Fantasy sports and betting company DraftKings (NASDAQ: DKNG) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 38.7% year on year to $1.10 billion. On the other hand, the company’s full-year revenue guidance of $6.4 billion at the midpoint came in 24.9% above analysts’ estimates. Its non-GAAP loss of $0.17 per share was 30.1% above analysts’ consensus estimates.

Is now the time to buy DraftKings? Find out by accessing our full research report, it’s free.

DraftKings (DKNG) Q3 CY2024 Highlights:

- Revenue: $1.10 billion vs analyst estimates of $1.11 billion (1.4% miss)

- Adjusted EPS: -$0.17 vs analyst estimates of -$0.24 (30.1% beat)

- EBITDA: -$58.5 million vs analyst estimates of -$73.31 million (20.2% beat)

- The company lifted its revenue guidance for the full year to $6.4 billion at the midpoint from $5.15 billion, a 24.3% increase

- EBITDA guidance for the full year is $260 million at the midpoint, below analyst estimates of $385 million

- Gross Margin (GAAP): 32.2%, up from 31.2% in the same quarter last year

- Operating Margin: -27.3%, up from -36.3% in the same quarter last year

- EBITDA Margin: -5.3%, up from -19.4% in the same quarter last year

- Free Cash Flow Margin: 11.9%, down from 17.1% in the same quarter last year

- : 3.6 million, up 1.3 million year on year

- Market Capitalization: $18.57 billion

“DraftKings delivered strong performance in the third quarter with the return of NFL and college football,” said Jason Robins, DraftKings’ Chief Executive Officer and Co-founder.

Company Overview

Getting its start in daily fantasy sports, DraftKings (NASDAQ: DKNG) is a digital sports entertainment and gaming company.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

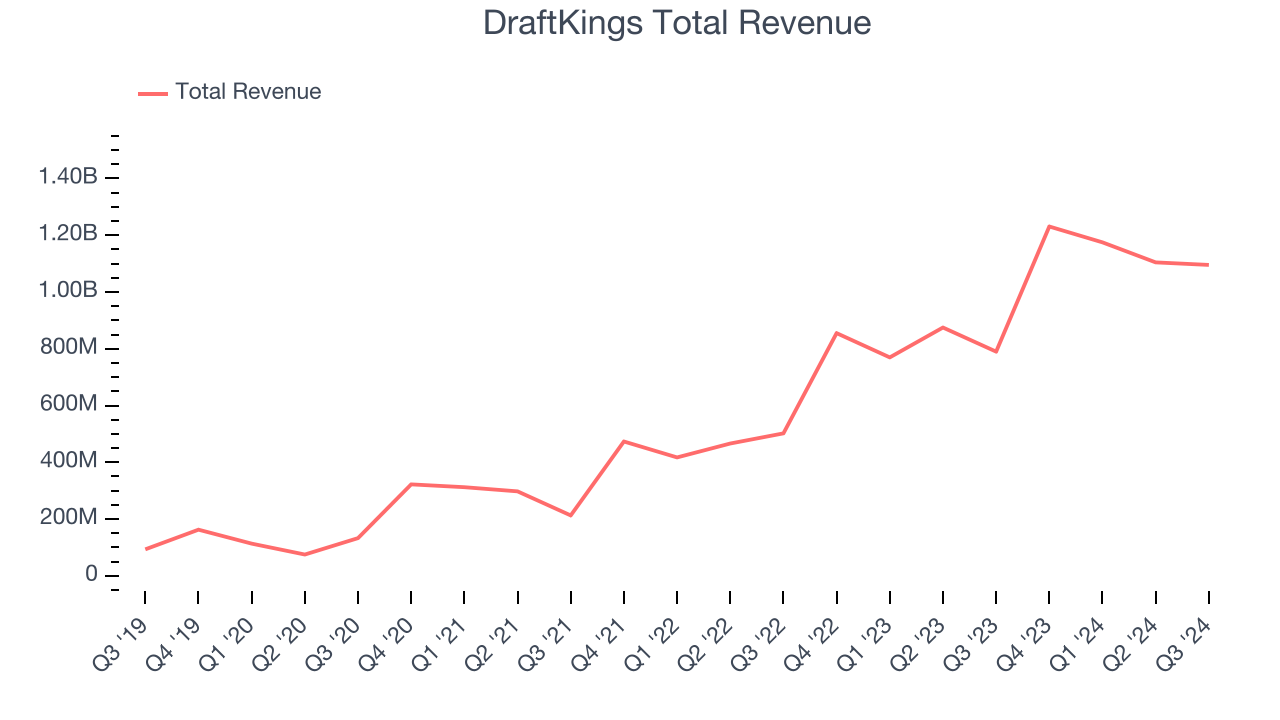

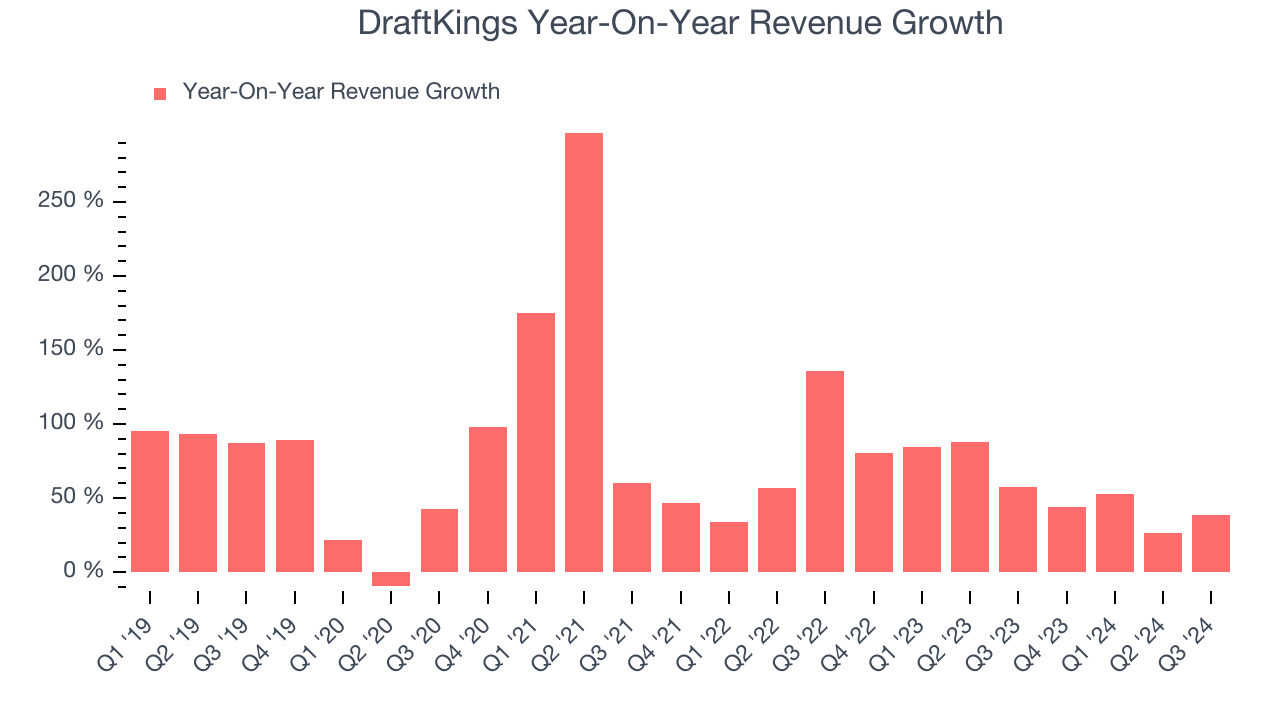

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, DraftKings’s 66.9% annualized revenue growth over the last five years was incredible. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. DraftKings’s annualized revenue growth of 57.4% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, DraftKings pulled off a wonderful 38.7% year-on-year revenue growth rate, but its $1.10 billion of revenue fell short of Wall Street’s rosy estimates.

Looking ahead, sell-side analysts expect revenue to grow 28% over the next 12 months, a deceleration versus the last two years. This projection is still noteworthy and illustrates the market sees success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

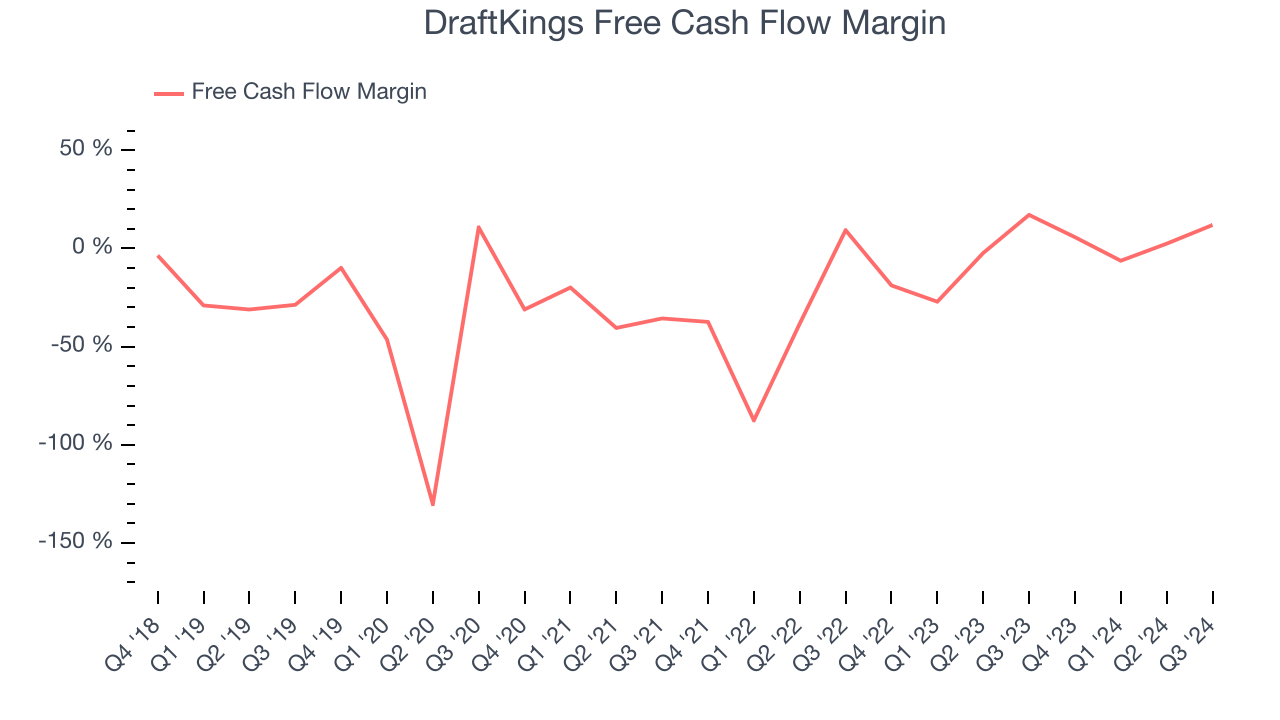

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

While DraftKings posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, DraftKings’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.26 of cash on fire for every $100 in revenue.

DraftKings’s free cash flow clocked in at $130.9 million in Q3, equivalent to a 11.9% margin. The company’s cash profitability regressed as it was 5.2 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

Key Takeaways from DraftKings’s Q3 Results

We were impressed that DraftKings beat analysts' revenue expectations and lifted its full-year revenue guidance. On the other hand, its full-year EBITDA forecast was well short of Wall Street's estimates, sending shares lower. This trumped its strong sales trends because the key debate for DKNG centers around whether it can reel back marketing expenses and harvest its mature markets (each U.S. state can be thought of as a market). Overall, this quarter was mixed. The areas below expectations seem to be driving the move, and shares traded down 5.3% to $36.93 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.