Vacation ownership company Marriott Vacations (NYSE: VAC) announced better-than-expected revenue in Q3 CY2024, with sales up 10% year on year to $1.31 billion. Its non-GAAP profit of $1.80 per share was also 12.3% above analysts’ consensus estimates.

Is now the time to buy Marriott Vacations? Find out by accessing our full research report, it’s free.

Marriott Vacations (VAC) Q3 CY2024 Highlights:

- Revenue: $1.31 billion vs analyst estimates of $1.26 billion (3.3% beat)

- Adjusted EPS: $1.80 vs analyst estimates of $1.60 (12.3% beat)

- EBITDA: $198 million vs analyst estimates of $176.1 million (12.5% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $6.23 at the midpoint

- EBITDA guidance for the full year is $710 million at the midpoint, above analyst estimates of $699.8 million

- Gross Margin (GAAP): 74.9%, down from 95.8% in the same quarter last year

- EBITDA Margin: 15.2%, up from 12.6% in the same quarter last year

- Market Capitalization: $2.78 billion

“Our results this quarter reflect our continued progress on enhancing the experience for our owners, members and other customers, as well as the continued recovery from last year's Maui wildfires. We also took a series of targeted actions during the quarter, helping us grow contract sales 5% year-over-year,” said John Geller, president and chief executive officer.

Company Overview

Spun off from Marriott International in 1984, Marriott Vacations (NYSE: VAC) is a vacation company providing leisure experiences for travelers around the world.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

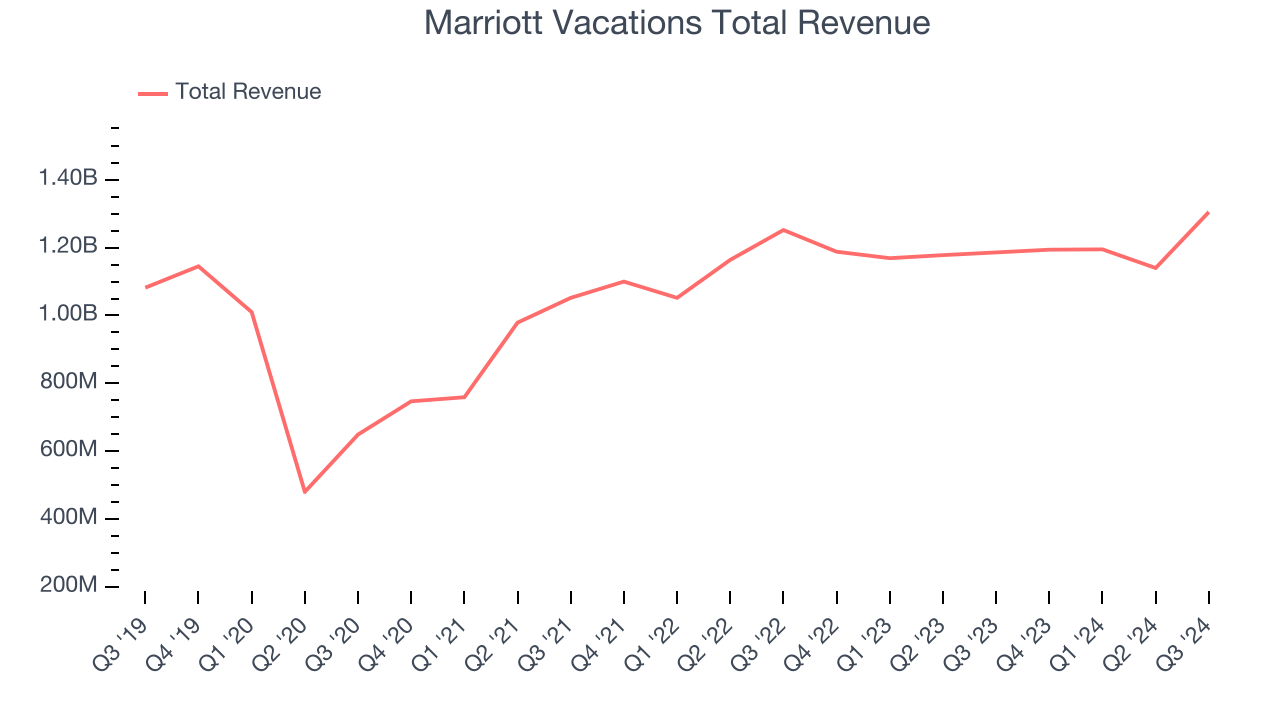

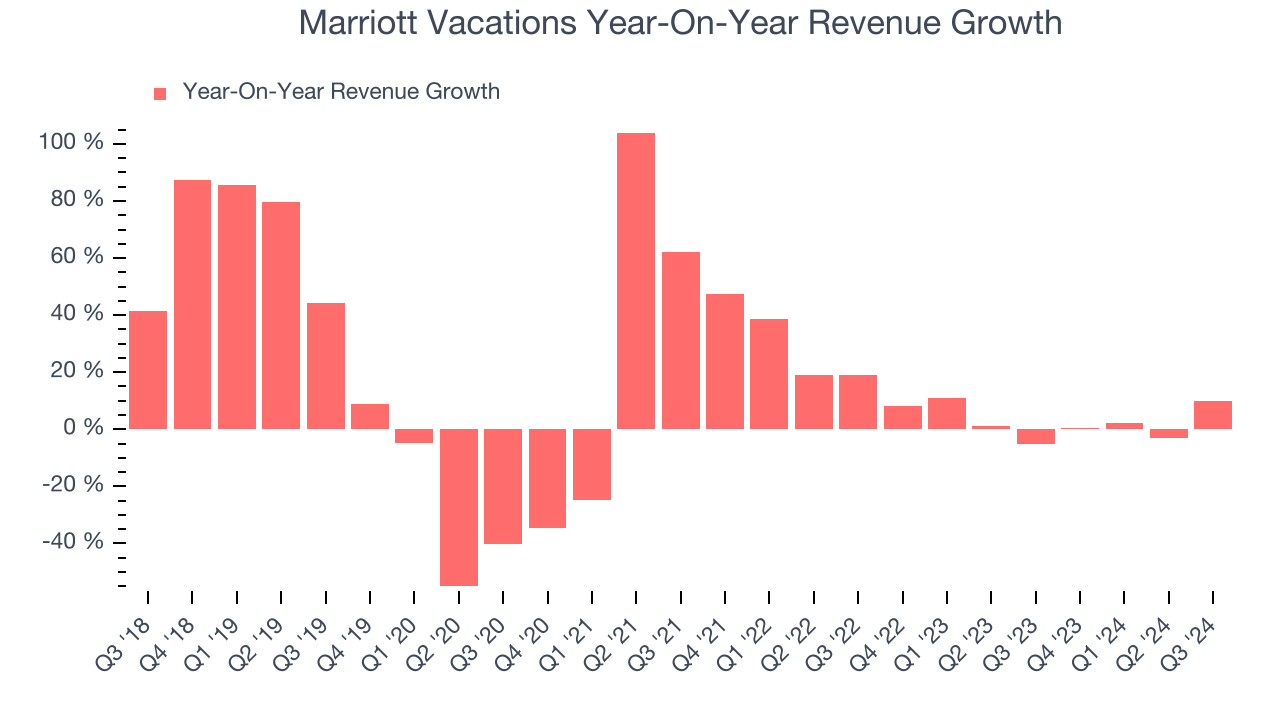

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Marriott Vacations’s 2.6% annualized revenue growth over the last five years was weak. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Marriott Vacations’s annualized revenue growth of 2.9% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Marriott Vacations reported year-on-year revenue growth of 10%, and its $1.31 billion of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, similar to its two-year rate. This projection is underwhelming and illustrates the market believes its newer products and services will not accelerate its top-line performance yet.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

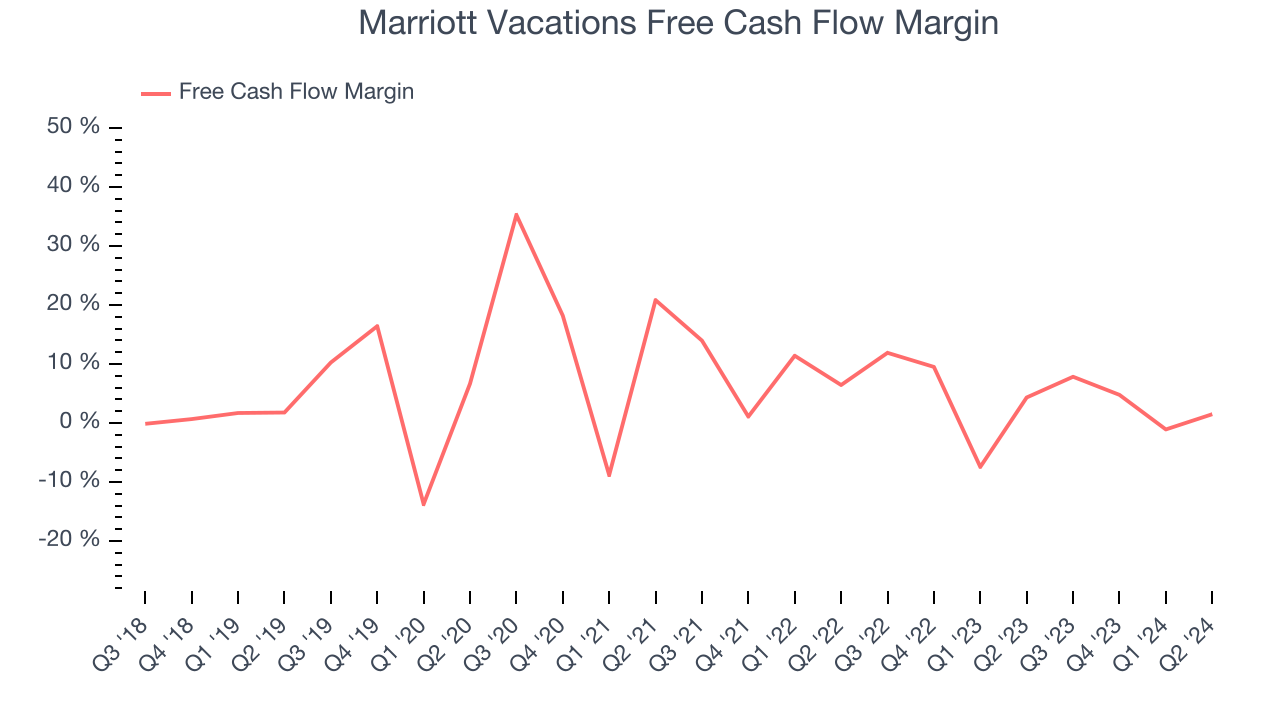

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Marriott Vacations has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.8%, lousy for a consumer discretionary business.

Key Takeaways from Marriott Vacations’s Q3 Results

It was good to see Marriott Vacations beat analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $85.26 immediately following the results.

Marriott Vacations had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.