Crypto lost its footing in late 2025. Retail and institutional investors trimmed positions, Bitcoin (BTCUSD) and Ethereum (ETHUSD) exchange-traded funds (ETFs) saw outflows in December, and capital rushed instead into equities, which logged record inflows. But the tone has started to change. JPMorgan (JPM) points to easing selling pressure, with ETF flows and futures positioning showing early signs of bottoming out as 2026 begins. Layer in a crypto-friendly administration — still early in its term — and the policy backdrop looks increasingly supportive.

That shift frames the Coinbase (COIN) story. Shares are still about 45% below their July peak, reflecting the broader fourth-quarter pullback. Yet beneath the surface, the company has been moving faster, not slower. Coinbase runs one of the world’s largest crypto platforms, and COIN stock naturally swings with market sentiment. Still, Coinbase's ambitions are widening. At a Dec. 17 product event, the firm laid out plans to add stock and ETF trading and launch prediction markets, nudging closer to its goal of becoming an “everything exchange.”

Bank of America is buying into that shift, upgrading COIN to “Buy” with a $340 target, citing its push beyond pure crypto trading, diversified business model, and seeing COIN stock’s pullback as a clear buying opportunity.

About Coinbase Stock

Founded in 2012, Coinbase is a crypto giant boasting a $64.9 billion market capitalization. As one of the largest exchanges globally, it serves both retail and institutional investors. Beyond trading, the firm is expanding through global licenses, acquisitions, and innovations like stablecoin payments, crypto cards, and subscriptions, positioning itself as a key architect in the evolution of digital finance.

Coinbase’s shares have traded like a mirror to the crypto cycle itself. As Bitcoin rallied and regulatory mood improved, COIN stock caught a strong tailwind, charging to a July peak of $444.64. That momentum, however, cooled just as quickly. A broad crypto pullback dragged the shares nearly 45% off those highs, leaving the stock down about 37% over the past six months and close to 9% in the last month alone.

Yet the recent tape tells a slightly different story. COIN is climbing again today, driven in part by upbeat analyst projections this month. Trading volume has picked up, often an early sign that interest is returning. Technically, the 14-day RSI, which flirted with oversold levels in December, has rebounded to around 45, suggesting pressure is easing rather than accelerating.

The MACD oscillator reflects a transition phase. Not long ago, the MACD line slipped below the blue signal line, reflecting lingering caution. Recently, however, that gap has narrowed, and the MACD line is beginning to edge back above the signal line, pointing to a potential shift in trend. That said, the histogram remains in negative territory, indicating that while downside momentum is weakening, confirmation of a sustained reversal has yet to emerge.

Coinbase’s valuation appears attractive to value-focused investors looking to gain exposure to COIN stock at a discount now. With a forward price-to-earnings multiple of 41 times, the stock trades below its five-year median, suggesting the market is offering exposure to its earnings potential at a more attractive level than in recent years.

Coinbase’s Q3 Earnings Snapshot

Coinbase’s third-quarter earnings report, released on Oct. 30, was solid as crypto activity picked up across both retail and institutional desks. The exchange posted total revenue of $1.87 billion, a sharp jump from $1.21 billion a year earlier and up 25% from the previous quarter, comfortably beating market expectations. Trading activity did much of the heavy lifting. Transaction revenue climbed to $1 billion, up 37% sequentially, reflecting stronger volumes and improved sentiment. Subscription and services revenue added balance to the mix, rising 14% sequentially to $747 million, underscoring Coinbase’s push to diversify beyond pure trading fees.

Profitability followed the revenue surge. Adjusted net income rose 151% year-over-year (YOY) to $421 million, while adjusted EBITDA increased 78% annually to $801 million. Adjusted EPS came in at $1.44, more than doubling from last year and beating analyst forecasts by nearly 40%, a clear signal that operating leverage is returning as volumes recover.

Beyond the income statement, Coinbase’s balance sheet stood out. By the end of Q3 2025, the company reported a liquidity of $11.9 billion, bolstered by a $3 billion convertible debt issuance in August. Long-term debt stood at $7.2 billion, but the cash position gives Coinbase flexibility to invest, acquire, and scale. When including $2.6 billion in crypto assets held for investment and $1 billion held as collateral, total liquidity rises to roughly $15.5 billion, reinforcing its financial cushion.

Two broader tailwinds are also coming into focus. A more supportive regulatory environment in the U.S. and the acquisition of derivatives exchange Deribit have helped drive institutional engagement. Management struck an optimistic tone, noting that as regulatory clarity improves, crypto infrastructure could power a larger share of global economic activity, with Coinbase well-positioned to lead.

Looking ahead, management expects subscription and services revenue between $710 million and $790 million, supported by growth in USDC — now at record market capitalization — and a rising Coinbase One subscriber base, partly offset by anticipated interest rate cuts. Transaction expenses are forecast in the mid-teens as a percentage of net revenue, while technology, development, and administrative costs are projected at $925 million to $975 million, reflecting hiring and acquisitions. Sales and marketing spending is expected to tick higher sequentially, estimated to be between $215 million and $315 million, signaling continued investment in growth.

Analysts monitoring Coinbase expect the company’s adjusted EPS for Q4 to be around $0.83, down 75% YOY. Fiscal 2025 EPS on an adjusted basis is anticipated to decline 39% annually to $4.64, before surging by 25% annually to $5.82 in fiscal 2026.

What Do Analysts Expect for Coinbase Stock?

Bank of America analysts see Coinbase as a company in transition, evolving beyond its original identity. The firm upgraded COIN to a “Buy,” pointing to the firm's steady shift toward becoming an “everything exchange” that brings crypto, stocks, ETFs, futures, payments, and prediction markets onto a single platform. Recent product announcements and new futures listings highlight a clear effort to diversify revenues and deepen user engagement.

There’s long-term value in initiatives like Base and asset tokenization, which could open new growth avenues over time. Despite the stock being almost slashed nearly in half below its July highs and short interest rising, BofA maintains a $340 price target, implying an upside potential of about 39%. In BofA’s view, Coinbase remains early in monetizing its broader platform and is well-positioned as the most regulated and trusted crypto-native company in the United States.

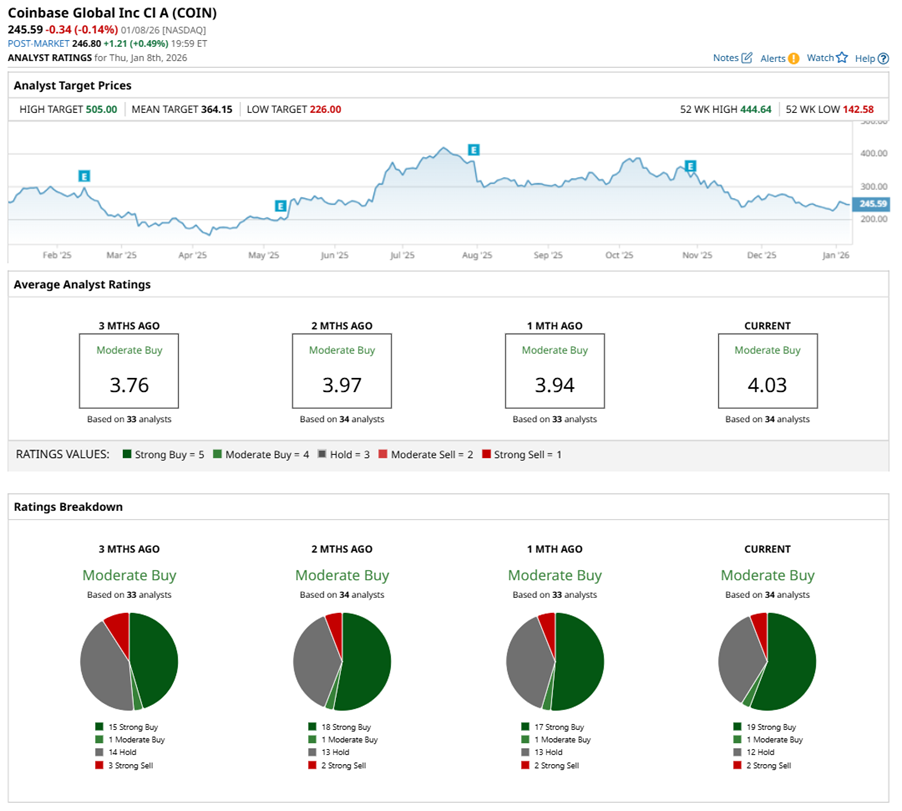

Wall Street leans bullish on COIN, with the stock having a “Moderate Buy” consensus rating overall. Out of 34 analysts, 20 rate it a “Strong Buy,” one calls it a “Moderate Buy.” 11 analysts have a “Hold" rating, and the remaining two are outright bearish with a “Strong Sell” rating.

The mean price target of $362.98 implies rebound potential of 48%. Meanwhile, the Street’s highest projection of $505 suggests COIN stock could rise as much as 106% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 45% From Its Highs, This Analyst Thinks You Should Buy the Dip in Coinbase Stock

- MicroStrategy Gets to Stay in MSCI Indexes. Is That Win Enough to Keep Buying MSTR Stock in 2026?

- MSTR Stock Breaks Above 20-Day Moving Average on MSCI Win. Should You Buy Shares Here?

- Big Pain Is Ahead for MicroStrategy Stock as Bitcoin Losses Mount. How Should You Play MSTR for January 2026?