Luxury furniture retailer Arhaus (NASDAQ: ARHS) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 2.2% year on year to $319.1 million. Next quarter’s revenue guidance of $316 million underwhelmed, coming in 3.5% below analysts’ estimates. Its GAAP profit of $0.07 per share was also 9.1% below analysts’ consensus estimates.

Is now the time to buy Arhaus? Find out by accessing our full research report, it’s free.

Arhaus (ARHS) Q3 CY2024 Highlights:

- Revenue: $319.1 million vs analyst estimates of $328.9 million (3% miss)

- EPS: $0.07 vs analyst expectations of $0.08 (9.1% miss)

- EBITDA: $23.11 million vs analyst estimates of $26.88 million (14% miss)

- Revenue Guidance for Q4 CY2024 is $316 million at the midpoint, below analyst estimates of $327.5 million

- EBITDA guidance for the full year is $120 million at the midpoint, below analyst estimates of $131 million

- Gross Margin (GAAP): 38.6%, down from 46.5% in the same quarter last year

- Operating Margin: 3.3%, down from 7.3% in the same quarter last year

- EBITDA Margin: 7.2%, down from 10.3% in the same quarter last year

- Free Cash Flow Margin: 1.4%, down from 18.4% in the same quarter last year

- Locations: 100 at quarter end, up from 86 in the same quarter last year

- Same-Store Sales fell 9.2% year on year (-2.1% in the same quarter last year)

- Market Capitalization: $1.28 billion

John Reed, Co-Founder and Chief Executive Officer, said, “Our third-quarter results demonstrate our team’s commitment to operational excellence in a challenging environment. We remain focused on our long-term growth strategy grounded in our premium, livable luxury offerings and exceptional client experience. With ten new showrooms opened already this year and an eleventh opening tomorrow in Corte Madera, California, we remain committed to expanding our presence in key markets.

Company Overview

With an aesthetic that features natural materials such as reclaimed wood, Arhaus (NASDAQ: ARHS) is a high-end furniture retailer that sells everything from sofas to rugs to bookcases.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Arhaus is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

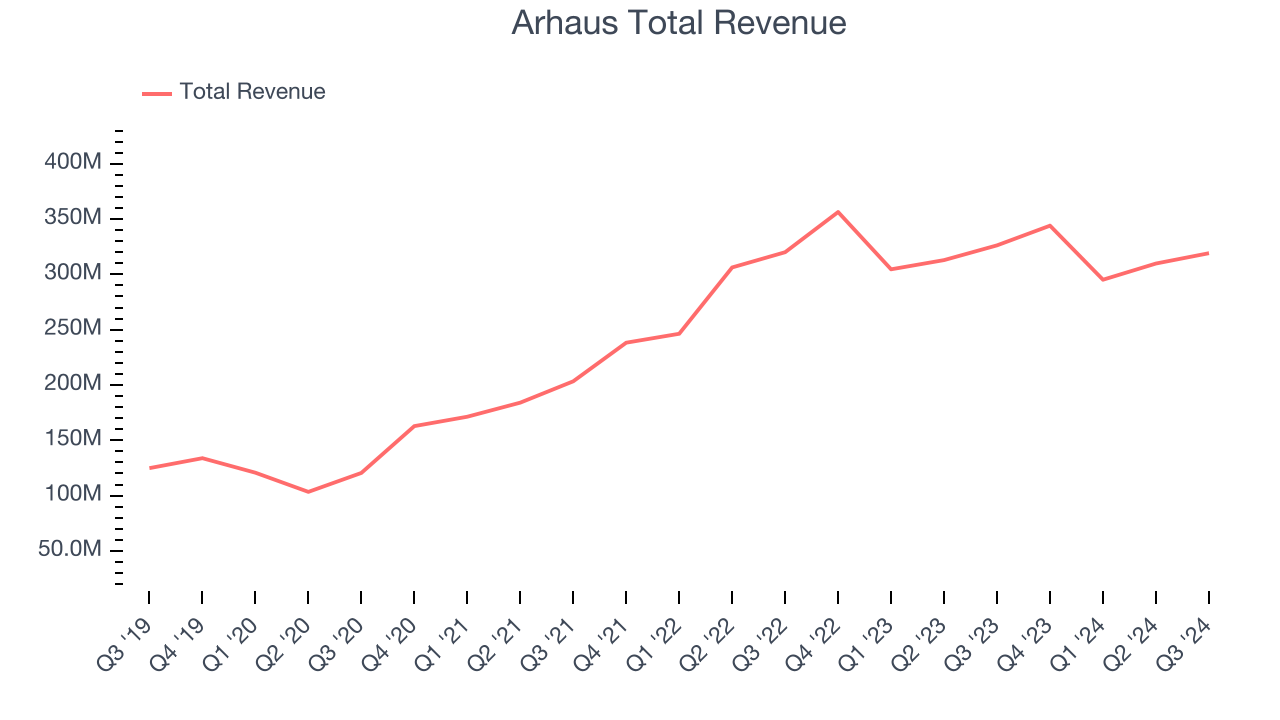

As you can see below, Arhaus grew its sales at an exceptional 20.7% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and increased sales at existing, established locations.

This quarter, Arhaus missed Wall Street’s estimates and reported a rather uninspiring 2.2% year-on-year revenue decline, generating $319.1 million of revenue. Management is currently guiding for a 8.1% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, a deceleration versus the last five years. This projection is still noteworthy and shows the market is baking in success for its products.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Store Performance

Number of Stores

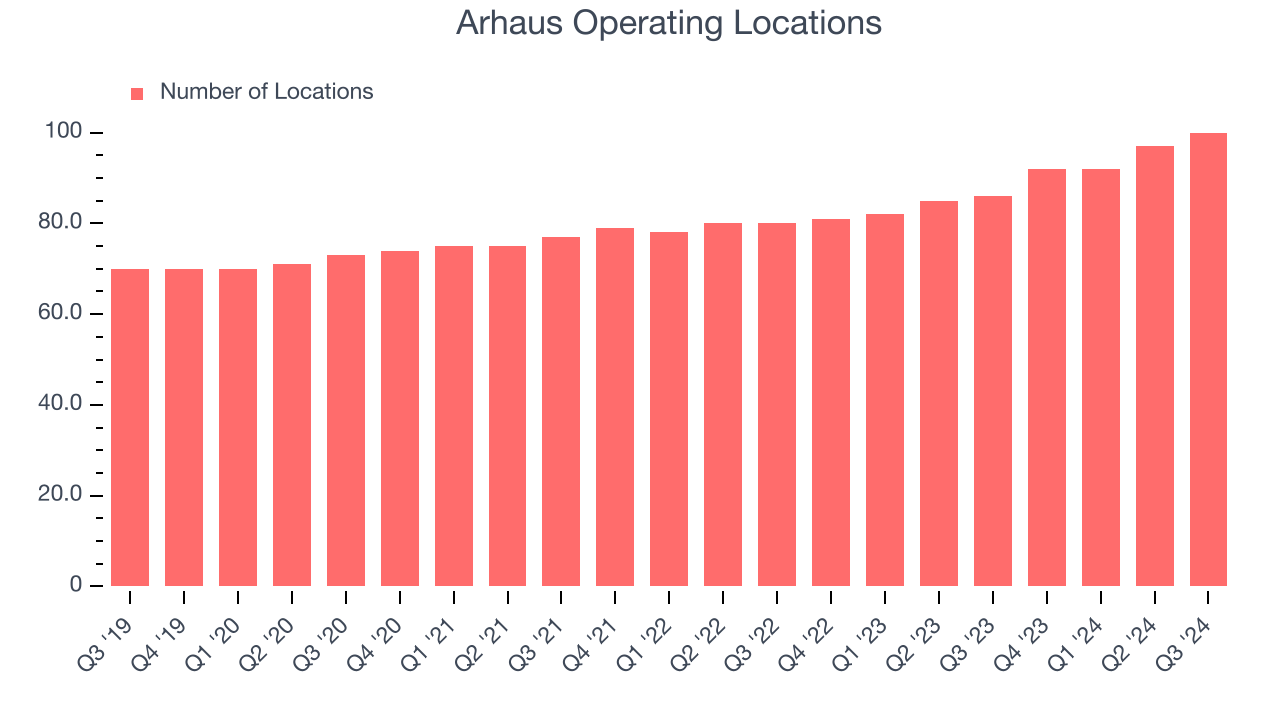

Arhaus sported 100 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip and averaged 9.7% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

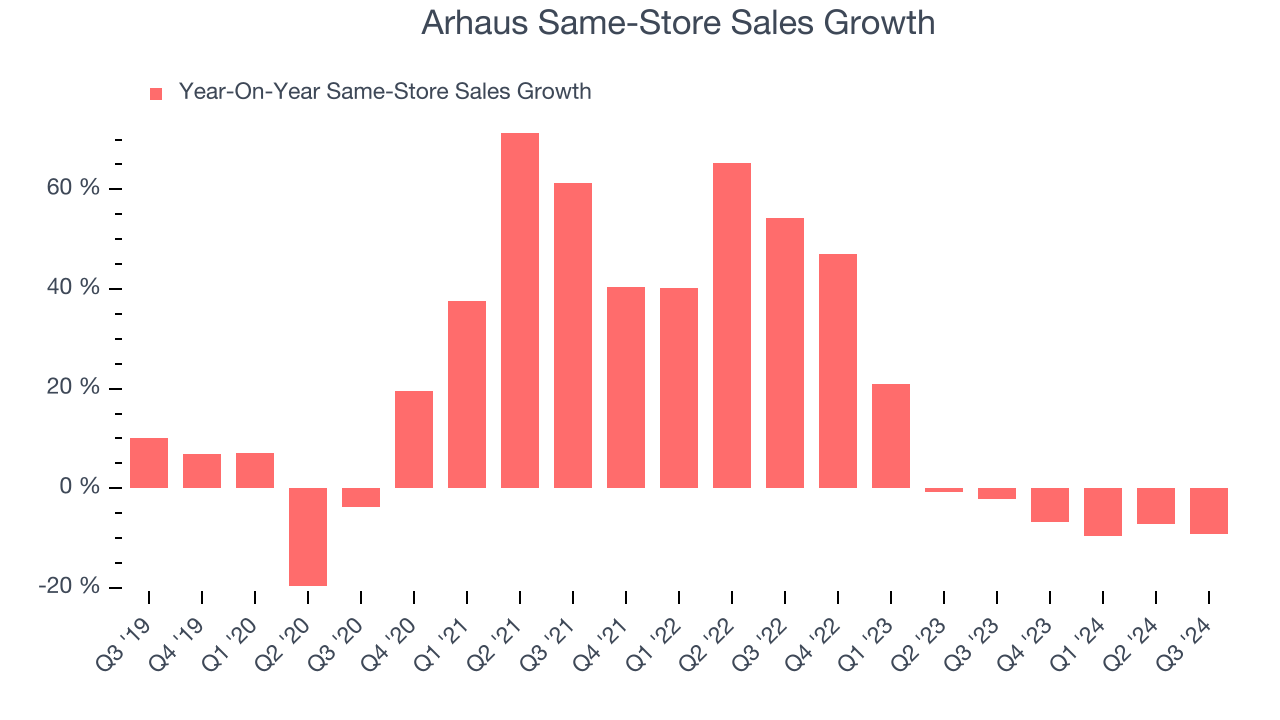

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Arhaus’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 4.1% per year. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Arhaus multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Arhaus’s same-store sales fell by 9.2% annually, a reversal from its longer-term trend. We hope the business can get back on track.

Key Takeaways from Arhaus’s Q3 Results

We struggled to find many strong positives in these results as Arhaus missed on all key metrics including revenue, same-store sales, EBITDA, and EPS. Its guidance also fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 11.2% to $8.10 immediately following the results.

Arhaus didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.