Global talent agency and entertainment company Endeavor (NYSE: EDR) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 51.1% year on year to $2.03 billion. Its GAAP loss of $0.86 per share was also below analysts’ consensus estimates.

Is now the time to buy Endeavor? Find out by accessing our full research report, it’s free.

Endeavor (EDR) Q3 CY2024 Highlights:

- Revenue: $2.03 billion vs analyst estimates of $2.15 billion (5.5% miss)

- EPS: -$0.86 vs analyst estimates of $0.38 (-$1.24 miss)

- EBITDA: $277.6 million vs analyst estimates of $546.2 million (49.2% miss)

- Gross Margin (GAAP): 46%, down from 63.7% in the same quarter last year

- Operating Margin: 0.3%, down from 2.4% in the same quarter last year

- EBITDA Margin: 13.7%, down from 23.2% in the same quarter last year

- Market Capitalization: $8.91 billion

“During the quarter, our owned sports and representation segments delivered solid results driven by continued consumer demand for live events and content,” said Ariel Emanuel, CEO, Endeavor.

Company Overview

Owner of the UFC, WWE, and a client roster including Christian Bale, Endeavor (NYSE: EDR) is a diversified global entertainment, sports, and content company known for its talent representation and involvement in the entertainment industry.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

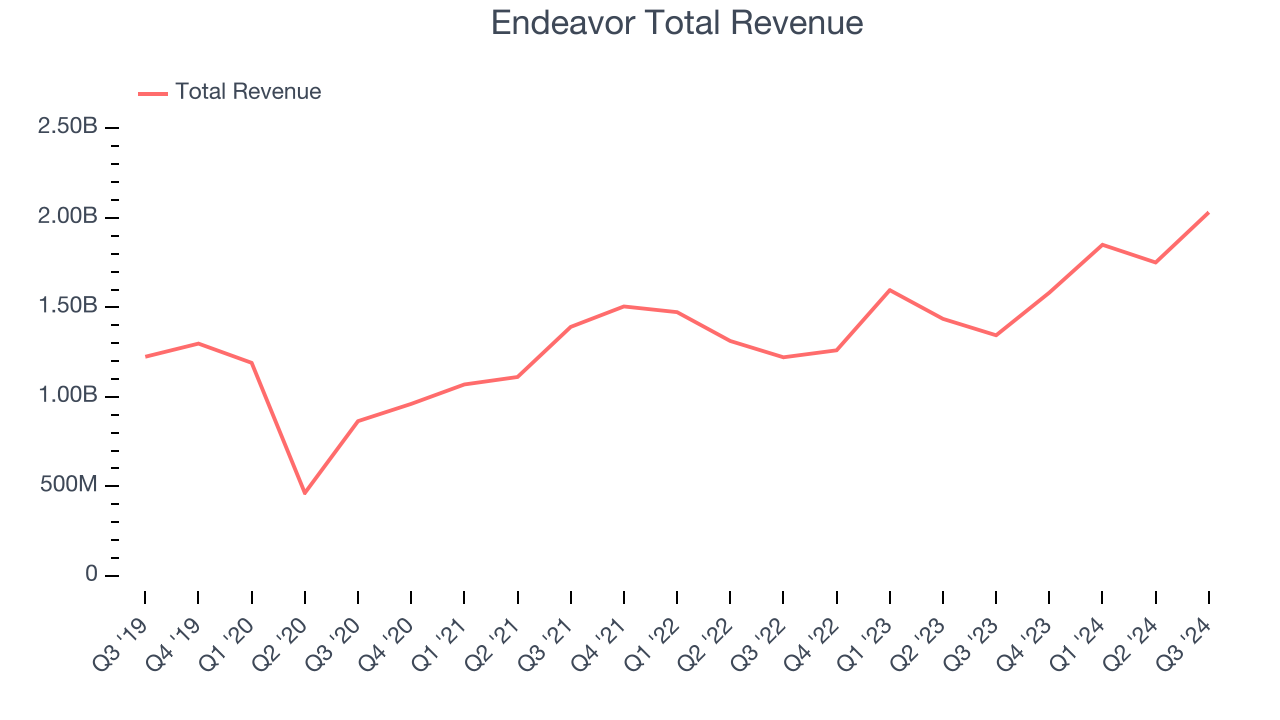

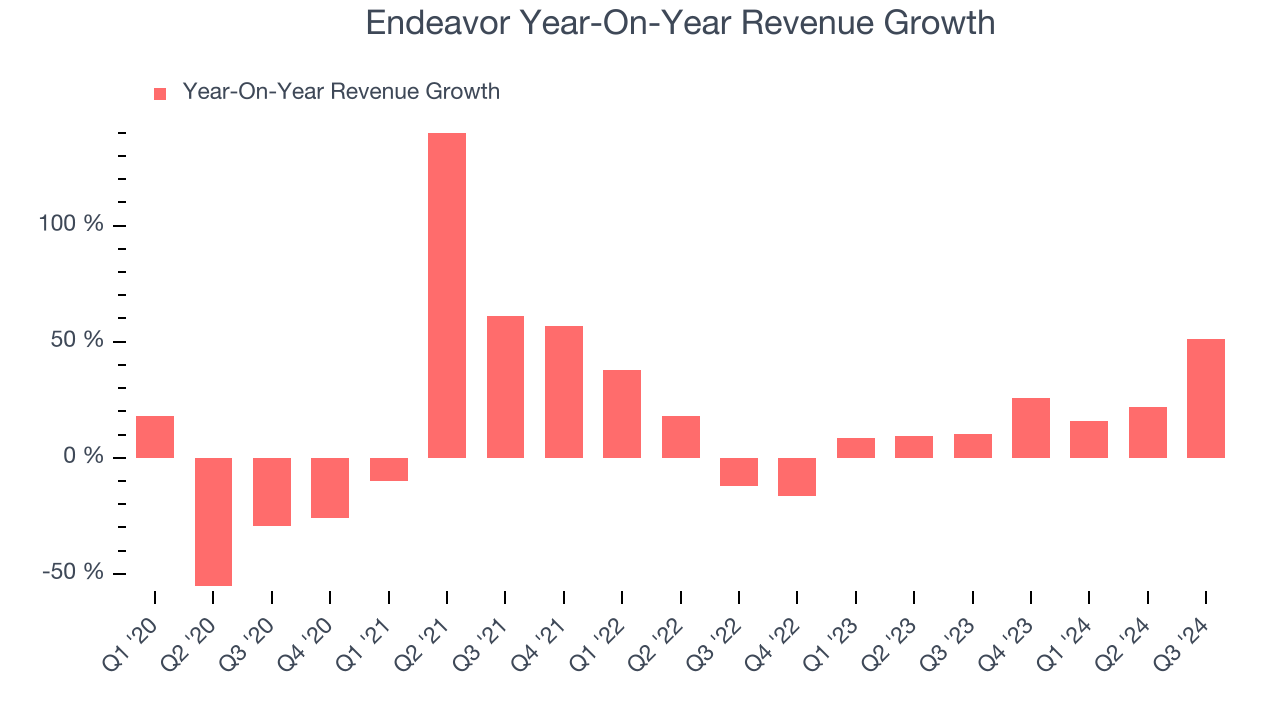

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Endeavor’s sales grew at a tepid 11.5% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Endeavor’s annualized revenue growth of 14.4% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Events, Sports, and Representation, which are 44.3%, 36.2%, and 21.1% of revenue. Over the last two years, Endeavor’s Events (live events) and Sports (UFC, Euroleague) revenues averaged year-on-year growth of 10% and 59.1% while its Representation revenue (WME talent agency, IMG Models) averaged 2.1% declines.

This quarter, Endeavor achieved a magnificent 51.1% year-on-year revenue growth rate, but its $2.03 billion of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market believes its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Key Takeaways from Endeavor’s Q3 Results

We struggled to find many strong positives in these results as its revenue, EBITDA, and EPS missed Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $29.21 immediately following the results.

So do we think Endeavor is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.