Super Micro Computer, better known as Supermicro (SMCI), has hit a rough patch after a strong run driven by the artificial intelligence (AI) boom. The company’s shares have tumbled more than 33% over the past month as investors reacted to disappointing results and cautious guidance.

Supermicro, a leading provider of high-performance servers and storage systems that power AI workloads, has seen its once-blistering growth start to cool. While the company remains a key player in the AI infrastructure market, its top-line growth rate has been slowing quarter after quarter, and its recent earnings results maintained that trend.

Ahead of its fiscal 2026 first-quarter earnings release, Supermicro trimmed its revenue outlook, warning that certain design upgrades had pushed some expected revenue into the second quarter. When the results were announced, the company reported net sales of $5 billion, representing a steep year-over-year decline of approximately 15% and a 13% sequential decrease. That figure also fell well short of its earlier guidance range of $6 billion to $7 billion.

The slowdown is particularly notable given Supermicro’s impressive run last year. In the fourth quarter of fiscal 2025, the company reported $5.8 billion in revenue, representing a 7.4% increase from the same period a year earlier. That followed growth of 19.5% in the third quarter, 54.9% in the second quarter, and 180.1% in the first quarter of fiscal 2025. However, as the numbers indicate, each quarter saw slower growth, suggesting that the company didn’t execute well despite a solid demand environment.

This deceleration has also pressured its profitability. In its most recent quarter, Supermicro reported adjusted earnings per share of $0.35, which is less than half of the $0.73 it earned in the same quarter a year earlier. The weaker performance highlights how the company’s margins have tightened alongside its slowing sales momentum.

Supermicro’s Growth Rate to Accelerate

Supermicro is gearing up for a strong turnaround as the company looks to accelerate its growth trajectory after several quarters of underwhelming performance. During its latest first-quarter earnings call, the company’s management struck an upbeat tone, signaling confidence in the business outlook for the remainder of fiscal year 2026. The optimism is primarily driven by solid demand for AI GPU platforms, which already account for more than three-quarters of Supermicro’s quarterly revenue and remain its key growth engine.

Looking ahead, Supermicro expects a strong rebound in its top line, projecting second-quarter net sales between $10 billion and $11 billion. The guidance reflects a significant increase both year-over-year and sequentially. The acceleration in growth rate is likely to be driven by robust demand for advanced AI computing and infrastructure solutions. With its Data Center Building Block Solution (DCBBS) and other value-driven offerings, Supermicro is well-positioned to capture the AI-driven opportunity.

Supermicro’s industry-leading AI portfolio is expanding rapidly, with the Nvidia (NVDA) Blackwell Ultra featuring the GB300 product line already generating more than $13 billion in orders. With production ramping up and new orders pouring in, the company has raised its full-year fiscal 2026 revenue forecast to at least $36 billion, up from its earlier estimate of $33 billion. This strong guidance highlights growing confidence in its ability to capitalize on the AI boom.

Supermicro’s momentum extends beyond the GB300 platform. The firm is gaining traction with its B300 systems, building on the success of the earlier B200 generation. It is also shipping a variety of high-performance platforms, including the RTX PRO 6000, B200, and AMD MI350/355X.

While its strong AI product portfolio will drive solid sales, the company’s margins could remain under pressure in the short term. A large new design win for a GB300-optimized rack platform, which carries higher costs and lower initial margins, will weigh on short-term results. Additionally, the company is investing heavily in new customer relationships to secure future design wins, which is weighing on its margins. Management expects gross margins to decline by roughly 300 basis points in Q2 compared with Q1 of fiscal 2026.

However, these margin pressures are temporary. Over the longer term, Supermicro anticipates a rebound as it expands into higher-margin areas, including DCBBS, enterprise data centers, sovereign AI projects, internet of things (IoT) and telecom solutions, and software services. The company also stands to benefit from economies of scale as revenue rises, supported by its cost-efficient global manufacturing footprint, particularly in Malaysia, and growing customer diversification.

Should You Buy, Sell, or Hold SMCI Stock?

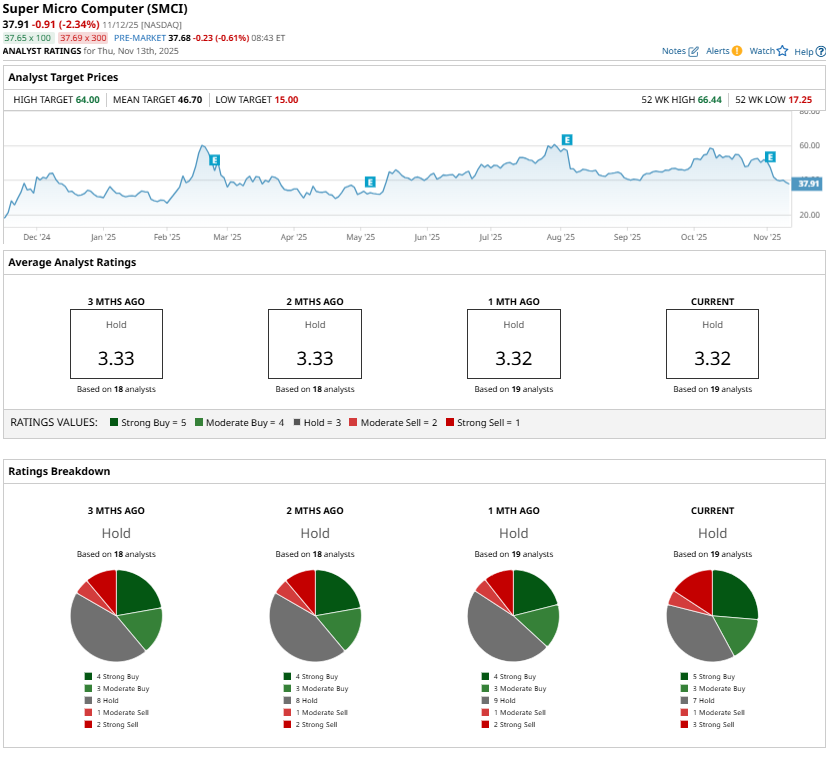

Analysts are currently maintaining a “Hold” consensus rating on SMCI stock, but the company’s outlook suggests reason for optimism. Supermicro appears to be entering a promising phase of growth, supported by its strong position in the rapidly expanding AI hardware market.

In the near term, its profitability may come under pressure as the company continues to channel resources into strategic investments and adjusts its product mix to capitalize on new opportunities. However, these short-term pressures could lay the groundwork for significant long-term gains. Supermicro’s deep AI portfolio, solid demand pipeline, and cost-efficient manufacturing model position it well to capitalize on future industry growth.

Adding to its appeal, the recent decline in SMCI’s share price has created a potentially attractive entry point for long-term investors.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Find Stocks to Trade Before the Rest of the Market by Adding This Trend Indicator to Your Charts

- IBM Is Staring Down Quantum Advantage. Should You Buy IBM Stock First?

- Michael Burry Shutters Hedge Fund as Trump’s 50-Year Mortgage Threatens an $11 Trillion Housing Collapse – Is Big Short 2.0 Brewing in Housing, Not Tech?

- Nvidia Stock Is a High-Stakes Trade Ahead of November 19. How to Hedge the Risk of a Post-Earnings Plunge.