I discussed a possible Occidental Petroleum Corp (OXY) dividend raise next month in my Dec. 23, 2025, Barchart article. I showed that OXY stock could be worth $50 per share. Investors are now piling into January 16, 2026, expiry OXY call options.

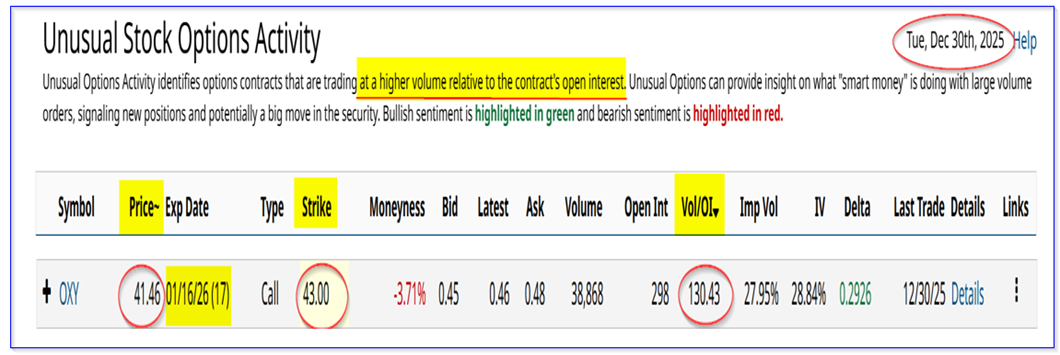

OXY closed at $41.46 on Dec. 30, 2025, but the $43.00 call option contract expiring January 16, 2026, has had huge, unusual volume.

This huge trading volume can be seen in Barchart's Unusual Stock Options Activity Report on Dec. 30, 2025. It shows that almost 39,000 call option contracts have traded.

That is over 130x more than the prior number of call contracts outstanding at the $43.00 exercise price for Jan. 16, 2026. In other words, massive volume traded here.

The premium paid by buyers is just 46 cents, or just 1.1% over the trading price of $41.46.

In other words, investors buying these calls have a strong belief that OXY stock could trade well over $42.00 (i.e., $41.46+$0.46 = $41.92 breakeven) in the next month.

And why not? As I have shown in my prior Barchart article, Occidental Petroleum will likely hike its dividend per share.

Dividend Hike Implies a Higher Target Price

As a result, OXY stock could be worth much more. For example, let's assume Occidental raises the annual dividend per share (DPS) to $1.00 from $0.96 at present.

That implies, at today's price, the dividend yield is 2.41% (i.e., $1.00 / $41.46).

But, historically, OXY stock has had a much lower dividend yield.

For example, Yahoo! Finance reports that the average yield over the last 5 years has been 1.16%. Morningstar's average yield calculation for the past 5 years has been 0.42%.

Just to be conservative, let's assume that the market will value OXY stock with a 2.0% dividend yield. That is close to the range in the past 2 years: 1.78% to 2.38%.

Here is what that implies for OXY stock's value:

$1.00 / 0.02 = $50.00 target price (TP)

In other words, if the market reverts to the average yield, the stock has to rise to the $50.00 TP mentioned above to give investors a 2.0% dividend yield on their investment.

In other words, OXY is worth 20.6% more:

$50/$41.46 -1 = 1.206 -1 = +20.6% upside

So, no wonder investors are piling into January 16, 2026, call options.

They believe OXY stock could move significantly higher than $42.00 by the time the company makes a dividend hike announcement near the end of the month or early February 2026.

Risks and Alternative Play

Be careful following this play. If OXY stays flat until an announcement is made, an investor could lose 100% of their call option investment.

That is because there is no intrinsic value in the premium paid. The call options are inherently out-of-the-money (OTM).

That is also one reason in my last article, I recommended selling short out-of-the-money put options.

For example, I suggested that the Jan. 23, 2026, expiration puts at the $38.00 put exercise price looked attractive to short.

The premium received at the time was 48 cents for a 1.26% one-month yield (i.e., $0.48/$38.00). That means an investor shorting these puts would make $48 on an $3,800 investment for every put contract “Sold to Open.”

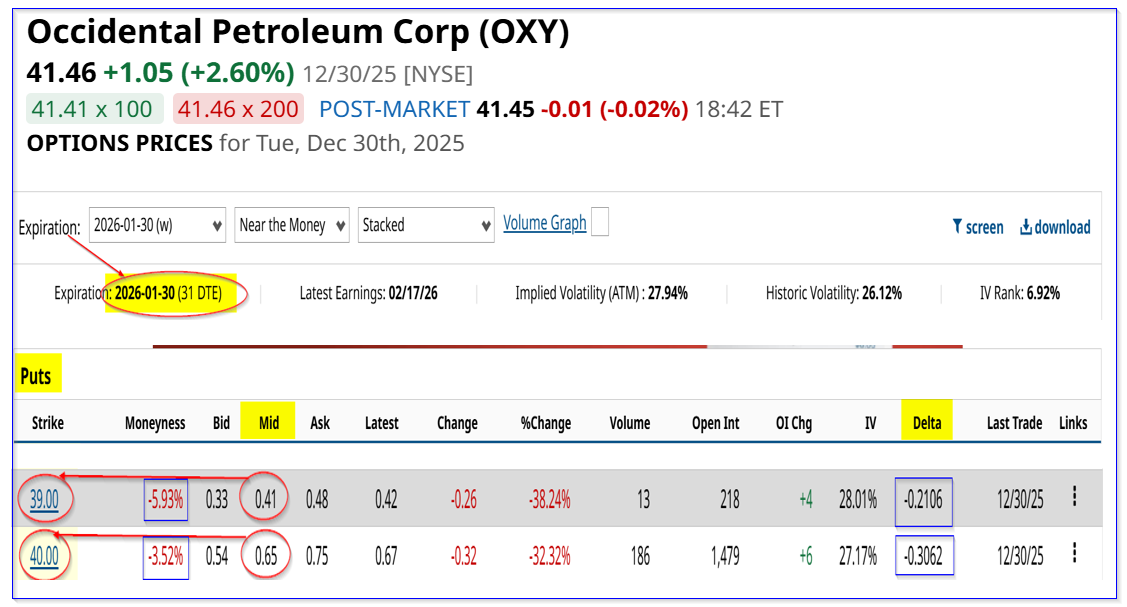

Today, the put premium has fallen to just 19 cents, making this a good trade already. It makes sense, therefore, the consider shorting the Jan. 30, 2026, expiry puts $39.00 for 41 cents or the $40.00 puts for $0.65.

That could pay for any investment in the Jan. 23, 2026, call options for 43 cents. In other words, this is a safer way to play any upside potential in OXY stock:

Use the credit from shorting out-of-the-money (OTM) puts next month in OXY stock to pay for slightly OTM calls in OXY stock. That is likely what is occurring here with institutional investors buying these calls.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual Activity in Occidental Petroleum Call Options - A Signal Investors Expect a Dividend Hike

- Ethereum Has Crashed, but the Option Strategy I Showed You 3 Months Ago Is Hanging Tough. Now What?

- Tesla Ratio Spread Targets A Profit Zone Between 410 and 430

- Silver Linings Playbook: How to Speculate Safely, Even on Record-High Silver Prices