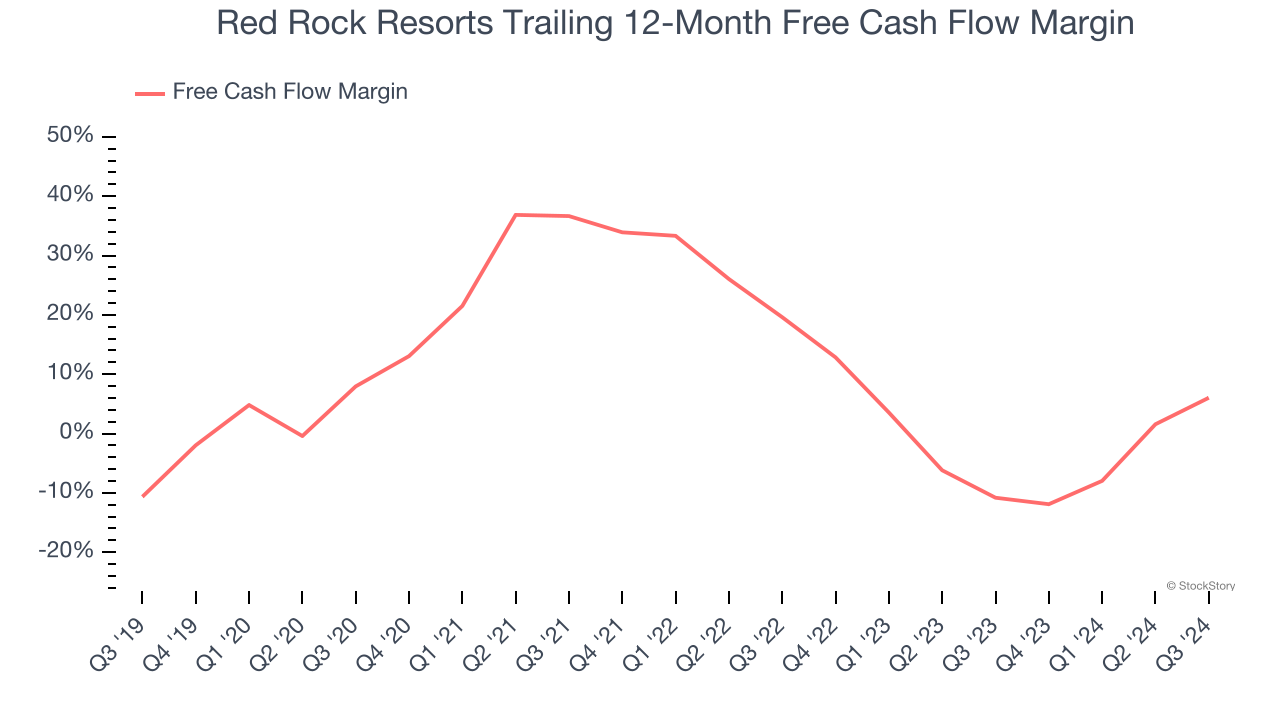

3. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Red Rock Resorts posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Red Rock Resorts’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.9%, meaning it lit $1.88 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Final Judgment

Red Rock Resorts isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 20.8× forward price-to-earnings (or $47.59 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Like More Than Red Rock Resorts

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.