With a market cap of $105.4 billion, CVS Health Corporation (CVS) delivers integrated health solutions through its Health Care Benefits, Health Services, and Pharmacy & Consumer Wellness segments. It provides health insurance, pharmacy benefit management, and retail pharmacy services to individuals, employers, government entities, and healthcare providers nationwide.

Shares of the Woonsocket, Rhode Island-based company have significantly outperformed the broader market over the past 52 weeks. CVS stock has surged 53.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.9%. In addition, CVS stock has risen 5.7% on a YTD basis, compared to SPX's 1.5% gain.

Looking closer, shares of the drugstore chain and pharmacy benefits manager have also outpaced the State Street Health Care Select Sector SPDR ETF's (XLV) 9.6% return over the past 52 weeks.

Shares of CVS fell nearly 2% on Oct. 29 after the company reported Q3 2025 loss of $3.13 per share, driven by a $5.7 billion goodwill impairment charge tied to its Health Care Delivery unit, which swung operating results to a $3.2 billion operating loss from a profit a year earlier. Investors were also concerned by the sharp cut in full-year 2025 EPS guidance to a loss of $(0.34) - $(0.24) from prior expectations of $3.84 - $3.94.

For the fiscal year that ended in December 2025, analysts expect CVS' adjusted EPS to grow 22.7% year-over-year to $6.65. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

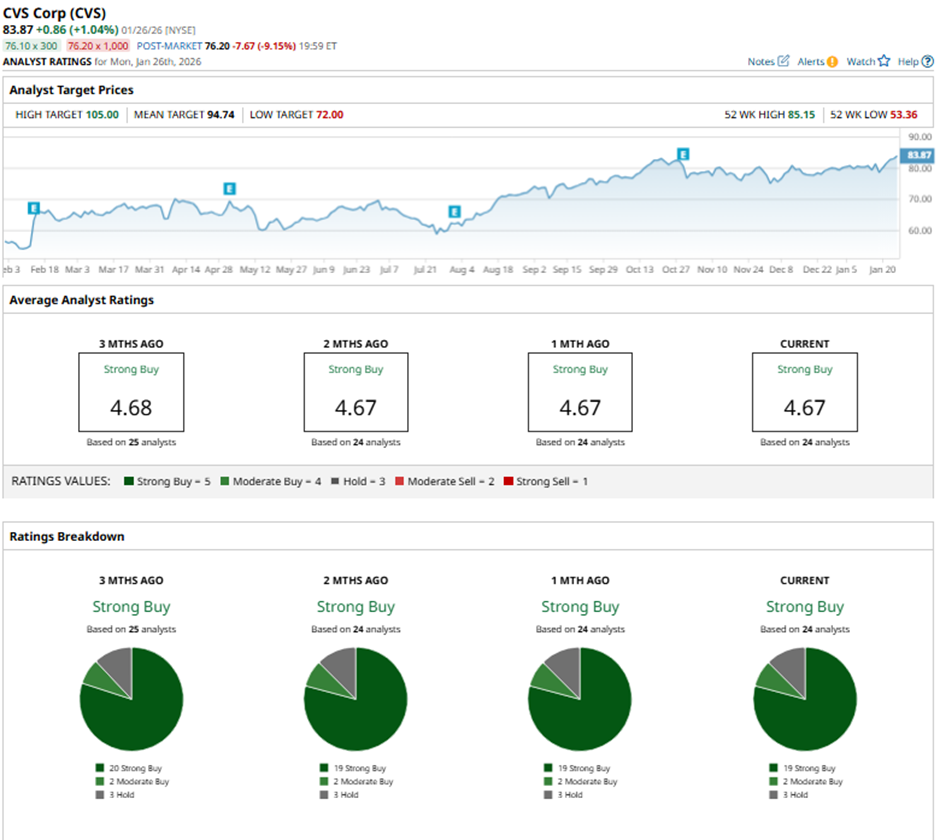

Among the 24 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.”

This configuration is slightly less bullish than three months ago, with 20 “Strong Buy” ratings on the stock.

On Jan. 6, Bernstein raised its price target on CVS Health to $91 while maintaining a “Market Perform” rating.

The mean price target of $94.74, representing a premium of nearly 13% to CVS' current price. The Street-high price target of $105 suggests a 25.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Microsoft Reports Q2 Earnings Jan. 28. Is MSFT Stock a Buy Before Then?

- As IonQ Snaps Up SkyWater Technology for $1.8B, Should You Buy the Quantum Computing Stock Here?

- What's Next for Sandisk Stock After a 1,000% Rally?

- USAR Stock Is Solidly in Overbought Territory as Trump Invests in USA Rare Earth. Can You Still Chase the Rally Here?