Mobile game developer Skillz (NYSE: SKLZ) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 32.6% year on year to $24.56 million. Its GAAP loss of $1.20 per share was also 7.4% below analysts’ consensus estimates.

Is now the time to buy Skillz? Find out by accessing our full research report, it’s free.

Skillz (SKLZ) Q3 CY2024 Highlights:

- Revenue: $24.56 million vs analyst estimates of $26.66 million (7.9% miss)

- EPS: -$1.20 vs analyst expectations of -$1.12 ($0.08 miss)

- EBITDA: -$13.88 million vs analyst estimates of -$11.32 million (miss)

- Gross Margin (GAAP): 86.3%, down from 89.9% in the same quarter last year

- EBITDA Margin: -56.5%, down from -50.8% in the same quarter last year

- Free Cash Flow was -$11.38 million, down from $27.13 million in the previous quarter

- Paying Monthly Active Users: 121,000, down 47,000 year on year

- Market Capitalization: $99.53 million

“Our third quarter operating performance was marked by continued execution on our strategic operating priorities as we further position Skillz to generate sustainable top-line growth and positive cash flow,” said Andrew Paradise, Skillz’ CEO.

Company Overview

Taking a new twist at video gaming, Skillz (NYSE: SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Sales Growth

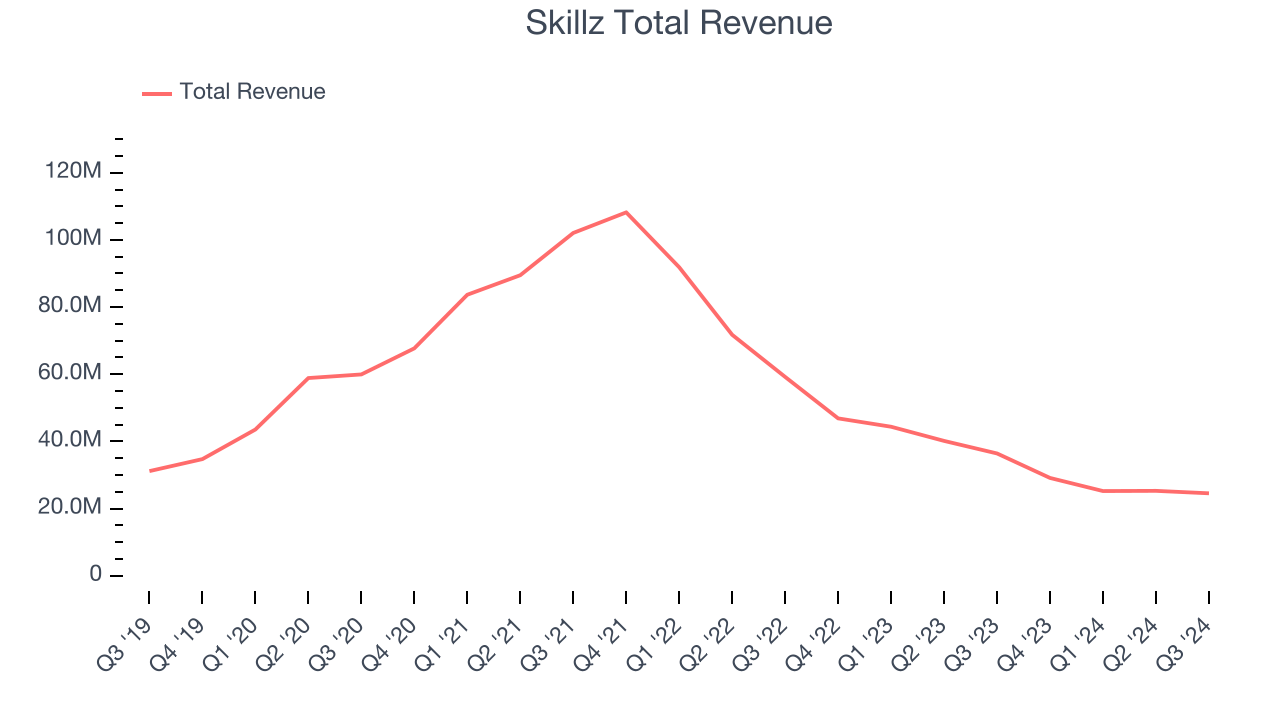

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Skillz struggled to generate demand over the last three years as its sales dropped by 32.8% annually, a rough starting point for our analysis.

This quarter, Skillz missed Wall Street’s estimates and reported a rather uninspiring 32.6% year-on-year revenue decline, generating $24.56 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 10.3% over the next 12 months, an acceleration versus the last three years. This projection is above the sector average and illustrates the market believes its newer products and services will spur faster growth.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Paying Monthly Active Users

User Growth

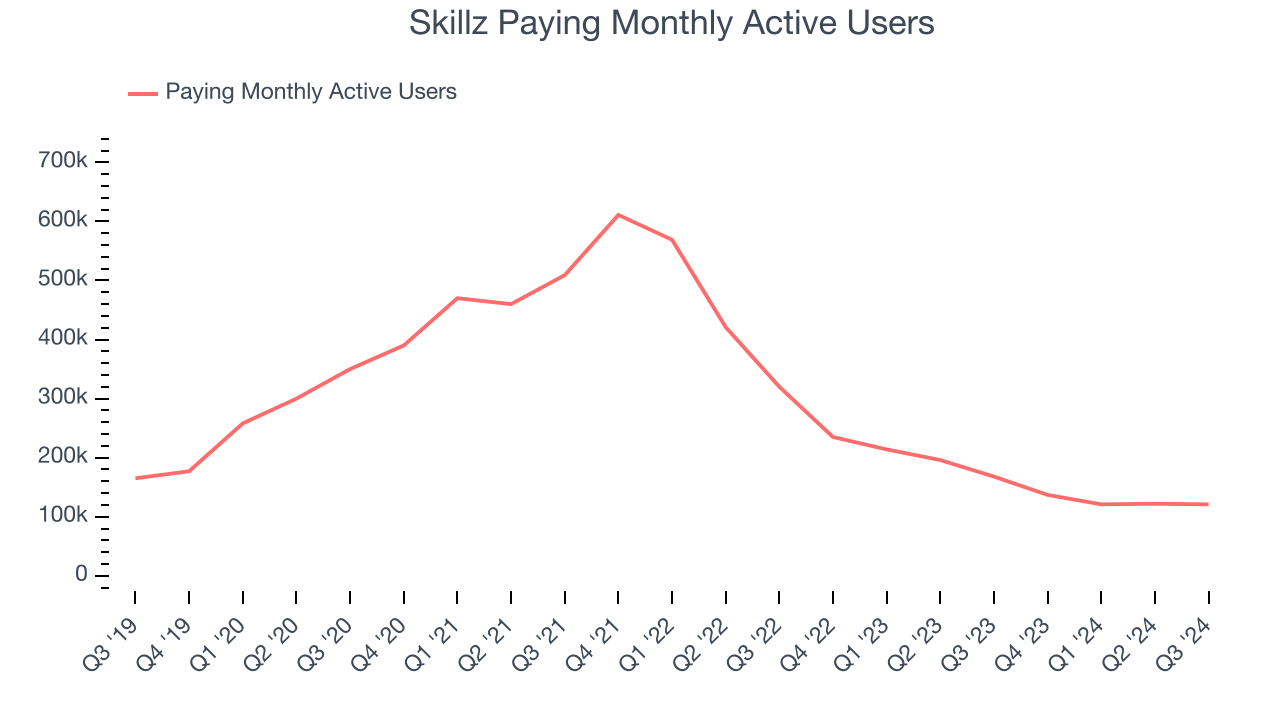

As a video gaming company, Skillz generates revenue growth by expanding both the number of people playing its games as well as how much each of those players spends on (or in) their games.

Skillz struggled to engage its paying monthly active users over the last two years as they have declined by 47% annually to 121,000 in the latest quarter. This performance isn't ideal because internet usage is secular. If Skillz wants to accelerate growth, it must enhance the appeal of its current offerings or innovate with new products.

In Q3, Skillz’s paying monthly active users once again decreased by 47,000, a 28% drop since last year. On the bright side, the quarterly print was higher than its two-year result and suggests its new initiatives are accelerating user growth.

Revenue Per User

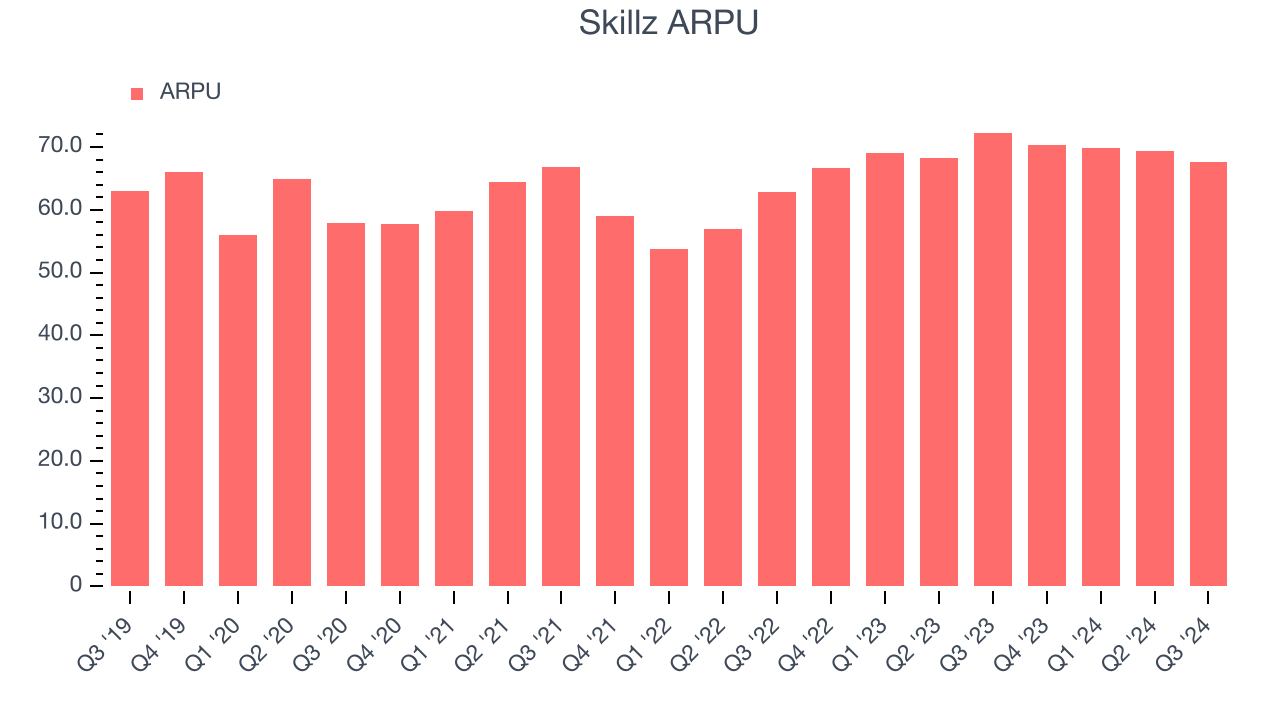

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Skillz because it measures how much revenue each user generates, which is a function of how much paying users spend on its games.

Skillz’s ARPU growth has been excellent over the last two years, averaging 9.8%. Although its paying monthly active users shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing users.

This quarter, Skillz’s ARPU clocked in at $67.60. It declined 6.5% year on year but outperformed the change in its paying monthly active users.

Key Takeaways from Skillz’s Q3 Results

We struggled to find many strong positives in these results. Its number of users declined and its users fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.2% to $5.40 immediately following the results.

Skillz’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.