Already serving several leading property and casualty insurers globally, Arturo aims to further expand its geographic reach, while breaking into lending and other business sectors

Arturo, an AI-powered platform that derives property insights and predictive analytics from aerial and satellite imagery, raised $25 million in a Series B funding round led by Atlantic Bridge Capital, with participation from RPS Ventures and existing investors Crosslink Capital and IAG Firemark Ventures – the venture capital fund for IAG, Australia’s largest general insurer.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210427005718/en/

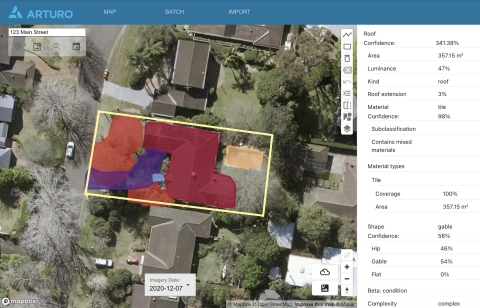

Some of the insights Arturo’s AI engine is able to deduce from aerial, satellite and stratospheric photography (Photo: Business Wire)

With the capital in hand, Arturo plans to expand its technical team to refine its industry-leading technology, which extracts valuable property data from the latest satellite, stratospheric, aerial and ground-level imagery, as well as unique proprietary data sources, in as little as five seconds. The round will also enable the company to further establish partnerships with imagery providers to offer coverage in Europe and Southeast Asia and expand its client base of leading property and casualty insurers. In the coming months, the company also aims to roll out its offering to the commercial property sector and other businesses that engage with the built environment, including banks, other financial institutions, asset managers, among others.

In conjunction with the funding round, the company appointed two new members to its board: Sunir Kapoor of Atlantic Bridge, who brings a background in growing technology businesses to enterprise scale; and Samantha Wang of RPS, a board observer, who brings expertise working with technology companies in the U.S. and Asia.

“Over the past twelve months, Arturo increased its revenue over 300%, which speaks directly to the tangible value it offers to leading insurers,” said Sunir Kapoor, Operating Partner, Atlantic Bridge. “With these new client wins, Arturo now counts among its clients two of the top five P&C insurers in the US, in addition to the two leading insurers in the Australian market. With the success that jC and his team have had onboarding several new clients fully remotely over the past year, we’re confident in Arturo’s continued expansion in bringing AI to the insurance industry and beyond.”

Arturo is a deep learning spin-out from American Family Insurance that delivers highly accurate physical property characteristic data and predictive analysis for residential and commercial properties for use in the property & casualty (P&C) insurance, reinsurance, lending and securities markets.

Since spinning out from American Family Insurance to become commercially available in 2018, Arturo has completed over 35 million on-demand property analyses for customers in North America and Oceania. As it has rolled out its platform to a growing number of leading clients, the company has also refined its technology, which increased the number of property attributes it can extract from aerial photographs to 71 within the past 18 months. The company recently announced partnerships with stratospheric imagery providers Urban Sky and Near Space Labs to bolster the frequency of its high-resolution image collection and to expand coverage in remote areas. It also announced the appointment of Roman Buegler to VP of research and development and Daniela Moody to VP of artificial intelligence.

“Arturo’s vision is to revolutionize the way businesses interact with properties by providing greater transparency into a building’s physical make-up, and we believe we’re only scratching the surface in terms of the level of value we can bring to our customers,” said John-Isaac “jC” Clark, CEO, Arturo. “Our insurance clients are already using our technology to bolster their quoting, underwriting, and claims processes, but with an increasingly granular level of property information available in real time, we can envision insurers improving their customer responsiveness, offering things like a ‘safe driver discount’-type bonus for a client whose property’s condition is well-maintained. A deeper property understanding stands to benefit virtually every building stakeholder, and this capital infusion will enable us to accelerate our product roll-out to serve a growing array of business sectors and geographic markets.”

About Arturo

Arturo is a deep learning spin-out from American Family Insurance relentlessly committed to delivering highly accurate physical property characteristic data and predictive analysis for residential and commercial properties for use in the Property & Casualty (P&C) Insurance, Reinsurance, Lending, and Securities markets.

Leveraging the latest satellite, aerial, and ground-level imagery, as well as unique proprietary data sources, Arturo’s deep learning models provide differentiated property data unparalleled by any other provider - often in as little as 5 seconds. To learn more about Arturo, Inc., visit: www.arturo.ai or follow on Twitter @arturo_ai.

About Atlantic Bridge Capital

Atlantic Bridge is a €1 Billion Pan European Technology Growth Firm founded in 2004 by successful technology entrepreneurs and executives. With offices in London, Dublin, Munich, Paris, Palo Alto, and Beijing, Atlantic Bridge invests in deep tech sustainable sectors such as Artificial Intelligence, Digital Health and Computer Vision. With 8 Funds under management, the Firm leverages its deep operational experience and unrivalled networks to help build deep technology companies into global market leaders across Europe, the US and Asia.

For further information, please visit www.abven.com.

About RPS Ventures

RPS Ventures is a venture capital firm focused on investing in revolutionary technology companies led by exceptional teams. RPS is a dedicated group of investment professionals who think outside the box and specialize in helping companies navigate the global environment in later-stage company growth, with access to a key network of some of the world's most successful entrepreneurs. RPS investments include such notable companies as RentTheRunway, Molekule, Meesho, and Glovo. For more, visit www.rpsventures.com.

About Crosslink Capital

Crosslink Capital is a leading early-stage investor based in Menlo Park, investing in emerging growth companies since 1989. They are a proven team of early-stage business builders investing out of their ninth fund ($350M) and managing over $3.6 billion. Crosslink partners with ambitious entrepreneurs who are reshaping markets with disruptive technology. For more information, visit crosslinkcapital.com.

About IAG

IAG is the parent company of a general insurance group (the Group) with controlled operations in Australia and New Zealand. The Group’s businesses underwrite over $12 billion of premium per annum, selling insurance under many leading brands, including: NRMA Insurance, CGU, SGIO, SGIC, Swann Insurance and WFI (Australia); and NZI, State, AMI and Lumley (New Zealand). IAG also has an interest in a general insurance joint venture in Malaysia. For further information, please visit www.iag.com.au.

Firemark Ventures is IAG’s strategic $75m venture capital fund. Its purpose is to bring the outside world into IAG, by strategically partnering with and investing in startups that have the potential to reinvent the insurance customer experience. This is IAG’s second investment in Arturo. Firemark Ventures investments include Airtasker, Life360, HyperAnna, UpGuard and ActivePipe.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210427005718/en/

Contacts

Media:

Shlomo Morgulis

Antenna Spaces

arturo@antennagroup.com

646-957-3365