In the ever-evolving landscape of artificial intelligence (AI), Alphabet's (GOOG) (GOOGL) Google has surged ahead with its groundbreaking Gemini 3 model, released in late 2025. This advanced AI model not only solidifies Google's ironclad grip on search dominance but also propels its cloud services upward from a solid third-place position.

Analysts speculate that Gemini 3 could enable Google Cloud to challenge Microsoft's (MSFT) Azure for the No. 2 spot and, in time, even dethrone Amazon's (AMZN) AWS as the industry leader. While that throne may still be a future conquest, the shift came on Monday with Google's landmark deal to power Apple's (AAPL) AI features and cloud operations. This partnership integrates Gemini into billions of iPhones, reshaping the AI competitive field by sidelining rivals like OpenAI and bolstering Google's ecosystem-wide influence.

About Alphabet Stock

Alphabet is a global technology powerhouse headquartered in Mountain View, California. The company dominates through its core businesses: Google Search, which handles the vast majority of global internet queries; YouTube, the leading video platform; Android, the world's most popular mobile operating system; and Google Cloud, a key player in cloud computing.

Additionally, Alphabet operates in hardware such as Pixel devices, autonomous driving via Waymo, and health tech through Verily. In search, Google commands approximately 91% of the worldwide market, while in cloud services, it holds about 13% of the share, trailing Amazon's 30% and Microsoft's 20%.

Alphabet's Class C shares delivered a stellar 65% return in 2025, far outpacing the S&P 500's ($INX) 16% gain for the year. This performance reflects surging AI-driven growth amid broader market optimism.

In terms of valuation, GOOG trades at a trailing price-to-earnings (P/E) of 32.81, above its historical average of around 25 but aligned with the tech industry's current 30 to 35 range, signaling premium pricing for its growth prospects. The forward P/E stands at 29.81, suggesting expectations of continued earnings expansion.

Its price-to-sales (P/S) ratio is 10.7 — elevated compared to historical norms of 6, but reasonable given revenue acceleration in cloud and AI. Other metrics, like a PEG ratio of 2.1, indicate the stock is fairly valued, as it balances high growth potential against market risks.

Why the Apple Deal Changes Everything

The recent pact between Google and Apple has fundamentally altered the AI investment narrative, positioning Alphabet as the frontrunner over upstarts like OpenAI. Under this multi-year agreement, Google's cutting-edge Gemini models will underpin Apple's upcoming AI enhancements, including a revamped Siri set to debut later this year.

Apple is reportedly committing to an annual payment of $1 billion to Google, alongside channeling additional cloud workloads to Google Cloud, which could significantly amplify Alphabet's revenue streams. This infusion not only bolsters Google's licensing income but also accelerates its cloud division's growth trajectory, potentially narrowing the gap with market leaders.

Strategically, the deal embeds Google's AI directly into the iPhone ecosystem, granting it access to billions of devices worldwide. Combined with its Android dominance, this creates an unparalleled distribution network for Gemini, effectively marginalizing competitors.

For OpenAI, this is a devastating blow. The startup had been in advanced talks to integrate its tech into Apple's platforms but was ultimately outmaneuvered. Analysts view this as a critical setback, hindering OpenAI's path to widespread adoption and revenue scaling, especially after its GPT-5.2 received lukewarm reception compared to Gemini 3's benchmark-topping performance.

The implications ripple to Microsoft, OpenAI's primary backer, as the deal indirectly erodes Azure's edge in AI partnerships. Meanwhile, Google benefits from fortified barriers in search, where AI integration could stave off disruptions from conversational alternatives. Investors eyeing 2026 should consider buying GOOG now, as this alliance accelerates Alphabet's ascent in the $1 trillion AI market.

With Gemini 3 already outperforming rivals, the deal ensures sustained innovation leadership, driving cloud market share gains from 13% toward 15% to 20% in the coming years. This isn't just a win — it's a paradigm shift, making Google the must-own AI play for the next decade.

What Do Analysts Expect For Alphabet Stock

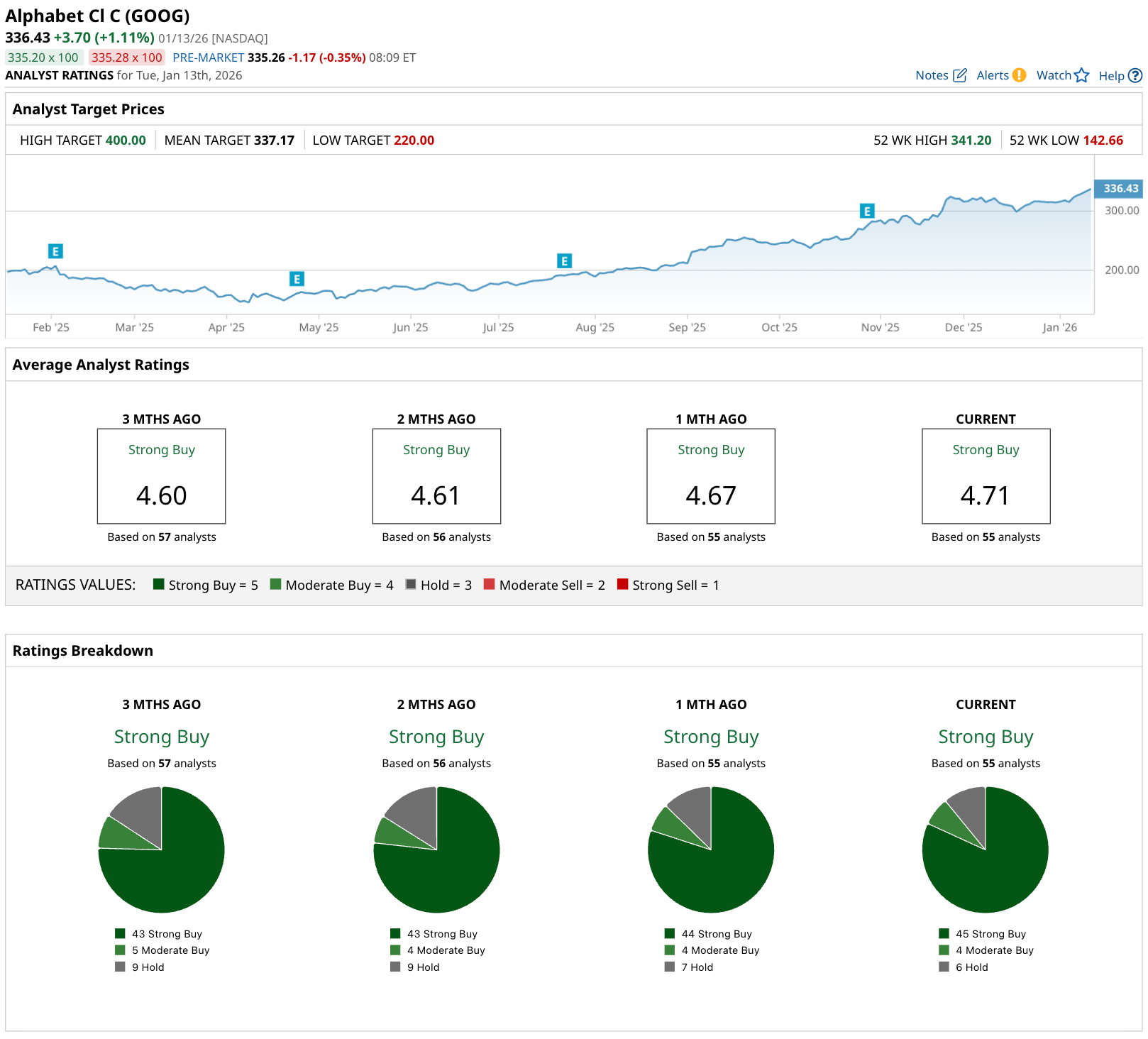

Analysts maintain a bullish stance on Alphabet stock, with a consensus rating of "Strong Buy" based on input from 55 covering firms. The ratings breakdown shows 45 "Strong Buy" recommendations, four "Moderate Buy," and six "Hold" ratings. There are currently no "Sell" ratings. This optimism has strengthened in recent months, as the consensus score improved from 4.60 three months ago to the current 4.71, reflecting fewer “Hold” ratings and more upgrades amid AI advancements and the Apple deal.

The mean target of $337.17 represents potential downside of 0.1% from the current share price, suggesting the stock is seen as fairly priced but with room for gains if earnings exceed expectations. Overall, the positive shift underscores confidence in Alphabet's AI-driven trajectory for 2026.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy or Sell Nvidia Stock Amid China’s H200 Whiplash?

- Morgan Stanley Just Upgraded This 1 Lesser-Known Tech Stock. Should You Buy Shares Now?

- China Just Banned Broadcom’s Cybersecurity Solutions. What Does That Mean for AVGO Stock?

- As Mark Zuckerberg Unveils Meta Compute, Should You Buy, Sell, or Hold META Stock?