As the year comes to a close, many investors are reflecting on what worked, what didn’t, and how to position their portfolios in 2026- myself included. Dividend stocks often move to the top of that list, especially for those looking to create a new or additional source of reliable income. Indeed, not all dividend stocks are created equal.

Sure, high yields are tempting- but the long-term winners are usually the companies that manage to balance dependable payouts with disciplined reinvestment and market conviction. Especially today, balance matters more than ever.

Using Wall Street's top picks, alongside sustainable dividend metrics, I screened for companies that are not just paying dividends but are also positioned to grow through any economic cycle. The result is a list of dividend stocks with strong fundamentals, balanced payout policies, and "Strong Buy" analyst ratings.

How I came up with the following stocks

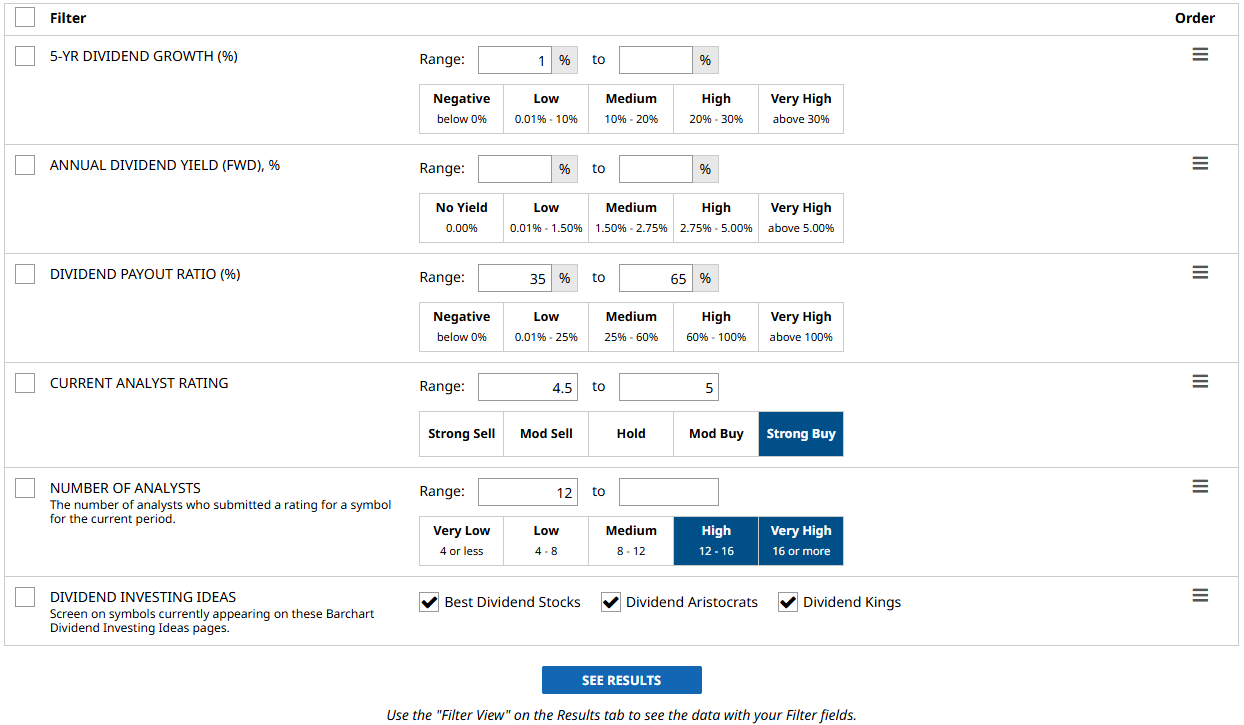

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- 5-YR Dividend Growth (%): At least 1%. These are companies that consistently increased their payouts

- Annual Dividend Yield (FWD),%: Left blank to be sorted from highest to lowest

- Dividend Payout Ratio: 35 to 65%. This is the sweet spot where companies are paying sustainable dividends while balancing customer value and company growth.

- Current Analyst Rating: 4.5 to 5. “Strong Buy” or best of the best stocks according to Wall Street.

- Number of Analysts: 12 or more. The more the analyst, the better.

- Dividend Investing Ideas: Best Dividend Stocks, Dividend Aristocrats, and Dividend Kings

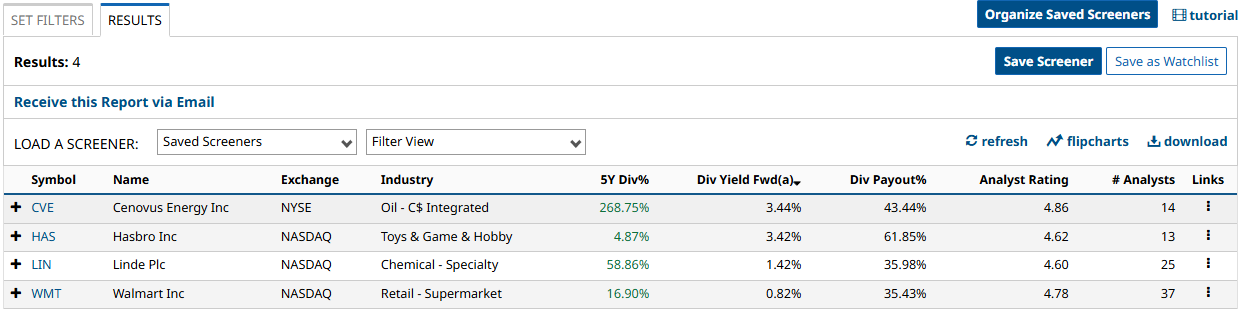

I ran the screen and got four results. While I'd normally cover the top three, I'll add in the fourth as a bonus.

Let’s start with the first dividend stock:

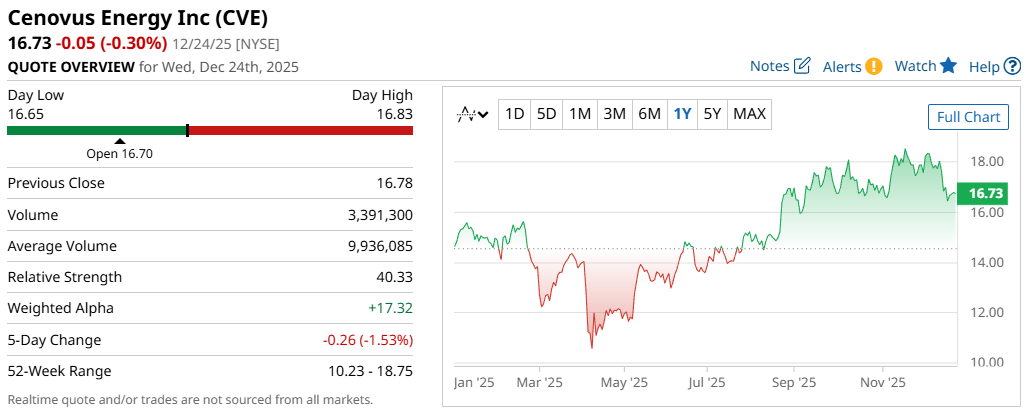

Cenovus Energy Inc (CVE)

Cenovus Energy Inc. manufactures oil and natural gas through oil sands, conventional oil and gas, and thermal projects. The company operates across the entire value chain, from exploration to production, and maintains a strong commitment to sustainability through its environmental, social, and Indigenous reconciliation initiatives.

In its recent quarterly financials, the company reported that sales are down 8% YOY to $9.6 billion, while its net income rose 55% to $933 million. Cenovus Energy also pays a forward annual dividend of $0.80, translating to a yield of around 4.8%. Its five-year dividend growth is up over 268% with a dividend payout ratio of 43.44%, which I think is fair for company growth and investor value.

A consensus among 14 analysts rates the stock a “Strong Buy” with a high target of $24.46, suggesting as much as 46% upside over the next year.

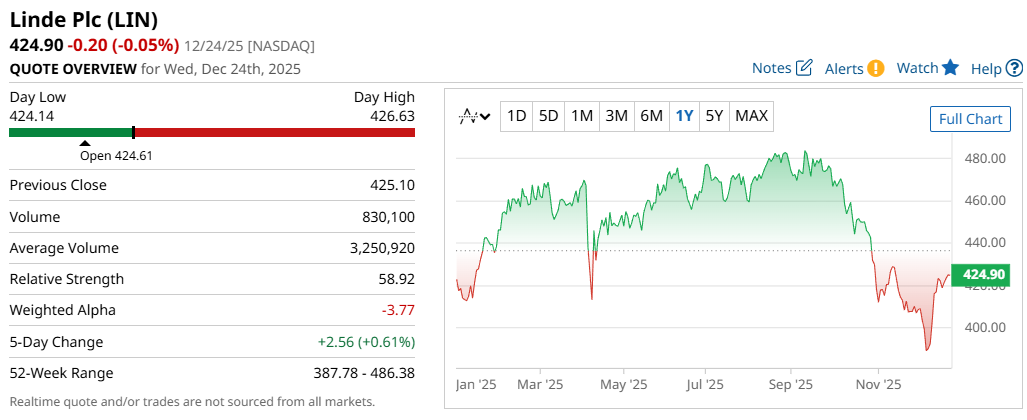

Linde Plc (LIN)

The second dividend stock on my list is Linde Plc, the world’s largest industrial and engineering company. It provides various gases for industries such as healthcare, electronics, and food & beverage, while advancing sustainability through carbon management, hydrogen infrastructure, and large-scale decarbonization solutions.

In its most recent financials, Linde reported that sales rose 3% YOY to $8.6 billion and net income grew 24.5% to $1.9 billion. The company also pays a forward annual dividend of $6, translating to a yield of approximately 1.41%, and over the last five years, its grown the dividend almost 59%. Linde’s payout ratio sits at around 36%, a bit conservative but still provides flexibility to reinvest in growth while supporting long-term dividend sustainability.

A consensus among 25 analysts rates the stock a “Strong Buy”, a rating consistent over the past three months. Further, stockholders could be in for as much as 33% upside over the next 12 months if it hits its high target of $565.

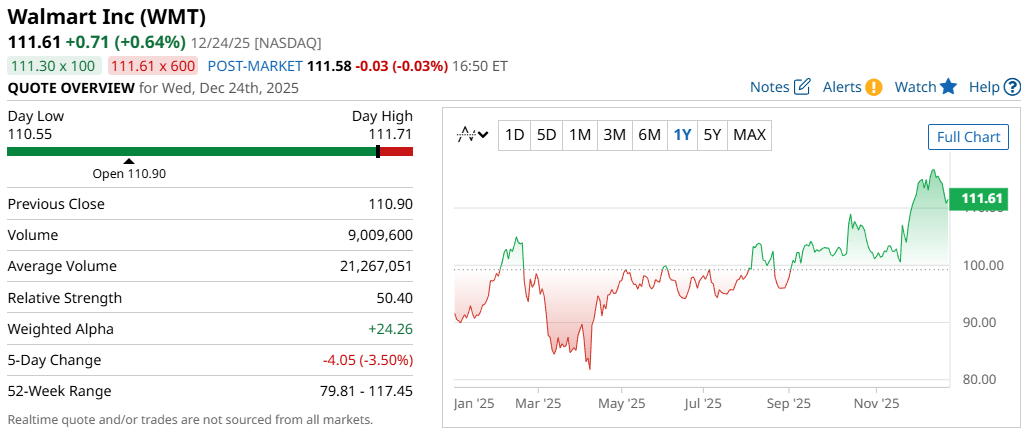

Walmart Inc (WMT)

Next on my list is Walmart Inc., the world’s largest company by revenue. Walmart dominates the retail industry, especially in groceries, with over 4,700 stores and clubs here in the U.S., and continues to invest in community-focused sourcing strategies that strengthen local economies and improve access to affordable products.

In its most recent financials, the company reported that sales grew almost 6% YOY to $179 billion, while its net income is up over 34% to $6.1 billion. Walmart also pays a forward annual dividend of $0.94, translating to a yield of about 0.84%, the lowest in this list, and it has a five-year dividend growth rate of 17%. Walmart’s dividend payout ratio of over 35% suggests that the payout remains well covered.

A consensus among 37 analysts rates the stock a “Strong Buy”. Further, it has a high target of $136, which could mean as much as 22% upside over the next year.

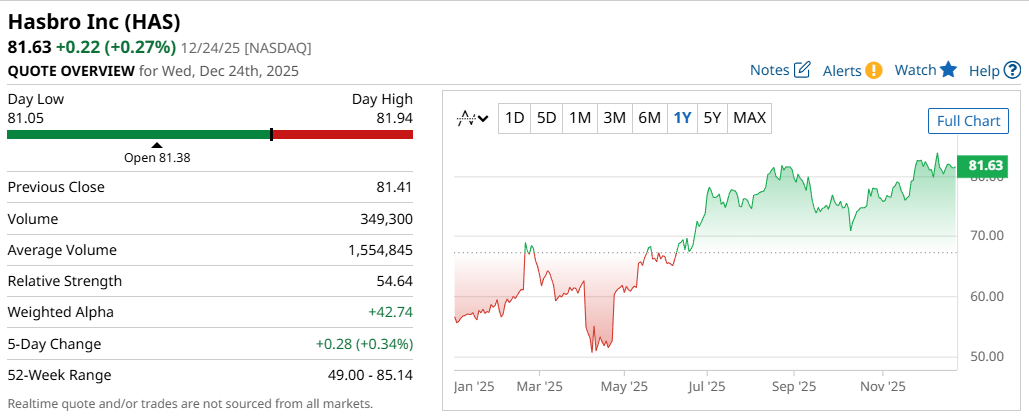

Hasbro Inc (HAS)

The last and a “bonus” dividend stock on my list is Hasbro Inc., a toy and board game company. You may have heard of its products, which include: Nerf, Monopoly, and more. The company is also expanding its portfolio through high-profile entertainment partnerships with global brands like Netflix to monetize iconic IP across toys, games, and licensed merchandise.

In its recent financials, Hasbro reported that sales rose 8% YOY to $1.4 billion, and its net income was also up 4.5% to $233 million. The company also pays a forward annual dividend of $2.80, translating to a yield of about 3.4%. Hasbro last increased its dividends in 2023, and has grown its marginally over the last five years. Its dividend payout ratio is almost 62%, suggesting the dividend is more income-focused, with less flexibility for aggressive growth compared to others on this list.

With that, a consensus among 13 analysts rates the stock a “Strong Buy”. The stock also has an upside potential of as much as 22.5% if it hits its high price of $100 over the next year.

Final Thoughts

So, there you have it, the four top-performing Dividend stocks based on what Wall Street analysts say. These companies balance shareholder and customer value, ensuring consistent future performance. While these stocks may not have the highest yields, strong analyst buy ratings suggest they are well-positioned to benefit from long-term growth and potential bullish momentum.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- High Yield Meets High Conviction: 3 Dividend Stocks Built for Any Market

- Tesla + Robinhood + FedEx’s Unusually Active Put Options Could Deliver $Big Income Over the Next 30 Days

- This International Pharma Stock Just Hit 5-Year Highs

- Cisco Systems Stock Is Treading Water - How to Use Puts and Calls to Play CSCO