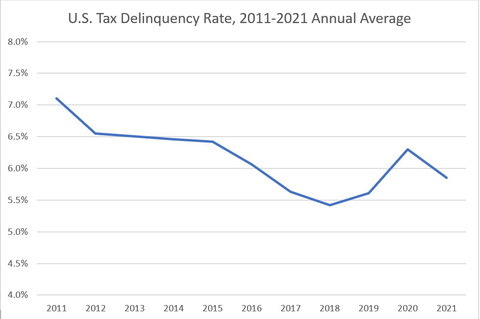

- Average national property tax delinquency rates declined from 6.3% in 2020 to 5.9% in 2021

- For the 2011 -2021 period, the average national property tax delinquency rates peaked at 7.1% in 2011 and declined to a low of 5.4% in 2018

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its Real Estate Property Tax Delinquency Report, which analyzes real estate property tax delinquency changes nationally and at state levels. 2021 annual data shows a national average delinquency rate of 5.9%, down 0.4% from the year prior.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220223005185/en/

U.S. Tax Delinquency Rate, 2011-2021 Annual Average (Graphic: Business Wire)

The CoreLogic Property Tax Delinquency Report analyzes national and state real estate property tax delinquency percentages spanning the period from 2011 to 2021. The report examines periodic changes to the tax payment status for loans requiring payment by the homeowner to appropriate taxing authorities.

“Homeowners in financial distress are more likely to be late on their property tax payment,” said Dr. Frank Nothaft, CoreLogic chief economist. “During the past decade, 2011 had the highest annual average unemployment and tax delinquency rates. Unemployment was at its lowest in 2018 and 2019, the two years with the lowest delinquency rates. The rise in delinquency in 2020 and decline during 2021 reflects the large job loss during the early months of the pandemic and substantial job gain of last year.”

Report Highlights:

- The top five states with the highest average property tax delinquency rates in 2021 include: Mississippi (15.6%), Delaware (14.5%), Virginia (10.5%), New Jersey/Massachusetts (tie) (10.2%) and Washington, D.C. (10.1%).

- The top five states with the lowest average property tax delinquency rates in 2021 include: North Dakota (1.2%), Minnesota (1.3%), Wisconsin (1.5), Illinois (1.8%) and Utah (2.2%).

In 2021, North Dakota had the lowest percentage of property tax delinquencies at 1.2%. For the same year, Mississippi had the highest with a rate of 15.6%. The 14.4% gap in between the lowest and highest rates in 2021 is slightly less at 13.9% for period spanning 2011 through 2021. Over that time, Minnesota had the lowest average property tax delinquency percentage of 2.0% while Mississippi had the highest rate of 15.9%.

Methodology

The CoreLogic Property Tax Delinquency Report analyzes data for approximately 10M first mortgages for which the borrower is responsible for payment to taxing authorities. As new tax cycles are created, CoreLogic performs a search and determines if taxes are paid and in good standing, or if they are delinquent. Additional reviews help ensure further confirmation regarding any lingering delinquencies from prior years. CoreLogic reports the status with each tax cycle on each non-escrowed loan, whether paid or delinquent.

View the full CoreLogic Property Tax Delinquency Report here.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data contact Robin Wachner at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220223005185/en/

Contacts

Robin Wachner

newsmedia@corelogic.com