Headquartered in San Francisco, California, Salesforce, Inc. (CRM) designs cloud-based customer relationship management software that unifies customers, data, and intelligence on a single platform.

With a market cap brushing $198.9 billion, Salesforce leverages Agentforce, its suite of customizable artificial intelligence (AI) agents and tools, to merge autonomous intelligence, unified data, and Customer 360 applications.

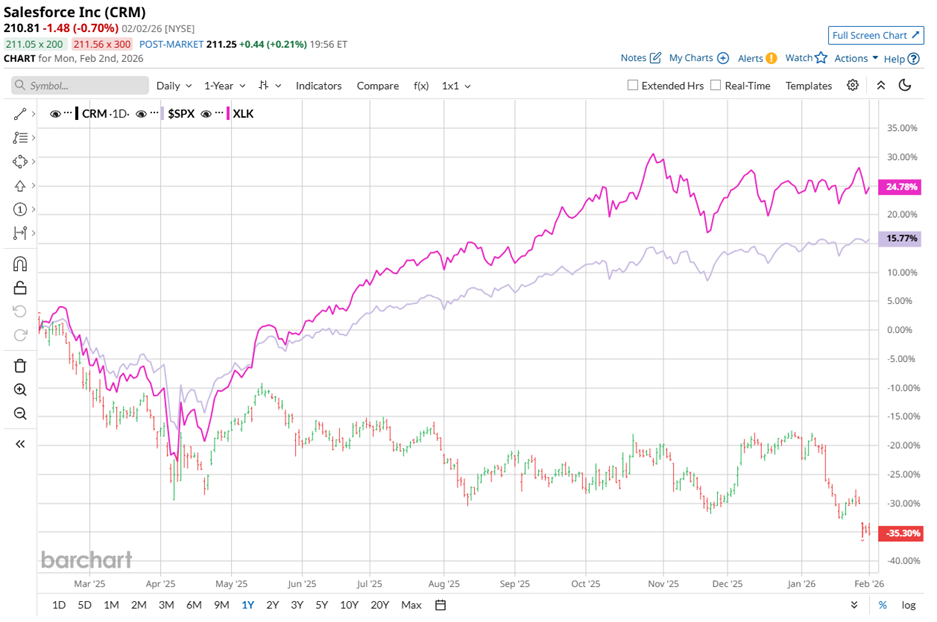

Despite its scale, CRM stock has struggled. Over the past 52 weeks, its shares declined nearly 38.3%, sharply underperforming the S&P 500 Index ($SPX), which gained 15.5% during the same period. The weakness has carried into the year, with CRM stock down 20.4% year-to-date (YTD), while the benchmark index posted a modest 1.9% gain.

Sector comparison has deepened the contrast. Over the past 52 weeks, the State Street Technology Select Sector SPDR ETF (XLK) surged 25.9% and remains marginally positive YTD. The company lagged significantly, largely due to fears that AI could displace portions of its legacy product portfolio rather than enhance it.

However, Salesforce has already begun to methodically tilt momentum back in its favor. On Dec. 3, 2025, the stock climbed 1.7%, followed by a sharper 3.7% advance in the subsequent trading session after the company released its Q3 fiscal 2026 results.

Revenue rose 8.6% year over year to $10.26 billion, narrowly missing Wall Street’s $10.27 billion estimate. Meanwhile, non-GAAP EPS increased 34.9% from the prior-year period to $3.25, decisively beating the $2.86 consensus forecast. Agentforce and Data 360 were the core momentum engines, delivering nearly $1.4 billion in annual recurring revenue.

Building on this traction, management has raised fiscal year 2026 revenue guidance to a range of $41.45 billion to $41.55 billion. The upward revision reflects confidence in demand visibility and reinforces the growing financial impact of the company’s AI-driven product portfolio.

On the other hand, for fiscal year 2026, which ended in January, analysts project diluted EPS of $8.92, representing 13.1% year-over-year growth. Importantly, the company has exceeded EPS expectations across all four trailing quarters, reinforcing execution credibility and earnings consistency.

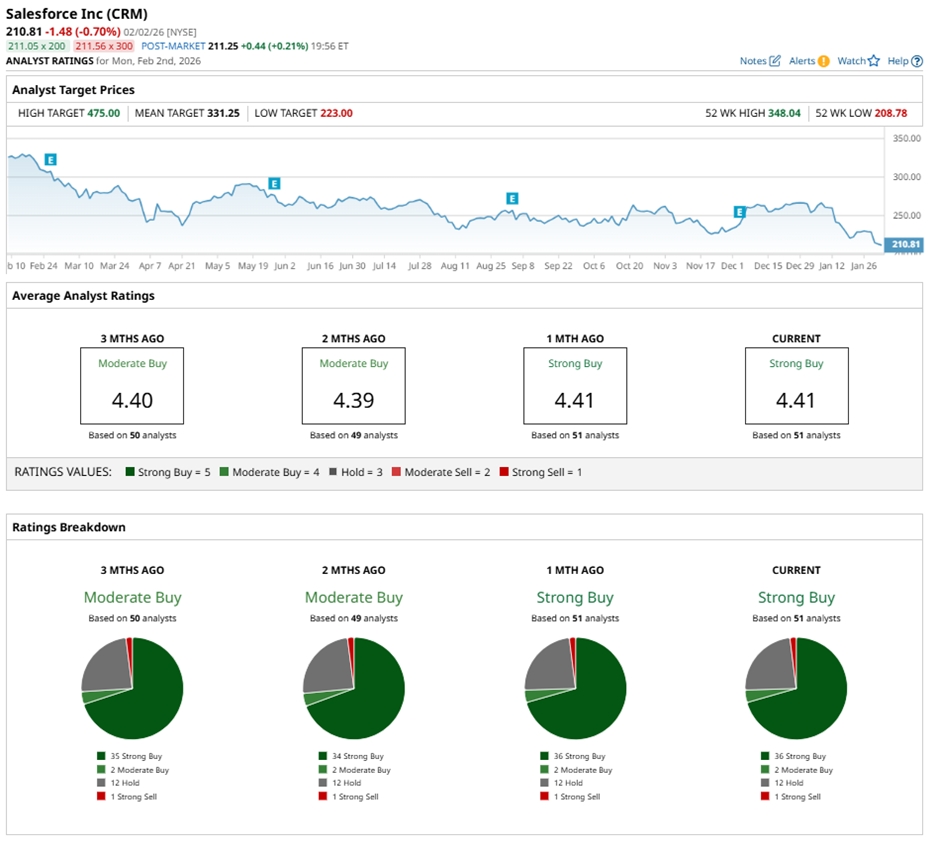

Wall Street sentiment increasingly echoes the strengthening outlook. CRM stock is carrying a “Strong Buy” consensus rating. Of 51 analysts, 36 rate it “Strong Buy,” two recommend “Moderate Buy,” 12 advise “Hold,” and just one flags “Strong Sell.”

The current analyst sentiment has improved from three months ago, when 35 analysts held a “Strong Buy” view.

Analyst endorsements soon followed, reinforcing Wall Street’s growing confidence in Salesforce’s trajectory. On Jan. 26, Evercore ISI analyst Kirk Materne reiterated a “Buy” rating and assigned a $340 price target. His stance underscores confidence in Salesforce’s operational momentum and the scalability of its evolving product portfolio.

Momentum strengthened further on Jan. 27, when Citizens analyst Patrick Walravens reiterated a “Market Outperform” rating with a $405 price target. The firm pointed directly to robust execution within the AI-powered Agentforce platform as the primary catalyst behind its continued optimism.

Against this backdrop, CRM’s average price target of $331.25 implies potential upside of 57.1%, while the Street-high target of $475 suggest a gain of 125.3% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Think This Dividend Stock Is Headed for Big Payout Growth Ahead

- What Company Is Ryan Cohen Eyeing for a GameStop Megadeal? And Should You Buy GME Stock Here?

- 2 High-Risk, High-Reward Quantum Computing Stocks to Buy Now

- Here’s What Options Traders Expect from Advanced Micro Devices Stock After Earnings