Low code software development platform provider Appian (Nasdaq: APPN) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 12.4% year on year to $154.1 million. The company expects next quarter’s revenue to be around $164.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.15 per share was also 277% above analysts’ consensus estimates.

Is now the time to buy Appian? Find out by accessing our full research report, it’s free.

Appian (APPN) Q3 CY2024 Highlights:

- Revenue: $154.1 million vs analyst estimates of $152 million (1.3% beat)

- Adjusted EPS: $0.15 vs analyst estimates of -$0.08 ($0.23 beat)

- EBITDA: $10.85 million vs analyst estimates of $1.61 million (575% beat)

- Revenue Guidance for Q4 CY2024 is $164.5 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $6 million at the midpoint, above analyst estimates of $0.8 million

- Gross Margin (GAAP): 75.9%, up from 73.7% in the same quarter last year

- Operating Margin: -4.6%, up from -11.1% in the same quarter last year

- EBITDA Margin: 7%, up from -3.9% in the same quarter last year

- Free Cash Flow was -$8.60 million compared to -$18.35 million in the previous quarter

- Net Revenue Retention Rate: 117%, down from 118% in the previous quarter

- Market Capitalization: $2.93 billion

“Appian continues to grow even as we become more efficient. Growth remains our top priority. We now project positive adjusted EBITDA for the full year 2024,” said Matt Calkins, CEO & Founder.

Company Overview

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ: APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

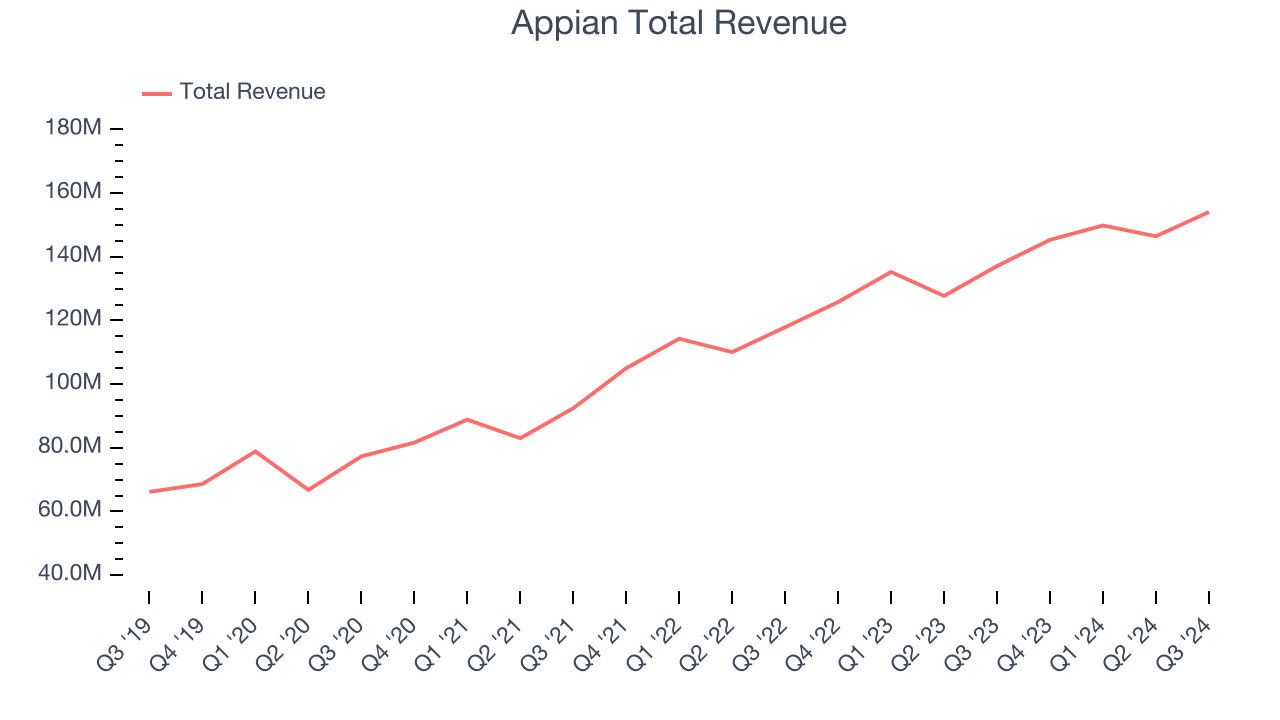

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Regrettably, Appian’s sales grew at a mediocre 19.9% compounded annual growth rate over the last three years. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

This quarter, Appian reported year-on-year revenue growth of 12.4%, and its $154.1 million of revenue exceeded Wall Street’s estimates by 1.3%. Management is currently guiding for a 13.2% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.2% over the next 12 months, a deceleration versus the last three years. This projection is still above the sector average and shows the market is baking in some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

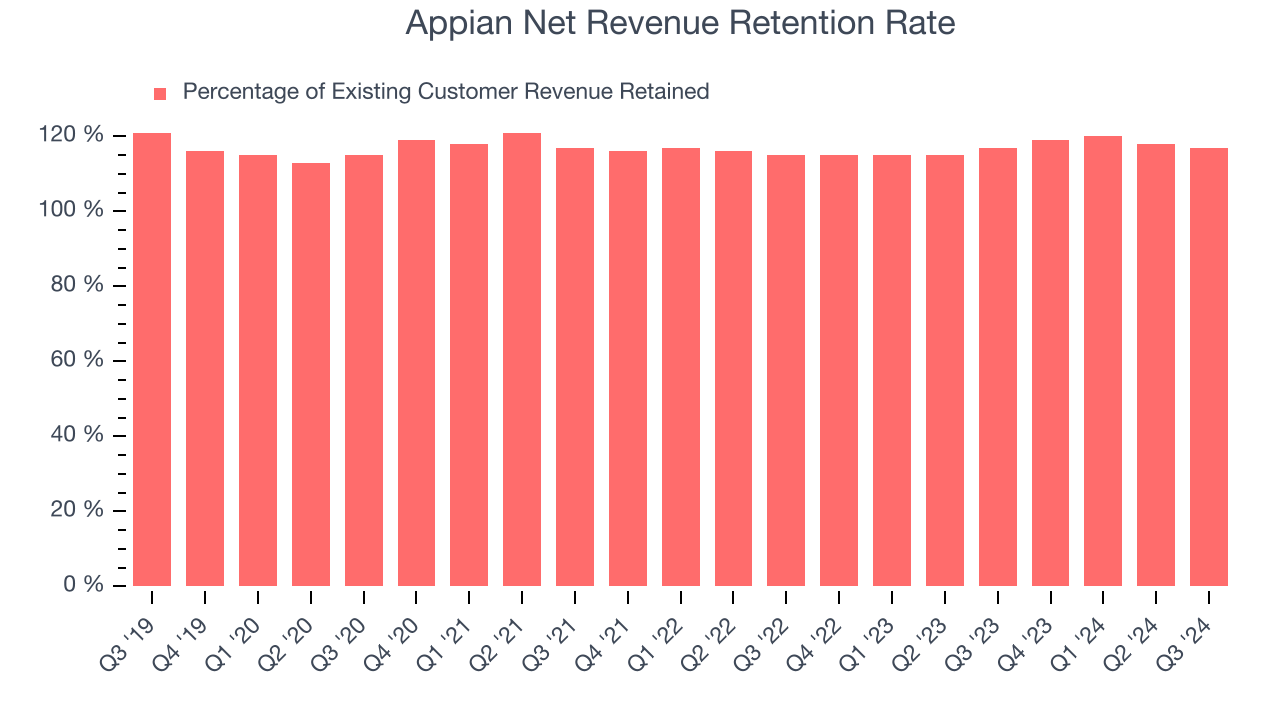

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Appian’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 119% in Q3. This means that even if Appian didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 18.5%.

Appian has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Appian’s Q3 Results

We liked that revenue and EBITDA beat expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its revenue forecast for next quarter was just in line. Overall, this quarter had some key positives. The stock traded up 3.6% to $42 immediately after reporting.

Is Appian an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.