Engineering simulation software provider Ansys (NASDAQ: ANSS) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 31.2% year on year to $601.9 million. Its non-GAAP profit of $2.58 per share was also 49.1% above analysts’ consensus estimates.

Is now the time to buy ANSYS? Find out by accessing our full research report, it’s free.

ANSYS (ANSS) Q3 CY2024 Highlights:

- Revenue: $601.9 million vs analyst estimates of $523.9 million (14.9% beat)

- Adjusted EPS: $2.58 vs analyst estimates of $1.73 (49.1% beat)

- Adjusted Operating Income: $275.4 million vs analyst estimates of $187 million (47.3% beat)

- Gross Margin (GAAP): 88.5%, down from 90.3% in the same quarter last year

- Operating Margin: 26.8%, up from 15.2% in the same quarter last year

- Market Capitalization: $28.36 billion

Company Overview

Used to help design the Mars Rover, Ansys (NASDAQ: ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

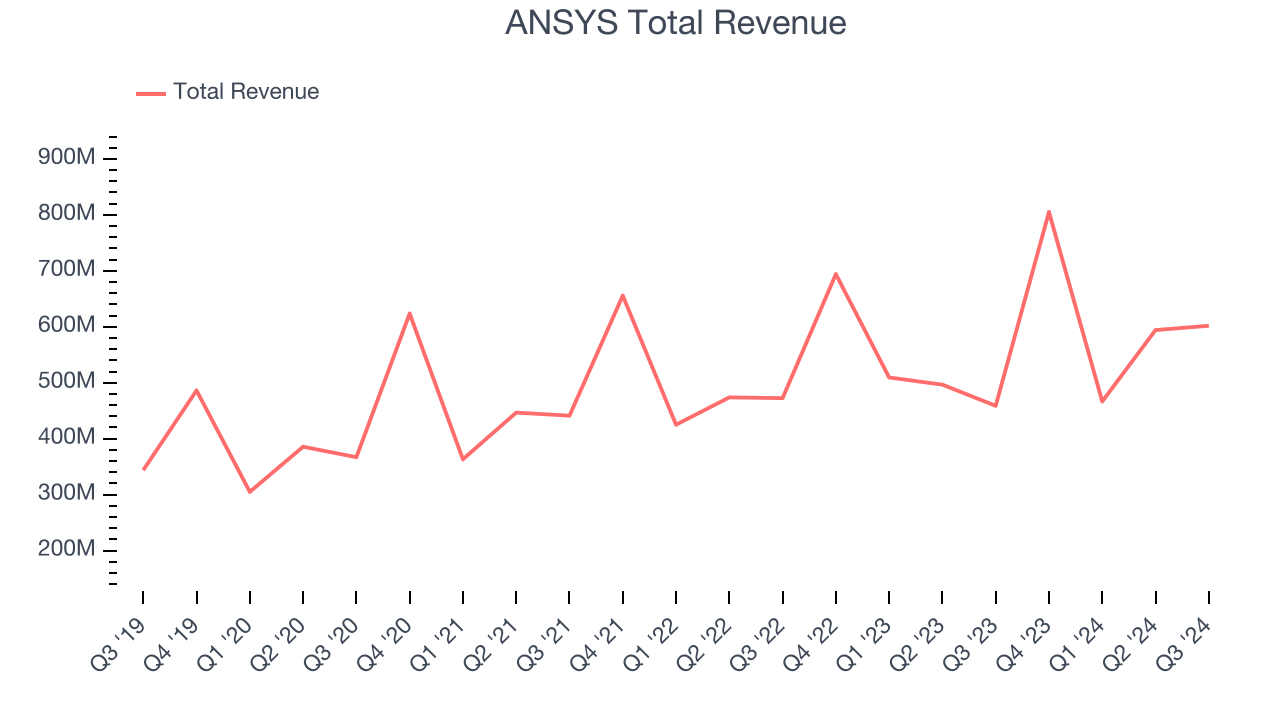

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, ANSYS grew its sales at a sluggish 9.6% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

This quarter, ANSYS reported wonderful year-on-year revenue growth of 31.2%, and its $601.9 million of revenue exceeded Wall Street’s estimates by 14.9%.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and illustrates the market thinks its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

ANSYS is very efficient at acquiring new customers, and its CAC payback period checked in at 26.2 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving it the freedom to invest resources into new growth initiatives while maintaining optionality.

Key Takeaways from ANSYS’s Q3 Results

We were impressed by how strongly ANSYS blew past analysts’ revenue expectations this quarter. On the other hand, its gross margin declined. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 1.9% to $339.68 immediately after reporting.

Sure, ANSYS had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.