VANCOUVER, BC / ACCESSWIRE / February 6, 2024 / Banyan Gold Corp. (the "Company" or "Banyan") (TSXV:BYN)(OTCQB:BYAGF) is pleased to announce positive results from the Phase 1 metallurgical test program conducted on the Company's AurMac Project in the Yukon Territory. Phase 1 metallurgical testing focused on the AurMac Project's Powerline Deposit ("Powerline") as Powerline hosts the majority of the Project's 6.2 million ounce ("Moz") gold inferred Mineral Resource Estimate ("MRE"). Results from the metallurgical test program demonstrate robust recoveries throughout Powerline, identifying multiple conventional mineral processing flow sheets which the Company continues to advance and optimize through ongoing metallurgical test work.

Highlights :

- Gold recoveries averaged 91% from 75 micron ("um") (200 Mesh) bottle roll cyanidation tests.

- Gold recoveries estimated to be 91% for the Carbon in Leach ("CIL")/Carbon in Pulp ("CIP") process.

- Gold recoveries for the combined gravity and flotation process are estimated at 84%.

- Heap leach gold recovery is estimated to range from 64-72% based on coarse size (9.5 mm) bottle roll testing, conventional column leach tests and Vat leach diffusion extraction testing.

- Flotation recovery into a rougher concentrate recovered on average 89% of the gold with a low mass pull of 3.7%, indicative that a small percentage of material would require further processing.

- Low cyanide consumption at an average of 0.52 kg/mt for primary grind of P80 passing 75 um.

- Gravity recovery has shown it may be an effective part of the flow sheet.

- Low sulphide concentration and excess buffering capacity indicates Powerline is non-acid generating.

"Metallurgical test work highlights robust gold recoveries with multiple conventional mineral processing flow sheets and further optimization has a high likelihood to result in increased overall gold recoveries," Tara Christie, President & CEO, stated. "These results represent a significant step forward at AurMac and continued work will focus on crush and grind sizes, in addition to power and reagent consumption. Work will be focused to support a future economic study using one or more of the identified processes."

Potential Mineral Processing Flow Sheets

Three gold recovery process flow sheets have been identified through the Phase 1 test program. This includes CIL or CIP gold extraction processes (91% gold recovery). The CIL/CIP flow sheet is the most commonly used milling gold recovery method worldwide. Canadian examples include Agnico Eagle's Detour Lake and Malartic Mines in Ontario and Quebec, respectively. The second process is conventional mill flotation (84% gold recovery) which is used at Kinross Gold's Paracatu Mine in Brazil and Centamin's Sukari Mine in Egypt. Test work supportive of gravity recoverable gold was also carried out that indicates a gravity recovery circuit could be included in either the CIL/CIP or mill flotation flow sheets to enhance gold recoveries and reduce reagent consumption. The third flow sheet is heap leach processing (64-72% gold recovery), a commonly used method for high volume, low-grade gold deposits; examples include Victoria Gold's nearby Eagle Mine in the Yukon and Kinross Gold's Fort Knox Mine in Alaska. Mines such as Fort Knox utilize both heap leaching and conventional mill processing.

Methodology

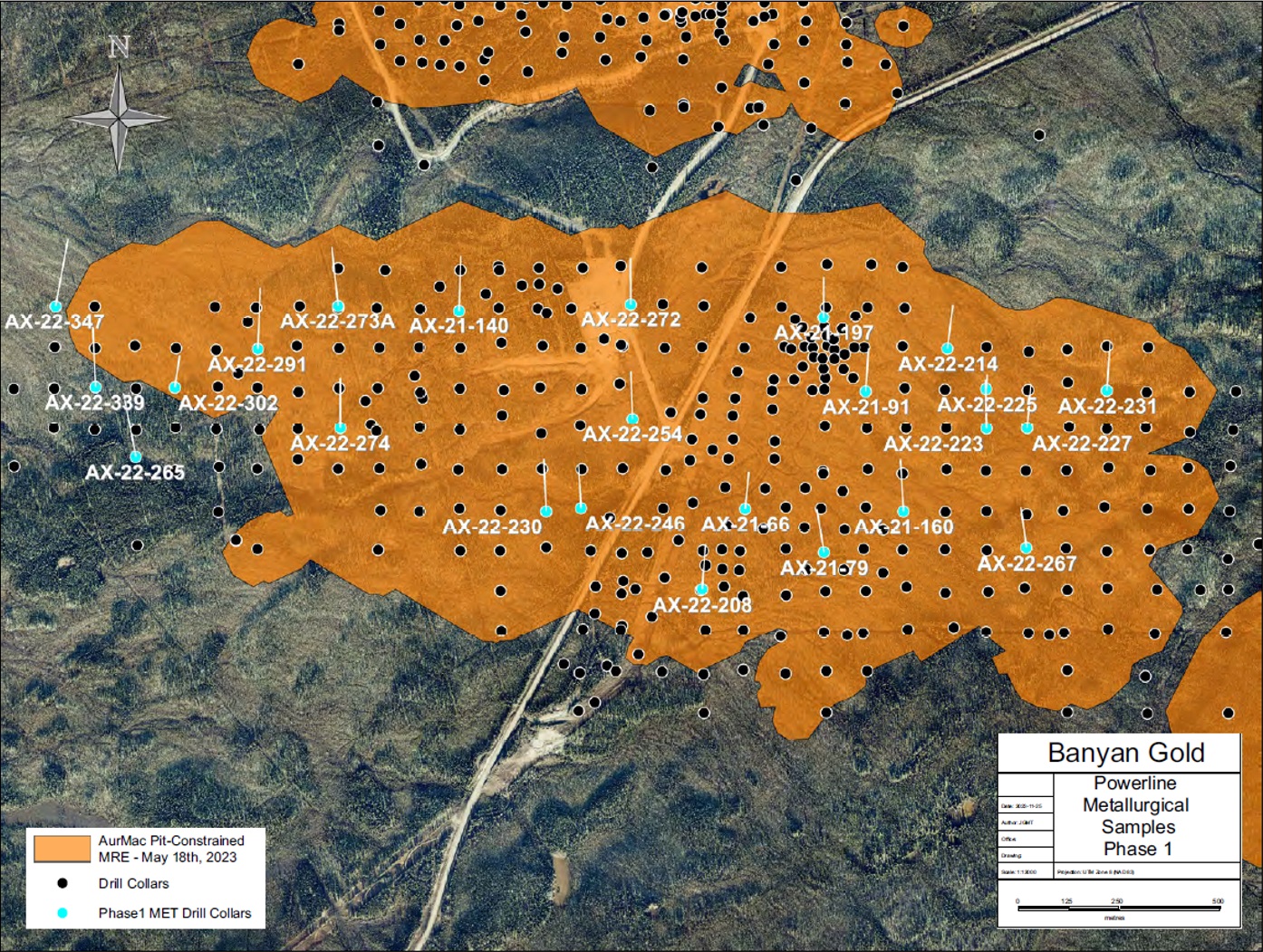

The Phase 1 metallurgical test program focused on the Powerline Deposit as it represents the majority (~62%) of the AurMac Project's current 6.2 Moz gold inferred MRE. Banyan submitted 34 individual intervals (~991 kg) of representative drill core from Powerline to Forte Analytical in Fort Collins, Colorado. The individual intervals selected were based on gold grade, depth from surface, spatial distribution, and lithology. Three master composite samples were prepared from the individual sample intervals as shown in Figure 1 and the composites were based on the three dominant lithologies identified within Powerline which include, Comp 1 - calcareous schist ("CSCH"), Comp 2 - muscovite quartz schist ("MQST") and Comp 3 - sericite schist ("SSCH").

The Phase 1 test program for Powerline included acid-base accounting, mineralogy, comminution, bottle roll cyanidation (9.5 mm and 75 um), flotation, gravity recovery, column leach tests, Vat leach diffusion extraction tests, and a gravity-flotation-intensive cyanidation process simulation. The program was overseen by Deepak Malhotra (SME-RM of Forte Analytical) who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects ("NI 43-101").

Figure 1. Metallurgical Sample Locations from the Powerline Deposit

Sample Assays and 75um Bottle Roll Testing

Head samples were assayed by both fire assay and metallic screen fire assay ("MSFA") (Table 1) with fire assays averaging 0.76 g/t gold for the test intervals and an overall average of 0.66 g/t gold for metallic screen fire assays. Calculated head assays based on the bottle roll tests is shown in Table 1. The variability in the head assays, calculated head grade assays and MSFAs demonstrate the known nuggetty coarse gold exhibited in Powerline. The total sulphur in the samples ranged from 0.39% to 1.15% with an average of 0.70%, and total carbon ranged from 0.28% to 2.07% predominantly as inorganic carbon (91%). For MSFA analysis, samples were split via metallic screen into +140 mesh and -140 mesh fractions to split the coarse gold from the fine gold.

Table 1. Powerline Deposit Sample Assays and 75 um Bottle Roll Results

Sample ID |

Gold Fire Assay |

Calc. Head Assay |

MSFA |

Carbon |

Sulphur |

Extraction, % gold |

Lithology |

|---|---|---|---|---|---|---|---|

[g/t gold] |

[g/t gold] |

[g/t gold] |

Total % |

Total % |

75um (200 Mesh) | ||

| Master Composite 1 | 0.415 |

- |

- |

0.76% |

0.68% |

87.5 |

CSCH |

| Master Composite 2 | 0.485 |

- |

- |

0.67% |

0.86% |

91.6 |

MQST |

| Master Composite 3 | 0.824 |

- |

- |

0.75% |

0.80% |

92.6 |

SSCH |

| AX-21-79 47.29-57.9 | 1.871 |

1.07 |

0.68 |

0.73% |

0.65% |

78.5 |

MQST |

| AX-21-140 43.5-49.5 | 1.201 |

0.90 |

2.81 |

0.64% |

0.57% |

90.7 |

CSCH |

| AX-21-91 131.1-135.1 | 0.613 |

0.56 |

0.71 |

1.10% |

0.45% |

96.4 |

CSCH |

| AX-22-208 82.7-112.8 | 0.633 |

0.94 |

1.2 |

0.28% |

0.39% |

89.8 |

MQST |

| AX-22-214 10.7-35.4 | 0.269 |

0.72 |

0.28 |

0.66% |

0.72% |

95.1 |

MQST |

| AX-22-223 25.9-32.8 | 1.99 |

0.25 |

0.30 |

0.76% |

0.46% |

80.1 |

CSCH |

| AX-22-225 61.5-77.7 | 0.587 |

0.37 |

1.49 |

0.62% |

0.73% |

56.7 |

CSCH |

| AX-22-225 85.4-111.3 | 0.222 |

0.33 |

0.21 |

0.94% |

0.81% |

80.4 |

CSCH |

| AX-22-227 185.9-192 | 0.259 |

0.31 |

0.33 |

0.92% |

0.73% |

80.2 |

CSCH |

| AX-22-230 70.1-79.3 | 0.317 |

0.73 |

0.62 |

0.49% |

0.71% |

91.8 |

MQST |

| AX-22-230 99.1-109.3 | 0.48 |

0.05 |

0.34 |

0.38% |

0.39% |

61.1 |

MQST |

| AX-22-230 135.6-166.1 | 0.775 |

0.82 |

0.85 |

2.07% |

1.15% |

80.3 |

MQST |

| AX-22-230 166.1-188.5 | 0.159 |

0.17 |

0.16 |

0.73% |

0.44% |

79.1 |

MQST |

| AX-22-231 59.1-63.7 | 0.464 |

0.39 |

0.45 |

0.84% |

0.98% |

86.6 |

CSCH |

| AX-22-246 58.5-82.3 | 0.378 |

0.19 |

0.69 |

0.82% |

0.79% |

83.0 |

CSCH |

| AX-22-246 116.7-134.6 | 2.674 |

0.42 |

0.63 |

1.77% |

0.79% |

89.7 |

MQST |

| AX-22-254 76.2-79.3 | 0.267 |

0.44 |

0.27 |

1.81% |

0.87% |

68.7 |

SSCH |

| AX-22-272 160.8-163.9 | 1.496 |

1.04 |

1.07 |

0.50% |

0.52% |

93.0 |

MQST |

| AX-22-273A 50.1-56.1 | 0.501 |

0.43 |

0.61 |

0.41% |

0.46% |

89.4 |

CSCH |

| AX-22-274 171.8-182.8 | 0.812 |

0.77 |

0.40 |

0.87% |

0.78% |

89.7 |

GNST |

| AX-22-291 45.7-50.6 | 0.816 |

0.70 |

0.70 |

0.87% |

0.77% |

87.6 |

MQST |

| AX-22-302 51.8-59.4 | 1.284 |

0.51 |

0.57 |

0.36% |

0.65% |

87.7 |

QTZT |

| AX-22-302 71.6-77.2 | 0.302 |

0.46 |

0.49 |

0.33% |

0.63% |

76.1 |

QTZT |

| AX-22-339 175.9-179.8 | 0.472 |

0.44 |

0.40 |

1.09% |

0.57% |

83.5 |

CSCH |

| AX-22-347 170-175 | 0.173 |

0.25 |

0.21 |

0.49% |

0.62% |

92.1 |

CSCH |

The three representative master composites returned an average of 90.6% gold recovery using 75 um bottle roll testing. Overall gold extraction percentages ranged from 56.7% to 96.4%. These 75 um bottle roll tests show that gold recovery does not significantly change across variations in grade, depth from surface, sulphide content and lithology and that no organic carbon or other materials present preclude or reduce leach extraction rates (commonly referred to as non preg-robbing). The 75 um bottle roll tests had an average of 65% gold recovery within the first two hours and over 80% average gold recovery in the first 8 hours showing rapid gold recovery kinetics. Average cyanide consumption for the 75 um bottle rolls was low at 0.52 kg/t.

Industry standard comminution testing was completed on the composite samples to determine crusher work index (CWi), Bond's ball mill work index (BWi) and abrasion work index (Ai) parameters. The average CWi for the composites was 15.2 kWh/t and the BWi was 14.6 kWh/t, indicating Powerline is classified as medium to hard.

Gravity Recovery

Coarse gold is evident across Powerline and, therefore, gravity recovery was assessed as part of the Phase 1 program. Initial gravity recovery testing was completed on the three master composite samples and subsequently assayed as either rougher concentrate or cleaner concentrate. The Knelson concentrate produced the rougher concentrate, which was then further cleaned using a Gemeni table to produce the cleaner concentrate. Two grind sizes, 150 um (100 mesh) and 212 um (65 mesh), were tested throughout the gravity campaign, and the average gold recovery from rougher gravity concentrate was 53%.

Flotation

Flotation testing was conducted on all three composites across three different grind sizes: 150 um (100 mesh), 75 um (200 mesh), and 44 um (325 mesh). The tailings from the gravity recovery tests completed on the three composites were also assessed for flotation response at the 100 mesh particle size. All composites demonstrated high gold recovery in rougher concentrate with an average gold recovery of 89% from the composite samples (Table 2). Of significance is the overall low mass pull of ~3.7% on average. The high rougher flotation concentrate recovery along with the low mass pull suggests a small intensive cyanidation circuit leaching a flotation rougher concentrate as a process flow sheet option to be further investigated.

Table 2. Flotation Results for Powerline Deposit Composites

Sample |

P 80 Grind Size |

Concentrate wt% |

Gold Recovery |

Conc. Grade |

Calc. Head |

Tail Grade |

|---|---|---|---|---|---|---|

[ um ] |

[wt.%] |

[% gold] |

[g/t gold] |

[g/t gold] |

[g/t gold] |

|

Comp 1 |

150 |

3.3 |

89.1 |

31.67 |

1.16 |

0.13 |

Comp 1 |

75 |

2.7 |

75.1 |

12.84 |

0.47 |

0.12 |

Comp 1 |

44 |

6.1 |

86.5 |

7.86 |

0.56 |

0.08 |

Comp 1 Grav Tail |

150 |

2.6 |

73.1 |

19.31 |

0.69 |

0.19 |

Comp 2 |

150 |

3.0 |

92.8 |

29.74 |

0.95 |

0.07 |

Comp 2 |

75 |

2.6 |

94.6 |

60.01 |

1.63 |

0.09 |

Comp 2 |

44 |

3.5 |

92.0 |

25.12 |

0.96 |

0.08 |

Comp 2 Grav Tail |

150 |

2.6 |

91.0 |

37.23 |

1.08 |

0.10 |

Comp 3 |

150 |

4.8 |

86.7 |

19.62 |

1.08 |

0.15 |

Comp 3 |

75 |

2.8 |

89.3 |

35.33 |

1.09 |

0.12 |

Comp 3 |

44 |

4.3 |

92.7 |

28.15 |

1.32 |

0.10 |

Comp 3 Grav Tail |

150 |

3.0 |

86.0 |

25.97 |

0.90 |

0.13 |

Gravity - Flotation - Intensive Cyanidation

Based on the individual flotation and gravity results, a non-optimized process simulation test was completed on remaining Composite 2 material and incorporated grinding, gravity recovery, rougher flotation, and intensive cyanidation of the concentrate products (gravity+float concentrate). Gravity and flotation recovery of Composite 2 resulted in 95% recovery and intensive cyanidation of the flotation and gravity concentrate returned 88% for a total recovery of 84.2%.

Heap Leaching Test Work

The response of Powerline to heap leach was assessed through a combination of coarse 9.5 mm bottle roll tests, standard column (10 cm) leach tests and Vat leach diffusion extraction tests. Coarse bottle roll tests at a crush size of P80 passing 9.5 mm were completed over a 264-hour test duration using standard bottle roll testing parameters. The average gold recovery for the composite weighted intervals was consistent and ranged from 33.7% - 35.6%. Conventional 10 cm diameter column leach tests at a crush size of P80 passing 9.5 mm were completed in duplicate on the three master composites. The overall gold recovery of all the column leach tests was 52.3% and ranged from 34.5% - 62.6% over a 76 to 78-day leach duration. The decrease in gold recovery with the coarse 9.5 mm crush size compared to the 75 um particle size shows that gold recovery is likely size dependent. Bottle roll and column leach test results are shown in Table 3.

Table 3. 9.5 mm Bottle Roll and Column Leach Test Results for Powerline Deposit

|

Bottle Rolls Composite Average |

10 cm Column Leach |

|||||

|---|---|---|---|---|---|---|

Sample ID |

Calc. Head Grade g/t gold |

Gold %Recovery |

Leach Duration (hrs) |

Calc. Head Grade g/t gold |

Gold %Recovery |

Leach Duration (days) |

Composite 1 |

0.46 |

34.9 |

264 |

0.498 |

57.9 |

76 |

Composite 1 Dup |

Na |

na |

na |

0.684 |

57.1 |

78 |

Composite 2 |

0.68 |

35.6 |

264 |

0.726 |

47.0 |

78 |

Composite 2 Dup |

Na |

na |

na |

0.911 |

34.5 |

78 |

Composite 3 |

0.57 |

33.7 |

264 |

0.812 |

55.1 |

78 |

Composite 3 Dup |

Na |

na |

na |

0.571 |

62.6 |

78 |

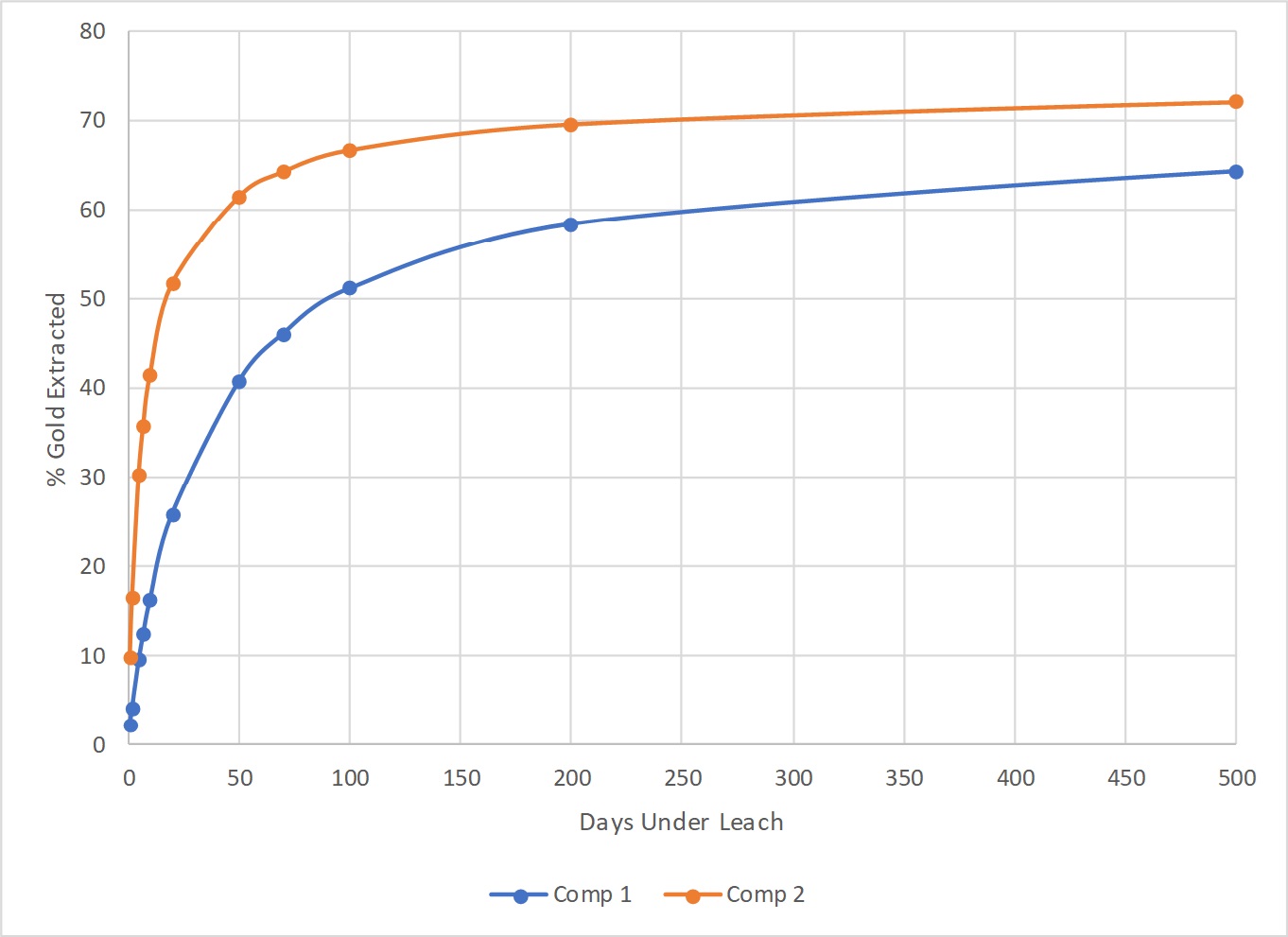

Vat Leach Diffusion Extraction Testing

Vat leach diffusion testing was conducted on both Composite 1 and Composite 2 material at size fractions of 12.7 mm, 9.5 mm and 6.4 mm. The Vat leach diffusion test is used in the early stages of metallurgical testing to optimize the crush size for a heap leach process flow sheet. Discrete particle sizes are loaded into a 15-30 kg charged Vat with cyanide solution, then a cycle of flooding/draining cyanide solution on a 24-hour basis in the early stages of testing, then to a weekly basis and continues until extraction is diminished, normally completed over 100-200 days depending on the particle size. Utilizing the Vat data of discrete particles measuring diffusion rates of the material, diffusion modeling was performed to represent a P80 9.5 mm particle size distribution, with recovery curves generated for estimating heap leach recoveries over an extended leach period (Figure 2). Long-term gold recovery is estimated at 64% for Composite 1 and 72% for Composite 2. The higher recovery from the Vats compared to the 10 cm column (P80 9.5 mm crush) tests also demonstrates a potential influence by coarse gold.

Figure 2. Modelled Vat Leach Gold Recovery Curves for Powerline Deposit Composites

Environmental

Mineralogy and acid-base accounting were performed on the three master composite samples and the results indicate that Powerline is not acid generating and has excess buffering capacity (Table 4). The samples were mainly composed of quartz (>70%) and minor quantities of plagioclase, orthoclase, muscovite, biotite, clinochlore, epidote and calcite with pyrite being the primary sulphide mineral present. The non-acid generating nature and excess buffering capacity of Powerline is an important consideration in future permitting and waste management designs.

Table 4. Acid-Base Accounting Results for Powerline Deposit Composites

Neutralization Potential |

Total Sulphur |

Acid Generation Potential |

Net Neutralization Potential |

Neutralization Potential Ratio |

|

kg/t |

% |

kg/t |

kg/t |

||

Comp 1 |

76.1 |

0.68 |

21.3 |

54.8 |

3.58 |

Comp 2 |

53.6 |

0.86 |

26.9 |

26.7 |

2.01 |

Comp 3 |

66.1 |

0.80 |

25.0 |

41.1 |

2.64 |

Summary and Next Steps

The results of the Phase 1 metallurgical testing program demonstrate gold recoveries ranging from 84% - 91% in multiple conventional process flow sheets inclusive of grinding followed by CIL/CIP cyanide leaching, flotation and leaching of a rougher concentrate, and as well as flotation, gravity recovery and intensive cyanide leaching of the concentrates. Heap Leach recoveries range from 64% to 72%. Environmental testing is positive showing excess buffering capacity coupled with low sulphide content meaning that Powerline is non-acid generating.

The test work results are supportive of all these processing options being carried forward with additional samples from Powerline, as well as expansion of the program to test samples from Aurex Hill and Airstrip Deposits. Continuing test work will endeavor to enhance understanding of:

- gold deportment;

- grind sizes for flotation, flotation concentrate and CIP/CIL;

- gravity separation; and,

- additional work on heap leaching including crush size sensitivity.

The focus will remain on flow sheet optimization and minimizing operating costs to maximize value in future economic studies.

Qualified Persons

Deepak Malhotra SME-RM, Director of Metallurgy, and Barry Carlson P.E, P.Eng, QP, President of Forte Dynamics are both "Qualified Persons" as defined by NI 43-101, independent of the Company and have reviewed and approved the content of this news release. Mr. Malhotra and Mr. Carlson have verified the data disclosed in this news release, including the sampling, analytical and test data underlying the information.

Paul D. Gray, P.Geo., is a "Qualified Person" as defined under NI 43-101 and has reviewed and approved the content of this news release. Mr. Gray is Banyan's geological consultant and has verified the data disclosed in this news release, including the sampling, analytical and test data underlying the information.

Upcoming Events

- CEM Whistler Capital Event, February 9 - 11, 2024

- Adelaide Capital Webinar - February 15, 2024 - 11 AM PST / 2 PM EST.

- BMO 33rd Global Metals, Mining & Critical Minerals Conference, February 25 - 28, 2024

- Tombstone Gold Rush Breakfast - Fireside Chat - Toronto, March 5, 2024

- 7AM to 9 AM EST

- Red Cloud Pre-PDAC Mining Showcase, Toronto, March 1

- PDAC, March 3 - 6, 2023

- Exhibitor Booth No. 2213, March 3 - 4

- PDAC 2024 One on One Meeting Program, March 4 - 5

- Core Shack Exhibitor Booth No. 3106, March 5 - 6

About Banyan

Banyan's primary asset, the AurMac Project is adjacent to Victoria Gold's Eagle Gold Mine, in Canada's Yukon Territory. The current inferred MRE for the AurMac Project of 6.2 million ounces has an effective date of May 18, 2023.

The 173 square kilometres ("sq km") AurMac Project lies 30 km from Victoria Gold's Eagle Project and adjacent to Hecla Mining's high grade Keno Hill Silver mine. The AurMac Project is transected by the main Yukon highway and access road to the Victoria Gold open-pit, heap leach Eagle Gold mine. The AurMac Project benefits from a 3-phase powerline, existing power station and cell phone coverage. Banyan has a right to earn up to a 100% interest, in both the Aurex and McQuesten Properties, subject to certain royalties.

The inferred MRE for the AurMac Project was prepared on May 18, 2023, and consisted of 6,181,000 ounces of gold (see Table 5) hosted within near surface, road accessible pit constrained Mineral Resources contained in three near/on-surface deposits: the Airstrip, Aurex Hill and Powerline Deposits.

Table 5: Pit-Constrained Inferred Mineral Resources - AurMac Project

| Deposit | Gold Cut-Off (g/t) |

Tonnage (Mt) |

Average Gold Grade (g/t) | Contained Gold (koz) |

| Airstrip | 0.25 | 41.2 | 0.68 | 897 |

| Powerline | 0.25 | 197.4 | 0.61 | 3,840 |

| Aurex Hill | 0.30 | 74.3 | 0.60 | 1,444 |

| Total Combined | 0.25 to 0.3 | 312.9 | 0.61 | 6,181 |

Notes :

- The effective date for the inferred MRE is May 18, 2023. The inferred MRE for the AurMac Project was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent Qualified Person in accordance with the requirements of NI 43-101. The technical report supporting the MRE (the "Technical Report") entitled "Technical Report - AurMac Property, Mayo Mining District, Yukon Territory, Canada" has been filed on SEDAR at www.sedar.com effective July 7, 2023.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

- The CIM Definition Standards were followed for classification of Mineral Resources. The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.25 g/t Au for the Airstrip and Powerline and 0.3 g/t Au for the Aurex Hill deposits, using a US$/CAN$ exchange rate of 0.75 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$1,800/ounce, US$2.50/t mining cost, US$5.50/t processing cost, UD$2.00/t G+A, 80% heap leach recoveries, and 45° pit slope.1

- The number of tonnes was rounded to the nearest hundred thousand. The number of ounces was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations as per NI 43-101.

In addition to the AurMac Project, the Company holds the Hyland Gold Project, located 70 km Northeast of Watson Lake, Yukon, along the Southeast end of the Tintina Gold Belt (the "Hyland Project"). The Hyland Project represents a sediment hosted, structurally controlled, intrusion related gold deposit, within a large land package (over 125 sq km), accessible by a network of existing gravel access roads.

Banyan trades on the TSX-Venture Exchange under the symbol "BYN" and is quoted on the OTCQB Venture Market under the symbol "BYAGF". For more information, please visit the corporate website at www.banyangold.com or contact the Company.

ON BEHALF OF BANYAN GOLD CORPORATION

(signed) "Tara Christie"

Tara Christie

President & CEO

For more information, please contact:

Tara Christie • 778 928 0556 • tchristie@banyangold.com

Jasmine Sangria • 604 312 5610 • jsangria@banyangold.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) nor OTCQB Venture Market accepts responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

FORWARD LOOKING INFORMATION: This news release contains forward-looking information, which is not comprised of historical facts and is based upon the Company's current internal expectations, estimates, projections, assumptions and beliefs. Such information can generally be identified by the use of forwarding-looking wording such as "may", "will", "expect", "estimate", "anticipate", "intend(s)", "believe", "potential" and "continue" or the negative thereof or similar variations. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company's plans for future metallurgical test work; potential future economic studies, potential future advancement and optimization of processing flow sheets, and statements regarding process flow sheet expectations; mineral resource estimates; mineral recoveries and anticipated mining costs.

Factors that could cause actual results to differ materially from such forward-looking information include uncertainties inherent in resource estimates, continuity and extent of mineralization, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the estimation of mineral resources and the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, availability of funding, and the other risks involved in the mineral exploration and development industry, enhanced risks inherent to conducting business in any jurisdiction, and those risks set out in Banyan's public documents filed on SEDAR. Although Banyan believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Banyan disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

SOURCE: Banyan Gold Corp.

View the original press release on accesswire.com