Online insurance comparison site EverQuote (NASDAQ: EVER) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 163% year on year to $144.5 million. On top of that, next quarter’s revenue guidance ($133.5 million at the midpoint) was surprisingly good and 5.8% above what analysts were expecting. Its GAAP profit of $0.31 per share was also 50.1% above analysts’ consensus estimates.

Is now the time to buy EverQuote? Find out by accessing our full research report, it’s free.

EverQuote (EVER) Q3 CY2024 Highlights:

- Revenue: $144.5 million vs analyst estimates of $140.3 million (3% beat)

- EPS: $0.31 vs analyst estimates of $0.21 ($0.10 beat)

- EBITDA: $18.78 million vs analyst estimates of $15.55 million (20.8% beat)

- Revenue Guidance for Q4 CY2024 is $133.5 million at the midpoint, above analyst estimates of $126.2 million

- EBITDA guidance for Q4 CY2024 is $15 million at the midpoint, above analyst estimates of $12.48 million

- Gross Margin (GAAP): 96.2%, up from 88.8% in the same quarter last year

- Operating Margin: 8.1%, up from -53.5% in the same quarter last year

- EBITDA Margin: 13%, up from -3.5% in the same quarter last year

- Free Cash Flow Margin: 15.3%, up from 9.8% in the previous quarter

- Market Capitalization: $604.2 million

“We delivered record third quarter results for revenue, Variable Marketing Margin, or VMM, and Adjusted EBITDA that once again exceeded the high-end of our guidance range,” said Jayme Mendal, CEO of EverQuote.

Company Overview

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

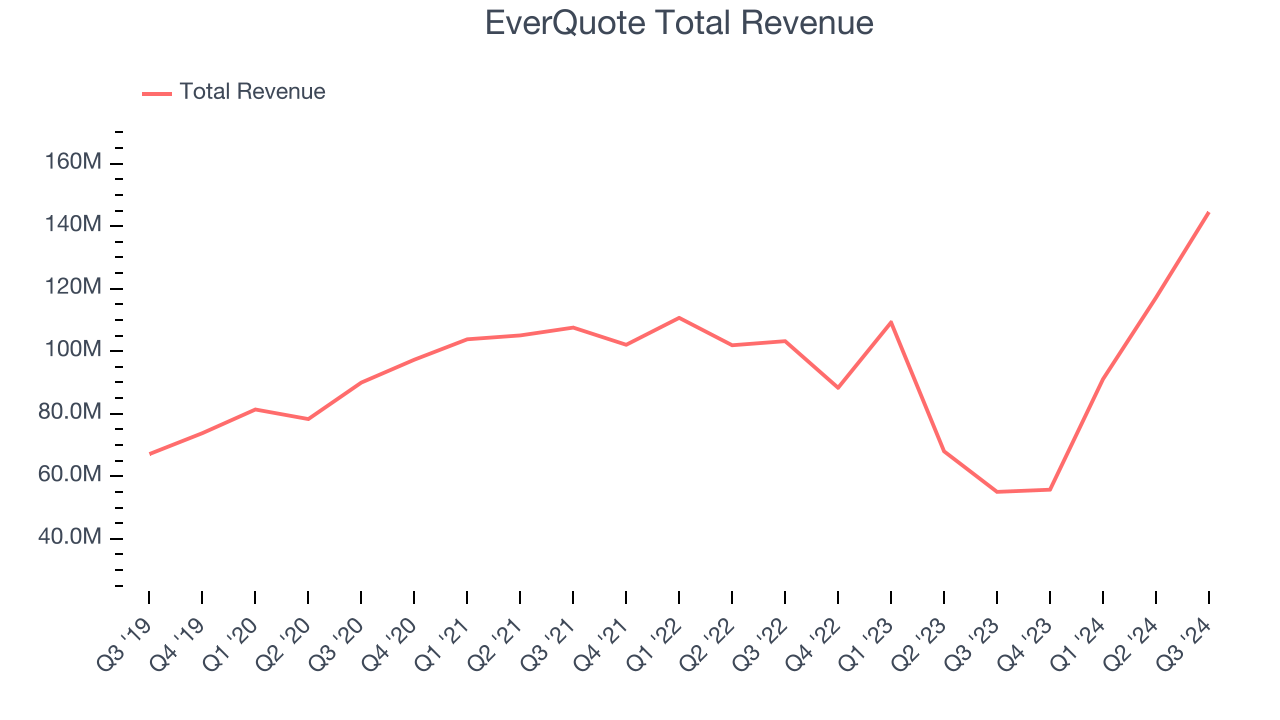

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. EverQuote’s demand was weak over the last three years as its sales were flat, a poor baseline for our analysis.

This quarter, EverQuote reported magnificent year-on-year revenue growth of 163%, and its $144.5 million of revenue beat Wall Street’s estimates by 3%. Management is currently guiding for a 140% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 39.7% over the next 12 months, an acceleration versus the last three years. This projection is noteworthy and shows the market thinks its newer products and services will spur faster growth.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

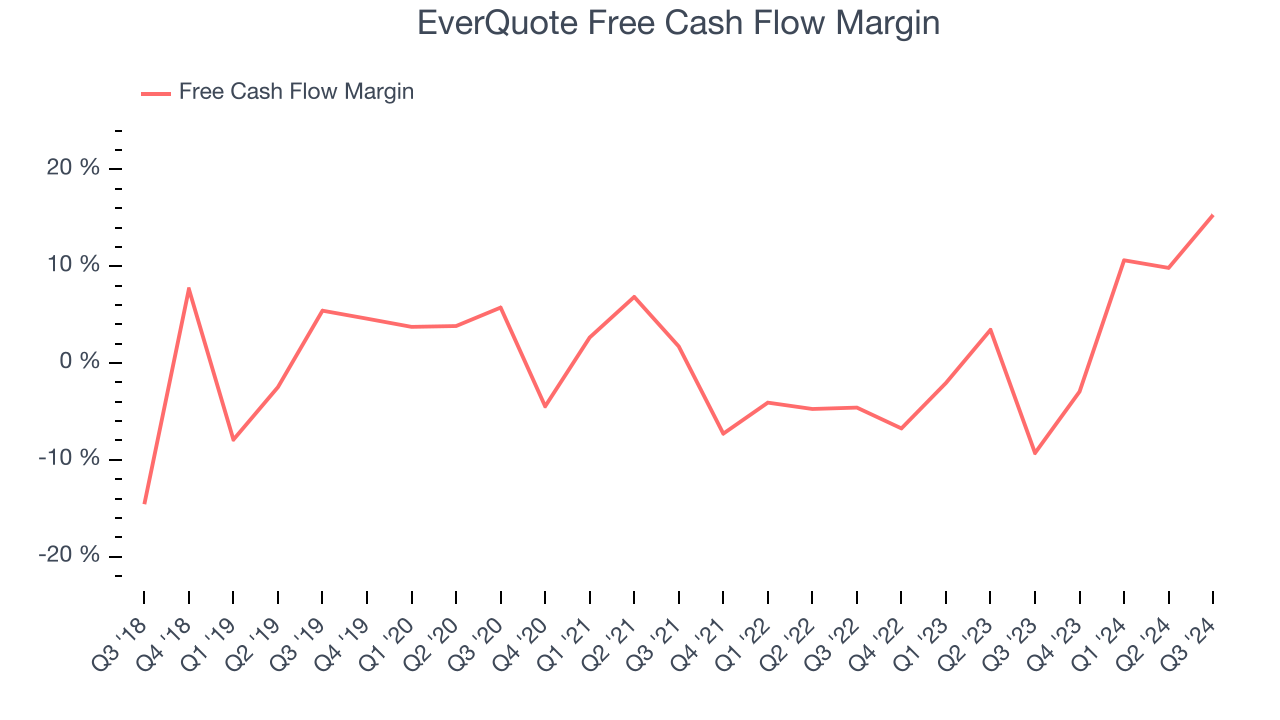

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

EverQuote has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.2%, subpar for a consumer internet business.

Taking a step back, an encouraging sign is that EverQuote’s margin expanded by 8.4 percentage points over the last three years. The company’s improvement shows it’s heading in the right direction, and because its free cash flow profitability rose more than its operating profitability, continued increases could signal it’s becoming a less capital-intensive business.

EverQuote’s free cash flow clocked in at $22.13 million in Q3, equivalent to a 15.3% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

Key Takeaways from EverQuote’s Q3 Results

We were impressed by EverQuote’s optimistic revenue and EBITDA forecast for next quarter, which blew past analysts’ expectations. We were also excited this quarter's revenue and EBITDA beat Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 2.2% to $17.71 immediately following the results.

EverQuote may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.