Business software provider Freshworks (NASDAQ: FRSH) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 21.5% year on year to $186.6 million. The company expects next quarter’s revenue to be around $189.3 million, close to analysts’ estimates. Its non-GAAP profit of $0.11 per share was also 41.5% above analysts’ consensus estimates.

Is now the time to buy Freshworks? Find out by accessing our full research report, it’s free.

Freshworks (FRSH) Q3 CY2024 Highlights:

- Revenue: $186.6 million vs analyst estimates of $181.7 million (2.7% beat)

- Adjusted EPS: $0.11 vs analyst estimates of $0.08 (41.5% beat)

- Adjusted Operating Income: $23.96 million vs analyst estimates of $14.31 million (67.5% beat)

- Revenue Guidance for Q4 CY2024 is $189.3 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the full year is $0.39 at the midpoint, beating analyst estimates by 15.3%

- Gross Margin (GAAP): 84%, up from 82.9% in the same quarter last year

- Operating Margin: -20.8%, up from -25.2% in the same quarter last year

- Free Cash Flow Margin: 21.5%, up from 18.8% in the previous quarter

- Net Revenue Retention Rate: 107%, up from 106% in the previous quarter

- Customers: 22,359 customers paying more than $5,000 annually

- Market Capitalization: $3.76 billion

“Freshworks delivered a strong third quarter, with revenue growing 22% year over year to $186.6 million, net cash provided by operating activities margin improving to 23%, and free cash flow margin improving to 21%,” said Dennis Woodside, CEO & President of Freshworks.

Company Overview

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

Sales Growth

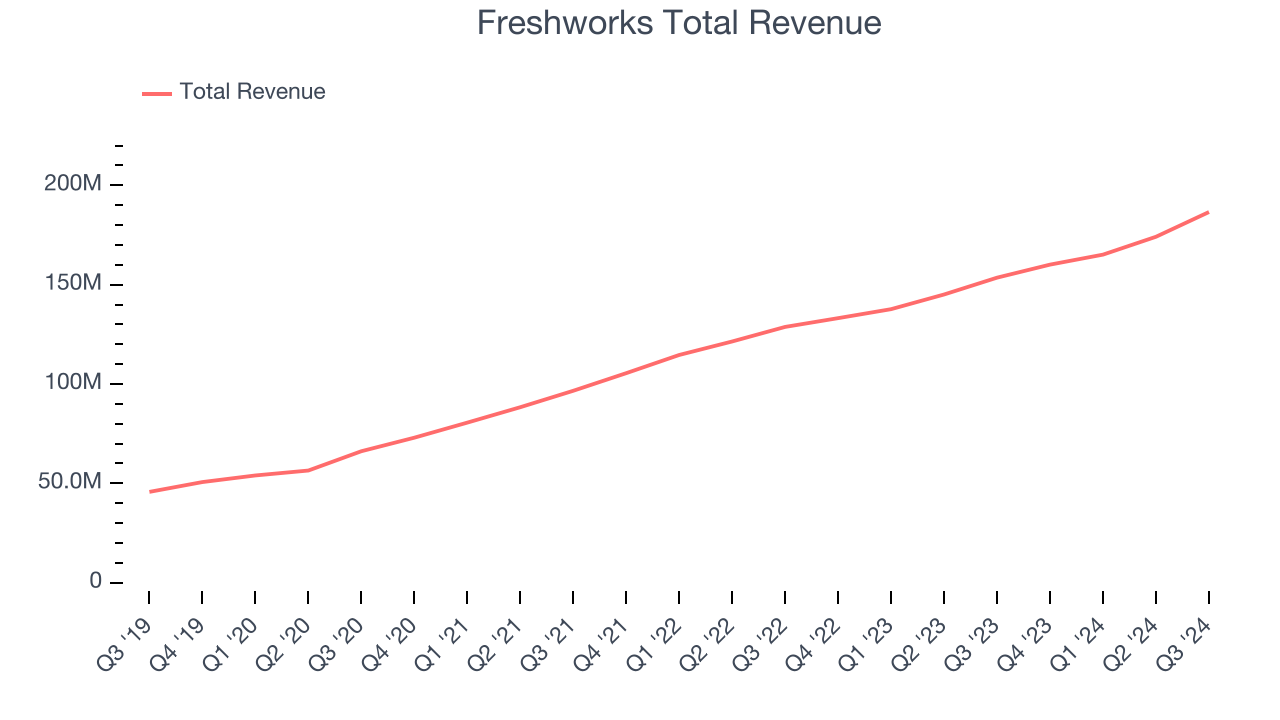

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Thankfully, Freshworks’s 26.5% annualized revenue growth over the last three years was solid. This is a good starting point for our analysis.

This quarter, Freshworks reported robust year-on-year revenue growth of 21.5%, and its $186.6 million of revenue topped Wall Street estimates by 2.7%. Management is currently guiding for a 18.2% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.5% over the next 12 months, a deceleration versus the last three years. Still, this projection is commendable and shows the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Customer Retention

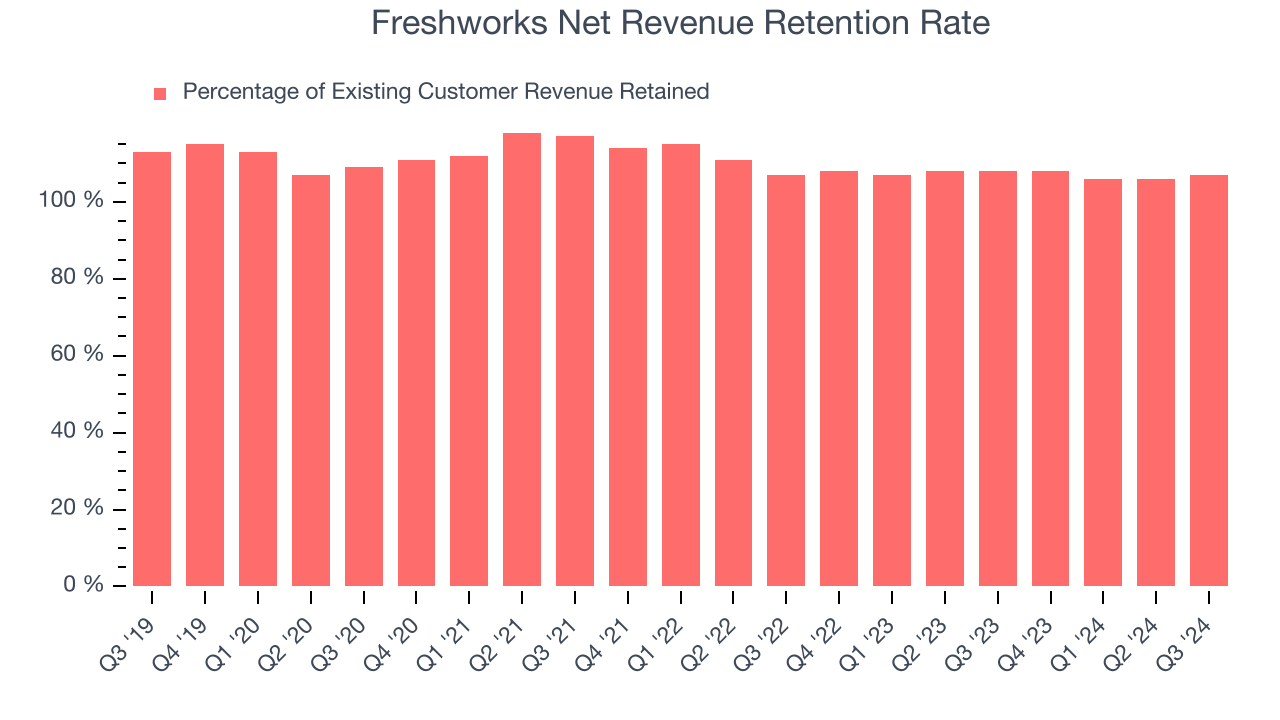

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Freshworks’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 107% in Q3. This means that even if Freshworks didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 6.7%.

Freshworks has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Key Takeaways from Freshworks’s Q3 Results

We were impressed by Freshworks’s optimistic full-year EPS forecast, which blew past analysts’ expectations. We were also glad this quarter's revenue and EPS outperformed Wall Street’s estimates. Overall, this was a good quarter. The stock traded up 16.9% to $15.30 immediately after reporting.

Big picture, is Freshworks a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.