Chinese internet retail giant Alibaba Group (BABA) is reportedly planning to list its chipmaking arm. Founded in 2018, this business segment, T-Head Semiconductor, has been developing data center and artificial intelligence (AI) chips for IoT products across the full chip-design stack. Although the timing of the IPO remains unclear, the company plans to make the entity partly employee-owned before seeking a listing. Based on this news, Alibaba’s stock gained 5.1% intraday on Jan. 22.

Does that make BABA stock a buy here?

About Alibaba Stock

Alibaba Group, headquartered in Hangzhou, Zhejiang, China, is a multinational conglomerate that excels in e-commerce, retail, the internet, and cutting-edge technology. Its platforms enable seamless consumer-to-consumer, business-to-consumer, and business-to-business exchanges through expansive online marketplaces that connect sellers, brands, and shoppers globally.

Additionally, the company delivers cloud computing, logistics solutions, digital media, entertainment, and pioneering innovations, cultivating an integrated ecosystem that propels worldwide trade and digital evolution. The company has a market capitalization of $423 billion.

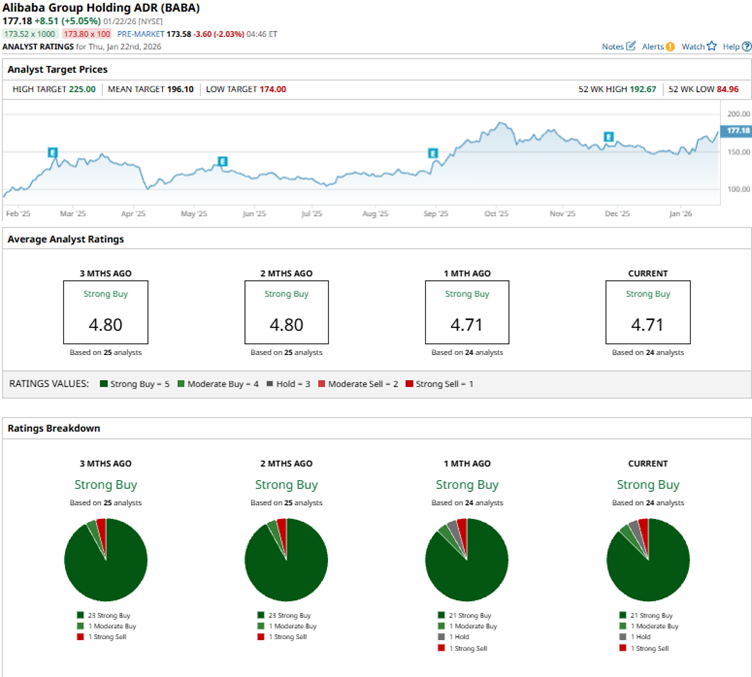

Alibaba’s stock rallied in the past year on optimism about AI breakthroughs and on President Xi Jinping’s meeting with Chinese entrepreneurs, including the company’s co-founder, Jack Ma. Over the past 52 weeks, BABA stock has gained 102%, while it has been up 42% over the past six months. Its shares reached a 52-week high of $192.67 in October 2025 but are down about 10% from that level.

BABA stock is trading at a price-to-earnings ratio of 22.96x, higher than the industry average of 20.52x.

Alibaba’s Latest Quarterly Earnings Showed Solid Cloud Growth

On Nov. 25, 2025, Alibaba reported topline growth for the second quarter that ended on Sept. 30, 2025. The company’s quarterly revenue increased by 5% year-over-year (YoY) to RMB 247.80 billion ($34.81 billion).

The Cloud Intelligence unit reported revenue of RMB 39.82 billion ($5.59 billion), up 34% YoY, driven by public cloud revenue growth. Moreover, Alibaba’s AI-related product revenue delivered another quarter of triple-digit growth compared to the prior-year period.

The company’s income from operations for the quarter decreased by 85% YoY to RMB 5.37 billion ($754 million) due to a decline in adjusted EBITA, which was, in turn, affected by investments in quick commerce, user experiences, and technology. Alibaba’s non-GAAP earnings per ADS were down 71% from the year-ago value to $0.61.

Wall Street analysts have a tepid view about Alibaba’s bottom-line trajectory. For the third quarter that ended December 2025, its EPS is expected to decline by 37.6% YoY to $1.73. For the current fiscal year (ending in March 2026), EPS is expected to decline by 34.9% to $5.38. On the other hand, for the next fiscal year, the company’s EPS is projected to increase by 49.6% annually to $8.05.

What Do Analysts Think About Alibaba’s Stock?

Recently, analysts at Jefferies reiterated their bullish “Buy” rating on Alibaba’s stock and maintained a $225 price target. Jefferies analysts maintained their stance on the stock after major upgrades to the company’s Qwen App, which integrates core services across the whole Alibaba ecosystem. This connects Taobao, Taobao Instant Commerce, Alipay, Fliggy, and Amap with the Qwen app. The firm also expects Alibaba to maintain a strong triple-digit YOY growth in its cloud segment.

On the other hand, analysts at Freedom Capital Markets downgraded the stock from “Buy” to “Hold” and lowered the price target from $180 to $140. Despite the company reporting quarterly results above expectations, Freedom Capital Markets analysts expressed concerns about rapidly rising capital expenditures in its cloud business, while its retail business showed moderate growth relative to competitors.

Last year in November, J.P. Morgan analyst Alex Yao maintained an “Overweight” rating. However, the price target has been lowered, suggesting the analyst has a cautiously optimistic view of the company’s stock. In the same month, Citi analysts stated that the White House memo, which suggests a tie between Alibaba and the Chinese military, should be a short-term overhang on the stock rather than a long-term one. Citi analysts reiterated their “Buy” rating on the stock and their $218 price target.

Alibaba is gaining praise on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 24 analysts rating BABA stock, most analysts, 21, have given it a “Strong Buy” rating; one analyst rated it “Moderate Buy,” while one analyst is taking the middle-of-the-road approach with a “Hold” rating, and one suggested “Strong Sell.” The consensus price target of $196.10 represents an 11% upside from current levels.

Key Takeaways

With a strong cloud segment and AI product growth, Alibaba stands at the forefront of the AI-based tech revolution gripping China. Despite bottom-line snags, the company’s topline is still growing. Moreover, the chip arm spin-off might create some efficiency gains in the future. Therefore, BABA stock might be a buy for investors willing to take a risk on this internet retail giant.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Micron’s 2026 Earnings Upside Makes MU Stock Hard to Ignore

- Blue Origin Is Gunning for AST SpaceMobile. Should You Sell ASTS Stock Now or Keep Betting on Gains?

- Down 25% in 2026, Morgan Stanley Says You Should Buy the Dip in This 1 Tech Stock

- Is Warren Buffett’s 1994 Berkshire Hathaway Prediction Finally Coming True? He Warns ‘A Fat Wallet is the Enemy of Superior Investment Results’