Software development tools maker JFrog (NASDAQ: FROG) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 23% year on year to $109.1 million. The company expects next quarter’s revenue to be around $114 million, close to analysts’ estimates. Its non-GAAP profit of $0.15 per share was also 41.7% above analysts’ consensus estimates.

Is now the time to buy JFrog? Find out by accessing our full research report, it’s free.

JFrog (FROG) Q3 CY2024 Highlights:

- Revenue: $109.1 million vs analyst estimates of $105.6 million (3.3% beat)

- Adjusted EPS: $0.15 vs analyst estimates of $0.11 ($0.04 beat)

- Adjusted Operating Income: $14.72 million vs analyst estimates of $10.6 million (beat)

- Revenue Guidance for Q4 CY2024 is $114 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted Operating Income Guidance for Q4 CY2024 is $14.5 million at the midpoint, roughly in line with what analysts were expecting

- Revenue Guidance for full year CY2024 raised to $426 million at the midpoint, slightly above what analysts were expecting

- Adjusted Operating Income Guidance for full year CY2024 raised to $57 million at the midpoint, above what analysts were expecting

- Gross Margin (GAAP): 75%, down from 77.7% in the same quarter last year

- Operating Margin: -27.4%, down from -20.4% in the same quarter last year

- Free Cash Flow Margin: 24.5%, up from 15.5% in the previous quarter

- Net Revenue Retention Rate: 117%, down from 118% in the previous quarter

- Customers: 966 customers paying more than $100,000 annually

- Market Capitalization: $3.50 billion

"Our third quarter results reflect strong execution in a tight budgetary environment, with some of the largest enterprise wins in JFrog's history," said Shlomi Ben Haim, Co-founder and CEO of JFrog.

Company Overview

Named after the founders' affinity for frogs, JFrog (NASDAQ: FROG) provides a software-as-a-service platform that makes developing and releasing software easier and faster, especially for large teams.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

Sales Growth

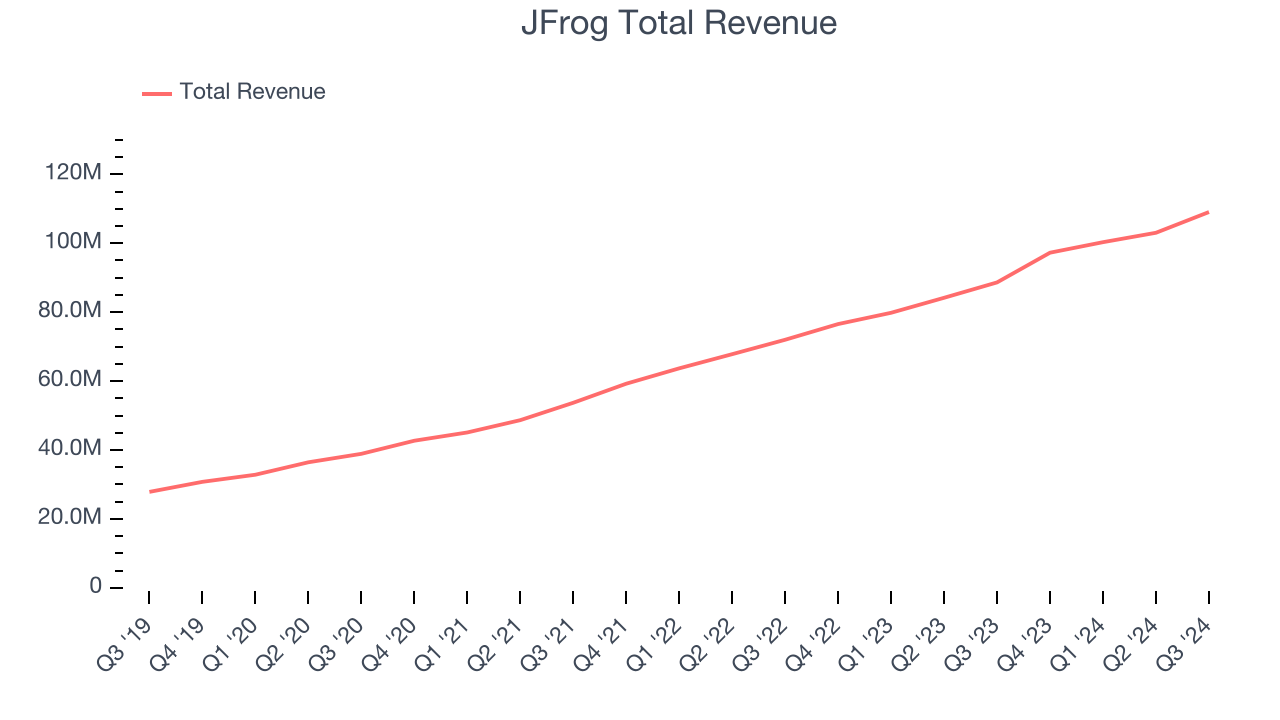

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, JFrog’s 29.2% annualized revenue growth over the last three years was impressive. This is encouraging because it shows JFrog’s offerings resonate with customers, a helpful starting point.

This quarter, JFrog reported robust year-on-year revenue growth of 23%, and its $109.1 million of revenue topped Wall Street estimates by 3.3%. Management is currently guiding for a 17.2% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.9% over the next 12 months, a deceleration versus the last three years. This projection is still noteworthy and indicates the market is factoring in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Retention

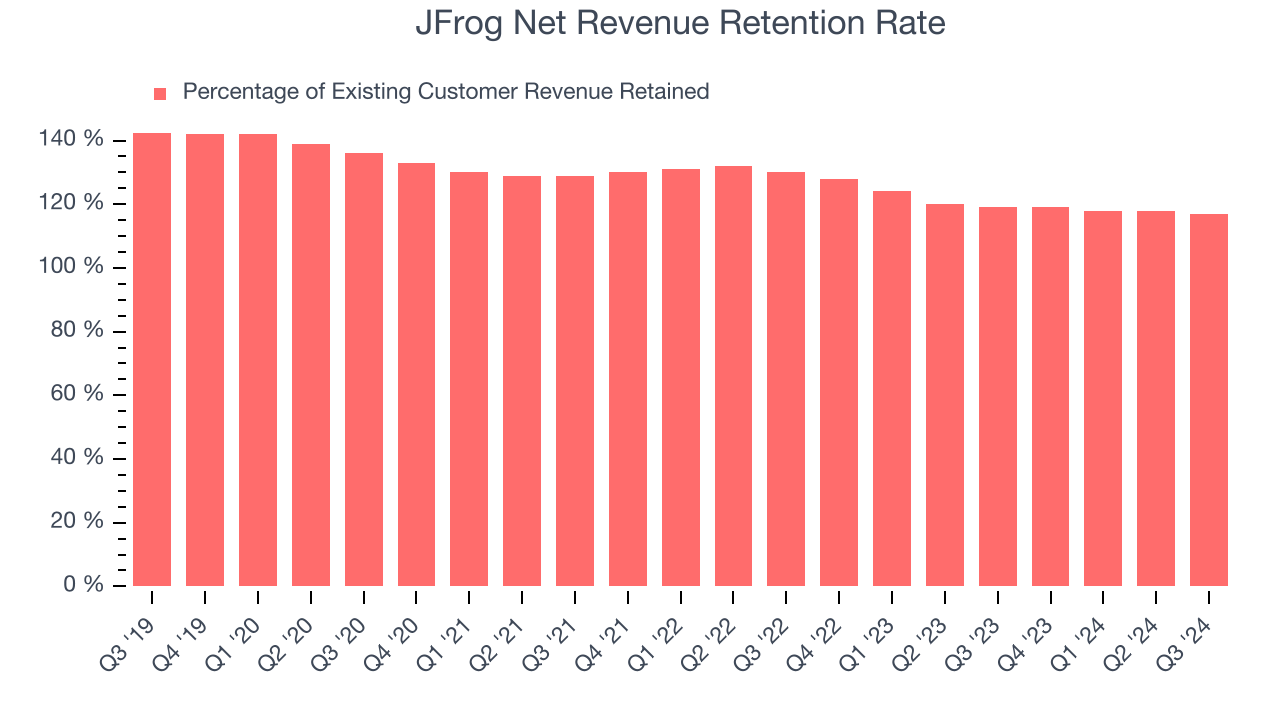

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

JFrog’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 118% in Q3. This means that even if JFrog didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 18%.

JFrog has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from JFrog’s Q3 Results

We were impressed by JFrog’s significant improvement in new large contract wins this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Guidance was largely fine, with next quarter and full year revenue and adjusted operating income guidance all in line to slightly above expectations. On the other hand, its gross margin declined. Overall, this quarter had some key positives, but perhaps expectations were high or the results were not good enough for a high-multiple stock. Shares traded down 1.2% to $32.50 immediately after reporting.

So should you invest in JFrog right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.