Infrastructure construction company Primoris (NYSE: PRIM) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 7.8% year on year to $1.65 billion. Its non-GAAP profit of $1.22 per share was also 18.9% above analysts’ consensus estimates.

Is now the time to buy Primoris? Find out by accessing our full research report, it’s free.

Primoris (PRIM) Q3 CY2024 Highlights:

- Revenue: $1.65 billion vs analyst estimates of $1.59 billion (3.5% beat)

- Adjusted EPS: $1.22 vs analyst estimates of $1.03 (18.9% beat)

- EBITDA: $127.7 million vs analyst estimates of $116.3 million (9.8% beat)

- Management raised its full-year Adjusted EPS guidance to $3.47 at the midpoint, a 3.7% increase

- EBITDA guidance for the full year is $412.5 million at the midpoint, above analyst estimates of $402.4 million

- Gross Margin (GAAP): 12%, in line with the same quarter last year

- Operating Margin: 6%, in line with the same quarter last year

- EBITDA Margin: 7.7%, in line with the same quarter last year

- Free Cash Flow Margin: 9.6%, up from 2.9% in the same quarter last year

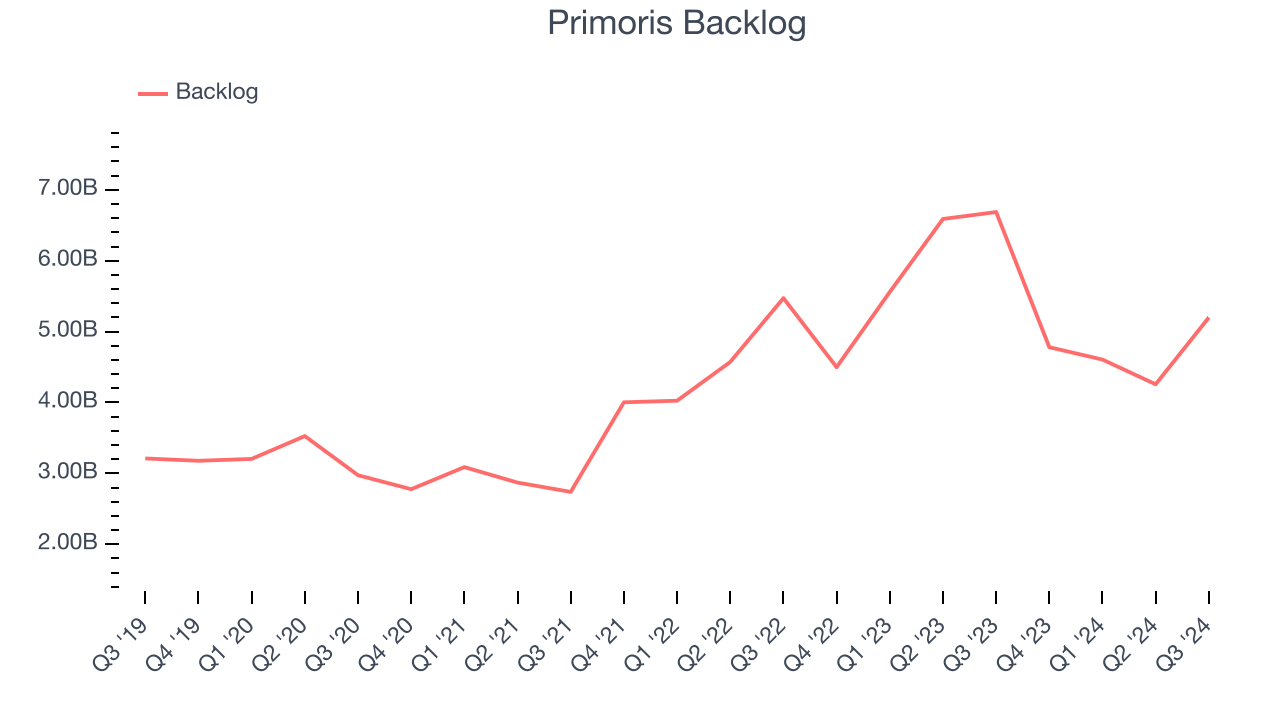

- Backlog: $5.20 billion at quarter end, down 22.2% year on year

- Market Capitalization: $3.41 billion

“In the third quarter, Primoris achieved record levels of revenue, earnings and backlog while also delivering strong operating cash flow,” said Tom McCormick, President and Chief Executive Officer of Primoris.

Company Overview

Listed on the NASDAQ in 2008, Primoris (NYSE: PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Sales Growth

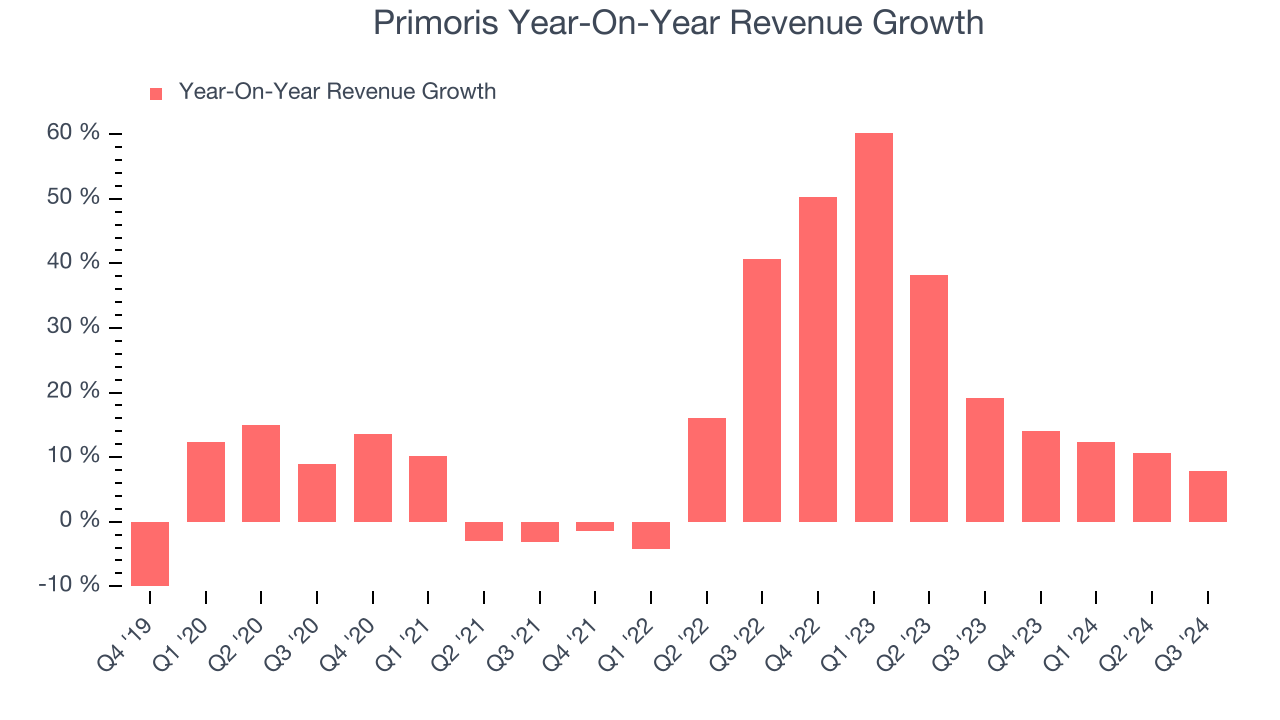

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Thankfully, Primoris’s 14% annualized revenue growth over the last five years was exceptional. This is encouraging because it shows Primoris’s offerings resonate with customers, a helpful starting point.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Primoris’s annualized revenue growth of 24.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

Primoris also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Primoris’s backlog reached $5.20 billion in the latest quarter and averaged 6% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Primoris was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Primoris reported year-on-year revenue growth of 7.8%, and its $1.65 billion of revenue exceeded Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and illustrates the market believes its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

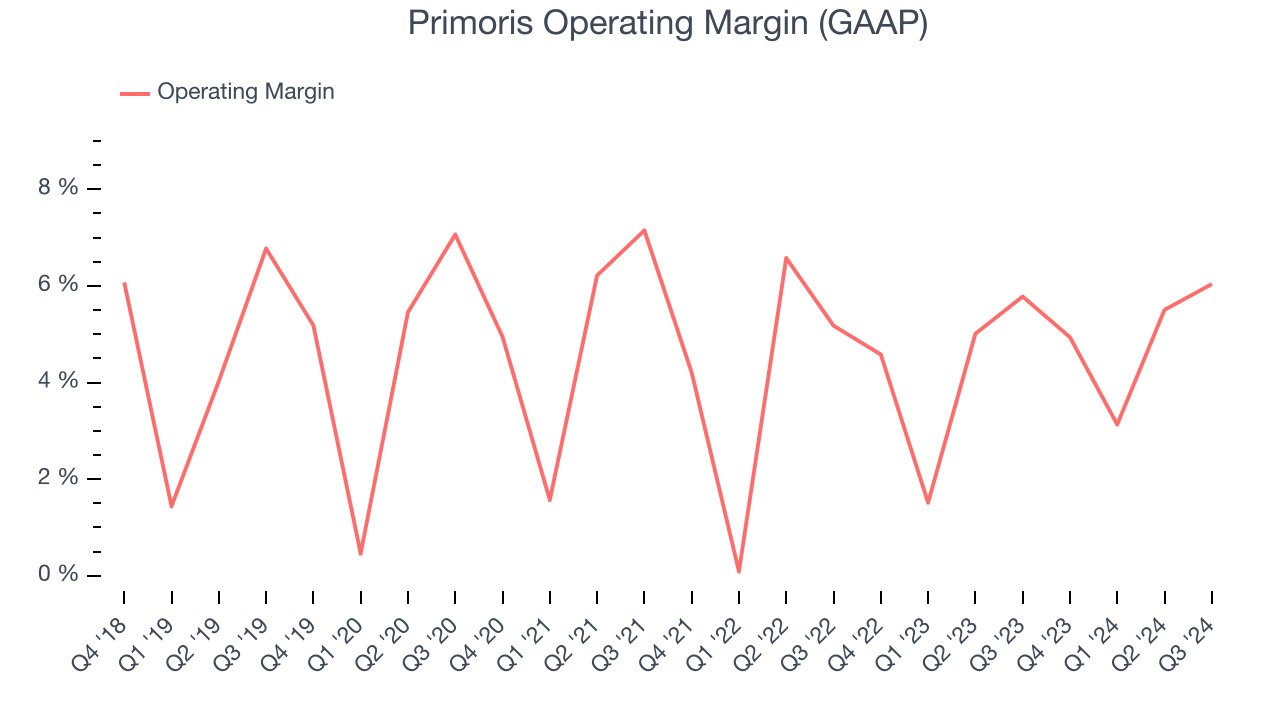

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Primoris was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Primoris’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, which doesn’t help its cause.

In Q3, Primoris generated an operating profit margin of 6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

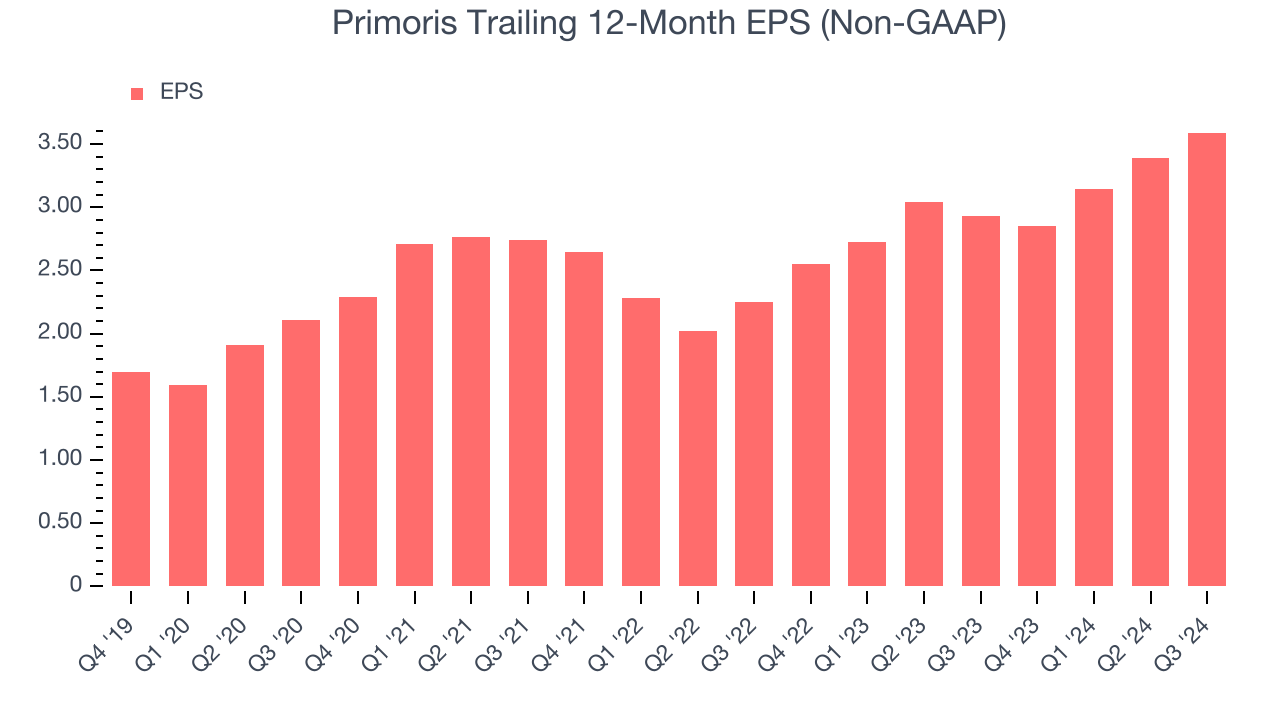

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Primoris’s EPS grew at an astounding 18.9% compounded annual growth rate over the last five years, higher than its 14% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Primoris, its two-year annual EPS growth of 26.3% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Primoris reported EPS at $1.22, up from $1.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Primoris’s full-year EPS of $3.59 to grow by 2.1%.

Key Takeaways from Primoris’s Q3 Results

We were impressed by how significantly Primoris blew past analysts’ revenue, EBITDA, and EPS expectations this quarter. We were also excited it raised its full-year earnings guidance. Overall, we think this was a good quarter with some key metrics above expectations. The stock traded up 4.9% to $67.50 immediately after reporting.

Primoris put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.