Valued at a market cap of $36.9 billion, United Airlines Holdings, Inc. (UAL) is an airline company that provides passenger and cargo air transportation services across an extensive global network. The Chicago, Illinois-based company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

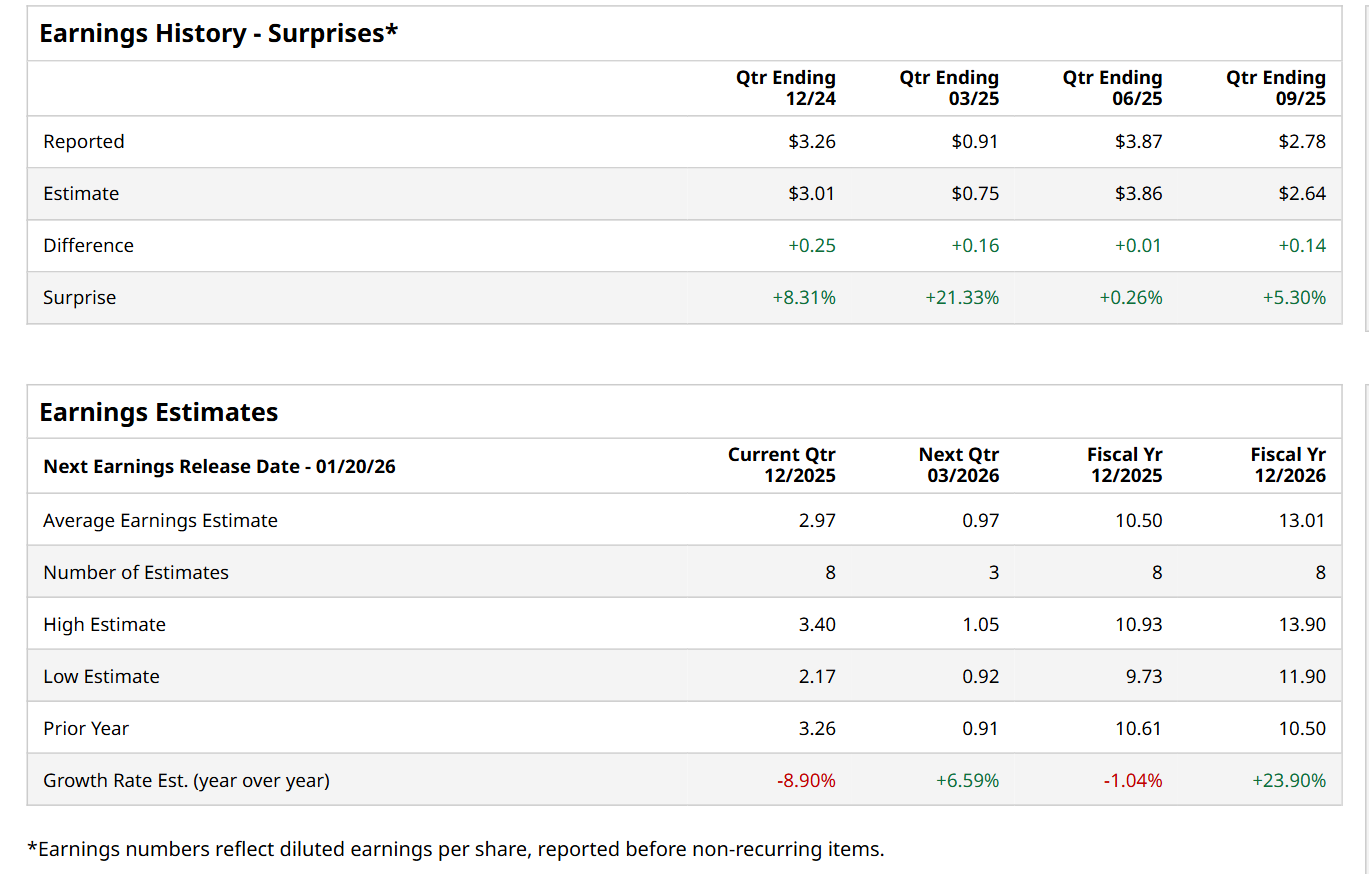

Ahead of this event, analysts expect this airline company to report a profit of $2.97 per share, down 8.9% from $3.26 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, UAL’s EPS of $2.78 exceeded the forecasted figure by 5.3%.

For the current fiscal year, ending in December, analysts expect UAL to report a profit of $10.50 per share, down 1% from $10.61 per share in fiscal 2024. Nonetheless, its EPS is expected to grow 23.9% year-over-year to $13.01 in fiscal 2026.

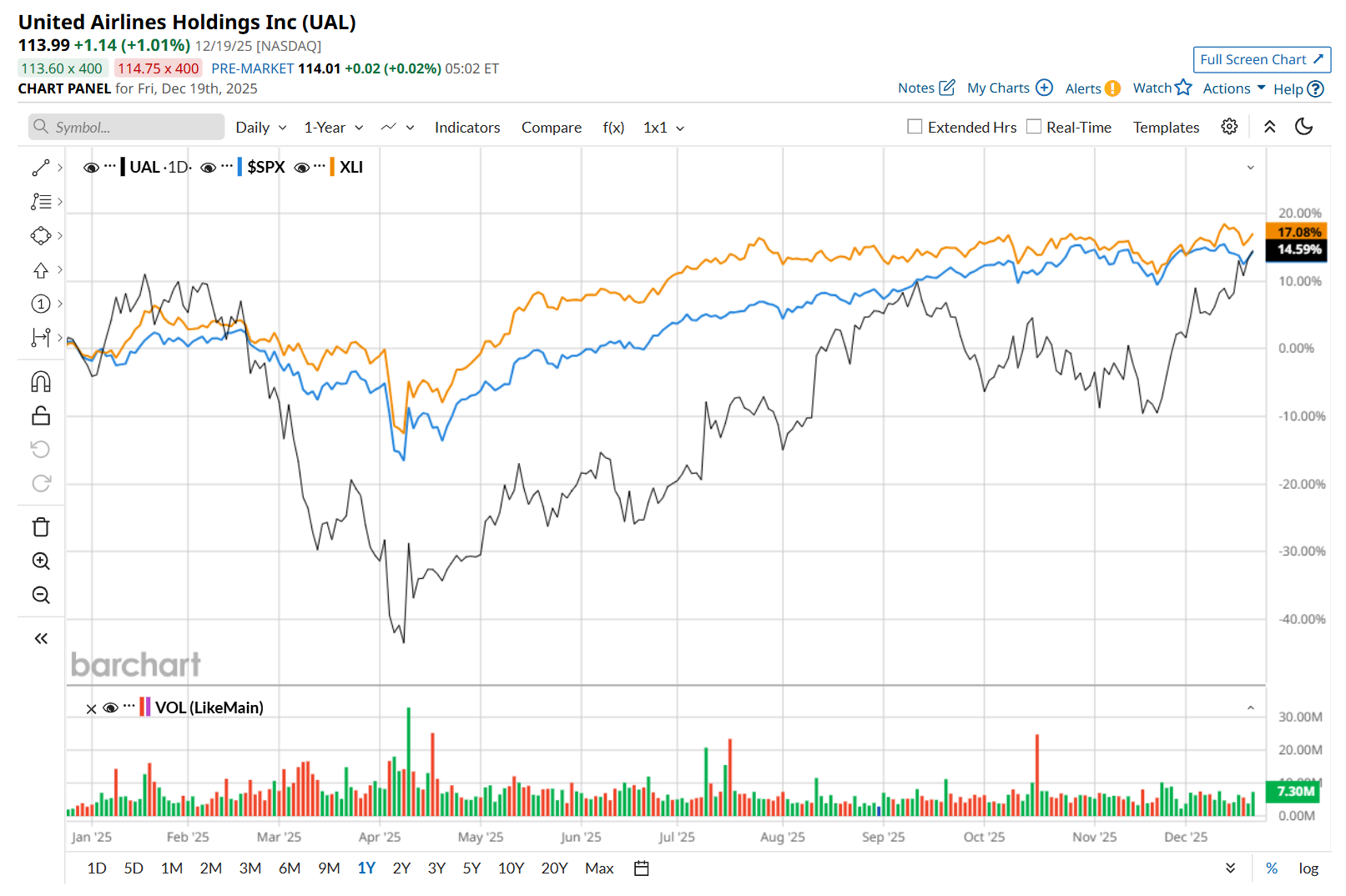

Shares of UAL have soared 19.3% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 16.5% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 17.8% uptick over the same time period.

On Dec. 2, shares of UAL rose 3.2% after TD Cowen reaffirmed its “Buy” rating, set a price target of $125, and designated the stock its "Best Idea for 2026." Investors reacted positively to expectations of better Boeing aircraft deliveries, which could help UAL upgrade its fleet, expand premium seating, and lower operating costs. The airline also announced a new partnership to modernize its sales technology, further boosting investor confidence.

Wall Street analysts are highly optimistic about UAL’s stock, with an overall "Strong Buy" rating. Among 24 analysts covering the stock, 20 recommend "Strong Buy," two indicate "Moderate Buy,” and two suggest "Hold.” The mean price target for UAL is $127.30, implying an 11.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart