Aerospace and defense company AXON (NASDAQ: AXON) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 31.6% year on year to $544.3 million. On top of that, next quarter’s revenue guidance ($565 million at the midpoint) was surprisingly good and 3.2% above what analysts were expecting. Its non-GAAP profit of $1.45 per share was also 21% above analysts’ consensus estimates.

Is now the time to buy Axon? Find out by accessing our full research report, it’s free.

Axon (AXON) Q3 CY2024 Highlights:

- Revenue: $544.3 million vs analyst estimates of $525.4 million (3.6% beat)

- Adjusted EPS: $1.45 vs analyst estimates of $1.20 (21% beat)

- EBITDA: $145.1 million vs analyst estimates of $119.2 million (21.7% beat)

- Revenue Guidance for Q4 CY2024 is $565 million at the midpoint, above analyst estimates of $547.6 million

- EBITDA guidance for the full year is $510 million at the midpoint, above analyst estimates of $480 million

- Gross Margin (GAAP): 60.8%, in line with the same quarter last year

- Operating Margin: 4.4%, down from 13.3% in the same quarter last year

- EBITDA Margin: 26.7%, up from 22.2% in the same quarter last year

- Free Cash Flow Margin: 11.9%, similar to the same quarter last year

- Market Capitalization: $34.73 billion

"We spend a lot of time thinking about what could go wrong. But we also need to think about what could go right. Can we do better than today?" — Rick Smith, Axon Founder and CEO

Company Overview

Providing body cameras and tasers for first responders, AXON (NASDAQ: AXON) develops technology solutions and weapons products for military, law enforcement, and civilians.

Law Enforcement Suppliers

Many law enforcement suppliers companies require licensing and clearance to manufacture products such as firearms. These companies can enjoy long-term contracts with law enforcement and corrections bodies, leading to more predictable revenue. It is still unclear how the recent focus on excessive force and police accountability will impact longer-term demand. On the one hand, lethal force products could become less popular. On the other hand, products such as body cams that aid in the transparency of policing could become standard. Generally, the sector’s fate will also ebb and flow with state or local budgets, and there is high reputational risk, as one mishap or bad headline can change a company’s fortunes.

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Thankfully, Axon’s 32.6% annualized revenue growth over the last five years was incredible. This is a great starting point for our analysis because it shows Axon’s offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Axon’s annualized revenue growth of 34.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Axon reported wonderful year-on-year revenue growth of 31.6%, and its $544.3 million of revenue exceeded Wall Street’s estimates by 3.6%. Management is currently guiding for a 30.7% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 22.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and shows the market is factoring in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

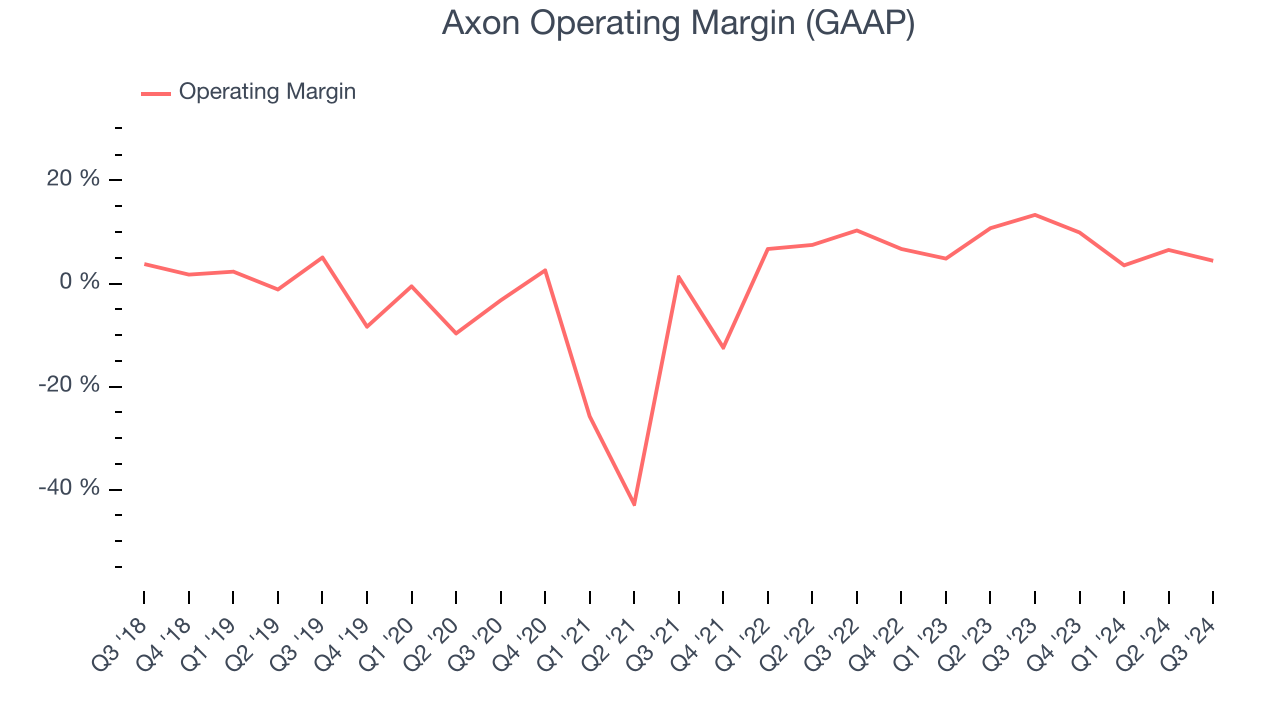

Operating Margin

Axon was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.1% was weak for an industrials business.

On the plus side, Axon’s annual operating margin rose by 11.5 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Axon generated an operating profit margin of 4.4%, down 8.9 percentage points year on year. This contraction shows it was recently less efficient because its expenses grew faster than its revenue.

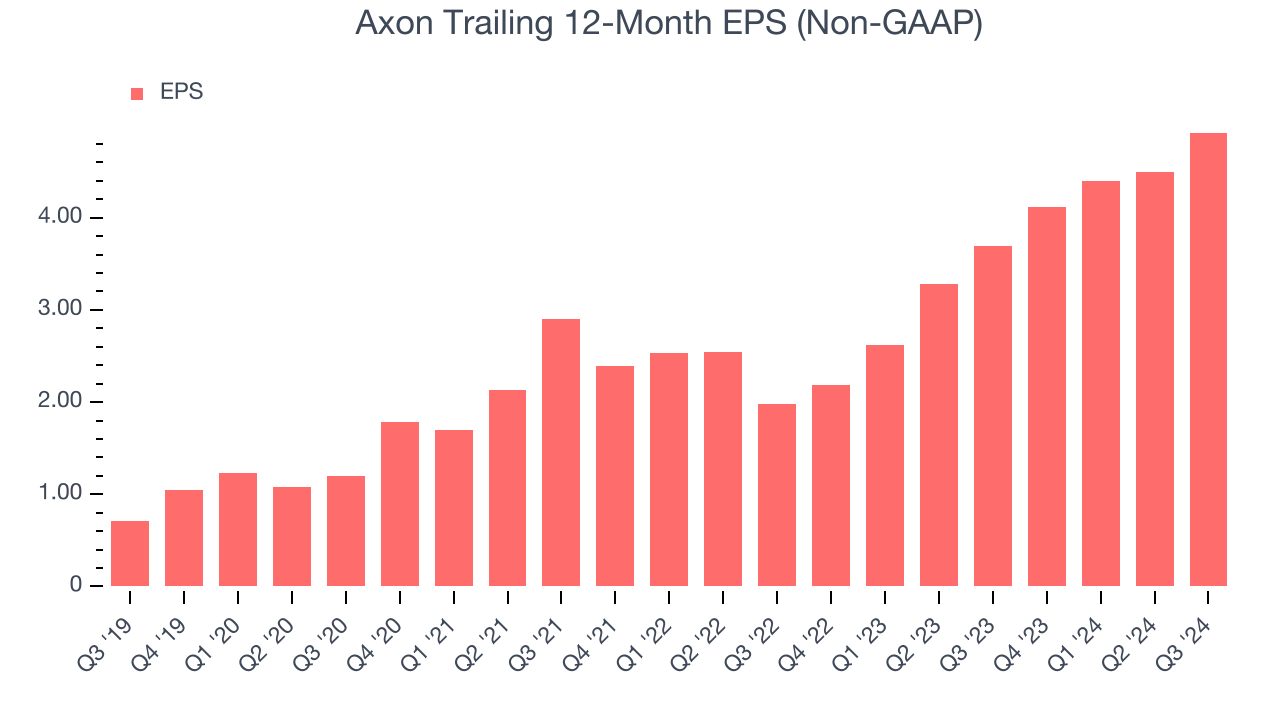

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Axon’s EPS grew at an astounding 47.4% compounded annual growth rate over the last five years, higher than its 32.6% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into the nuances of Axon’s earnings can give us a better understanding of its performance. As we mentioned earlier, Axon’s operating margin declined this quarter but expanded by 11.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Axon, its two-year annual EPS growth of 57.8% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Axon reported EPS at $1.45, up from $1.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Axon’s full-year EPS of $4.92 to grow by 12.6%.

Key Takeaways from Axon’s Q3 Results

We were impressed by how significantly Axon blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 11.1% to $520.86 immediately after reporting.

Sure, Axon had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.